FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Fixed

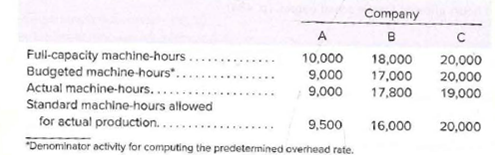

Selected operating information on three different companies for a recent year is given below:

Required:

For each company, state whether the company would have a favorable or unfavorable volume variance and why.

Transcribed Image Text:Company

A

Full-capacity machine-hours.

Budgeted machine-hours"..

Actual machine-hours....

Standard machine-hours allowed

for actual production..

"Denominator activity for computing the predetermined overhead rate.

10,000

18,000

20,000

20,000

19,000

9,000

17,000

9,000

16,000

20,000

9,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 4arrow_forwardComputation of Variable Cost Variances The following information pertains to the standard costs and actual activity for Repine Company for September: Standard cost per unit Direct materials Direct labor Activity for September Materials purchased Material A Material B Materials used Material A Material B Direct labor used Production output 3 units of material A x $8.00 per unit 2 units of material B x $4.00 per unit 2 hours x $15.00 per hour 7,000 units x $7.80 per unit 4,800 units x $4.50 per unit Materials price variance $ Materials quantity variance 6,430 units 3,950 units 4,100 hours x $15.50 per hour 2,000 units There were no beginning direct materials inventories. (a) Determine the materials price and quantity variances. Material A (b) Determine the labor rate and efficiency variances. Labor rate variance $ Labor efficiency variance $ ◆ → $ → Material B ◆ →arrow_forwardVariances, Entries, and Income Statement A summary of Martindale Company's manufacturing variance report for May follows: Direct material Direct labor Variable overhead Fixed overhead Total Standard Costs (9,200 units) $38,640 193,200 22,080 9,660 $263,580 Actual Costs (9,200 units) Variances $41,760 $3,120 U 191,760 1,440 F 23,230 1,150 U 9,660 $266,410 $2,830 U Standard materials cost per unit of product is 0.5 pounds at $8.40 per pound, and standard direct labor cost is 1.5 hours at $14.00 per hour. The total actual materials cost represents 4,800 pounds purchased at $8.70 per pound. Total actual labor cost represents 14,100 hours at $13.60 per hour. According to standards, variable overhead rate is applied at $1.60 per direct labor hour (based on a normal capacity of 15,000 direct labor hours or 10,000 units of product). Assume that all fixed overhead is applied to work-in-progress inventory.arrow_forward

- Amada Company's standard cost system reports this information from its December operations. Standard direct materials cost Direct materials quantity variance Direct materials price variance Actual direct labor cost Direct labor efficiency variance Direct labor rate variance Actual overhead cost Volume variance Controllable variance View transaction list Journal entry worksheet 1 Required: 1. Prepare December 31 journal entries to record the company's costs and variances for the month for (a) direct materials, (b) direct labor, and (c) overhead. Ignore the journal entry to close the variances. 2 3 Record direct materials costs and variances. Date December 31 Note: Enter debits before credits. $ 100,000 General Journal 3,000 U 500 F 90,000 7,000 F 1,200 U 375,000 12,000 U 9,000 U Debit Credit >arrow_forwardQuilcene Oysteria farms and sells oysters in the Pacific Northwest. The company harvested and sold 7,300 pounds of oysters in August. The company's flexible budget for August appears below: Quilcene Oysteria Flexible Budget Actual pounds (q) Revenue ($4.15q) Expenses: Packing supplies ($0.35q) Oyster bed maintenance ($3,100) Wages and salaries ($2,500 + $0.35q) Shipping ($0.60q) Utilities ($1,210) For the Month Ended August 31 Other ($400 + $0.019) Total expenses Net operating income Actual pounds Revenue The actual results for August were as follows: Expenses: Quilcene Oysteria Income Statement For the Month Ended August 31 Packing supplies Oyster bed maintenance Wages and salaries Shipping Utilities Other Total expenses Net operating income 7,300 $ 30,295 2,555 3,100 5,055 4,380 1,210 473 16,773 $ 13,522 7,300 $ 26,600 2,725 2,960 5,465 4,110 1,020 1,093 17,373 $ 9,227arrow_forwardFix the red pleasearrow_forward

- Required information [The following information applies to the questions displayed below.] AirPro Corporation reports the following for this period. Actual total overhead Standard overhead applied Budgeted (flexible) variable overhead rate Budgeted fixed overhead Predicted activity level Actual activity level Answer is complete but not entirely correct. Standard overhead applied Budgeted (flexible) overhead Volume variance Volume Variance ✓ S $ Compute the volume variance and identify it as favorable or unfavorable. $ $ 28,525 $ 31,620 28,525 X 12,600 x (2,400) Unfavorable $ 2.10 per unit $ 12,600 12,600 units 10,200 unitsarrow_forwardSagararrow_forwardRequired:1. Compute the plantwide predetermined overhead rate and calculate the overhead assigned toeach product.2. Calculate the predetermined departmental overhead rates and calculate the overheadassigned to each product.3. Using departmental rates, compute the applied overhead for the year. What is the under- oroverapplied overhead for the firm?4. Prepare the journal entry that disposes of the overhead variance calculated in Requirement3, assuming it is not material in amount. What additional information would you need ifthe variance is material to make the appropriate journal entry?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education