FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

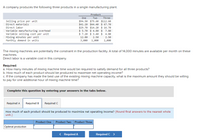

Transcribed Image Text:A company produces the following three products in a single manufacturing plant.

Product

One

Two

Three

Selling price per unit

Direct materials

$94.50 $79.60 $112.60

$41.20 $44.40 $ 67.7e

$29.70 $14.20 $ 16.70

$ 5.70 $ 4.80 $ 7.80

$ 7.20 $ 3.40 $ 4.80

Direct labor

Variable manufacturing overhead

Variable selling cost per unit

Mixing minutes per unit

Monthly demand in units

12.80

2.50

2.50

3,000

1,000

2,000

The mixing machines are potentially the constraint in the production facility. A total of 14,000 minutes are available per month on these

machines.

Direct labor is a variable cost in this company.

Required:

a. How many minutes of mixing machine time would be required to satisfy demand for all three products?

b. How much of each product should be produced to maximize net operating income?

c. If the company has made the best use of the existing mixing machine capacity, what is the maximum amount they should be willing

to pay for one additional hour of mixing machine time?

Complete this question by entering your answers in the tabs below.

Required A

Required B

Required C

How much of each product should be produced to maximize net operating income? (Round final answers to the nearest whole

unit.)

Product One

Product Two

Product Three

Optimal production

< Required A

Required C >

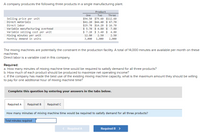

Transcribed Image Text:A company produces the following three products in a single manufacturing plant.

Product

One

Two

Three

Selling price per unit

Direct materials

$94.50 $79.60 $112.60

$41.20 $44.40 $ 67.7e

$29.70 $14.20 $ 16.7e

$ 5.70 $ 4.80 $ 7.8e

$ 7.20 $ 3.40 $

Direct labor

Variable manufacturing overhead

Variable selling cost per unit

Mixing minutes per unit

Monthly demand in units

4.80

12.80

2.50

2.50

3,000

1,000

2,000

The mixing machines are potentially the constraint in the production facility. A total of 14,000 minutes are available per month on these

machines.

Direct labor is a variable cost in this company.

Required:

a. How many minutes of mixing machine time would be required to satisfy demand for all three products?

b. How much of each product should be produced to maximize net operating income?

c. If the company has made the best use of the existing mixing machine capacity, what is the maximum amount they should be willing

to pay for one additional hour of mixing machine time?

Complete this question by entering your answers in the tabs below.

Required A

Required B

Required C

How many minutes of mixing machine time would be required to satisfy demand for all three products?

Total minutes required

< Required A

Required B >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Bruce Corporation makes four products in a single facility. These products have the following unit product costs: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead. Unit product cost Additional data concerning these products are listed below. Multiple Choice Product C Product B Product D Product A Products A B C D $17.20 $ 21.10 $ 14.10 $ 16.80 19.20 22.60 17.00 11.00 6.00 7.20 29.10 16.00 $71.50 A 2.25 $ 86.70 $ 2.95 4,600 9.70 16.10 $66.90 $ 56.90 Products Grinding minutes per unit Selling price per unit Variable selling cost per unit Monthly demand in units. The grinding machines are potentially the constraint in the production facility. A total of 10,500 minutes are available per month on these machines. Direct labor is a variable cost in this company. Which product makes the MOST profitable use of the grinding machines? Note: Round your intermediate calculations to 2 decimal places. B 1.30 $ 79.10 $ 3.65 3,600 C 0.85 $ 75.90 $4.40 3,600arrow_forwardBruce Corporation makes four products in a single facility. These products have the following unit product costs: Products A B C D Direct materials $ 19.90 $ 15.20 $ 20.80 $ 23.20 Direct labor 12.20 8.70 10.50 7.40 Variable manufacturing overhead $ 1.60 $ 2.10 $ 2.00 $ 2.10 Fixed manufacturing overhead 10.80 11.90 8.80 10.70 Unit product cost 44.50 37.90 42.10 43.40 Additional data concerning these products are listed below. Products A B C D Grinding minutes per unit 1.20 0.70 0.60 0.60 Selling price per unit $ 59.30 $ 51.70 $ 59.50 $ 55.60 Variable selling cost per unit $ 3.60 $ 1.50 $ 2.20 $ 3.60 Monthly demand in units 4,000 2,000 4,000 2,000 The grinding machines are potentially the constraint in the production facility. A total of 9,000 minutes are available per month on these machines. Direct labor is a variable cost in this company. Which product makes the MOST profitable use of the grinding machines? (Round your intermediate calculations to…arrow_forwardUrban Company reports the following information regarding its production cost: Units produced Direct labor Direct materials Variable overhead Fixed overhead Compute product cost per unit under variable costing. Multiple Choice O $24.00 $47.46 $54.00 26,000 units $ 19 per unit $ 24 per unit $ 11 per unit $ 116,000 in total $19.00arrow_forward

- help with work answer in textarrow_forwardKubin Company's relevant range of production is 15,000 to 19,000 units. When it produces and sells 17,000 units, its average costs per unit are as follows: Amount per Unit $ 7.60 $ 4.60 $ 2.10 $ 5.60 $ 4.10 $ 3.10 $ 1.60 $ 1.10 Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Fixed selling expense Fixed administrative expense Sales commissions Variable administrative expense Required: 1. If 15,000 units are produced and sold, what is the variable cost per unit produced and sold? 2. If 19,000 units are produced and sold, what is the variable cost per unit produced and sold? 3. If 15,000 units are produced and sold, what is the total amount of variable cost related to the units produced and sold? 4. If 19,000 units are produced and sold, what is the total amount of variable cost related to the units produced and sold? 5. If 15,000 units are produced, what is the average fixed manufacturing cost per unit produced? 6. If 19,000 units are produced,…arrow_forwardAverage Cost per Unit Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Fixed selling expense Fixed administrative expense $6.55 $3.45 $1.45 $3.80 $1.40 $0.95 $1.35 $0.85 Sales commissions Variable administrative expense If 7,300 units are sold, the variable cost per unit sold is closest to:arrow_forward

- ABC Company makes four products in a single facility. Data concerning these products appear below: Product Selling price per unit Variable manufacturing cost A C P28.20 P26.60 D P20.40 P24.70 per unit Variable selling cost per unit Milling machine minutes per P11.40 P7.70 P6.30 P9.30 P3.40 P1.50 P3.50 P1.80 unit 2.60 1.40 0.70 0.90 Monthly demand in units The milling machines are potentially the constraint in the production facility. A total of 10,400 minutes are available per month on these machines. 1,000 3,000 4,000 1,000 8)Which product makes the LEAST profitable use of the milling machines? a. Product A c. Product C d. Product D b. Product B 9) Which product makes the MOST profitable use of the milling machines? a. Product A b. Product B c. Product C d. Product D 10) Up to how much should the company be willing to pay for one additional hour of milling machine time if the company has made the best use of the existing milling machine capacity? (Round off to the nearest whole cent.)…arrow_forwardQuestion 9.3 Burnaby traders makes four products in a single facility. Following information regarding products is given: Product A B C D Selling Price per Unit $35.30 $30.20 $20.80 $26.00 Variable Manufacturing Cost per Unit $16.50 $15.80 $7.90 $8.50 Variable Selling Cost per Unit $3.80 $1.60 $1.90 $3.30 Milling Machine Minutes per Unit 3.20 1.80 2.20 2.50 Monthly Deman in Units 4,000 1,000 3,000 1,000 Maximum minutes on all machines (22,600) Required: 1) How many minutes of milling machine time would be required to satisfy demand for all four products? 2) Which product makes the LEAST profitable use of the milling machines? 3) Which product makes the MOST profitable use of the milling machines?arrow_forwardGemini plc manufactures four products using the same machinery. The following details relate to its products: ProductA £ per unit ProductB £ per unit ProductC £ per unit ProductD £ per unit Selling price 28 34 45 46 Direct material 6 7 9 7 Direct labour 5 5 10 10 Variable overhead 3 3 6 6 Fixed overhead * 8 8 16 16 Profit 6 11 4 7 Labour hours 1 1 2 2 Machine hours 4 3 4 5 Units Units Units Units Maximum demand per week 200 180 250 100 *Absorbed based on budgeted labour hours of 1000 per week. There is a maximum of 2000 machine hours available per week. A) Determine the production plan which will maximize the weekly profit of Gemini plc and prepare a profit statement showing the profit your plan will yield. - ANSWERED, SEE ATTACHED IMAGE Please see the findings of A) as an attachement. Please respond to part B) B) The marketing director of Gemini plc is concerned…arrow_forward

- Cranston Corporation makes four products in a single facility. Data concerning these products appear below: Products A B C D Selling price per unit $ 42.30 $ 50.00 $ 37.60 $ 33.50 Variable manufacturing cost per unit $ 20.80 $ 30.70 $ 21.00 $ 19.90 Variable selling cost per unit $ 2.70 $ 2.10 $ 1.00 $ 2.40 Milling machine minutes per unit 3.30 4.10 2.60 1.30 Monthly demand in units 1,000 4,000 3,000 3,000 The milling machines are potentially the constraint in the production facility. A total of 28,200 minutes are available per month on these machines.Up to how much should the company be willing to pay for one additional minute of milling machine time if the company has made the best use of the existing milling machine capacity? (Round your intermediate calculations to 2 decimal places.) $4.20 $0.00 $18.80 $11.20arrow_forwardRedhead Equipment Inc. manufactures three products. Information about the selling prices and unit costs for the three products is below: Product A Selling price $90.00 $60.00 $110.00 Variable costs $52.00 $24.00 $63.00 Fixed costs $22.00 $8.00 $25.00 Compression machine time 11 min. 6 min. 13 min. Fixed costs are applied based on direct labour hours. Demand for the three products exceeds the company's current production capacity. The compression machine is the constraint, with just 2,500 minutes of compression machine time available this week. Required: a. Given the compression machine constraint, which product should be emphasized? Be sure to show your calculations to support your recommendation Activa Go to Parrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education