FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

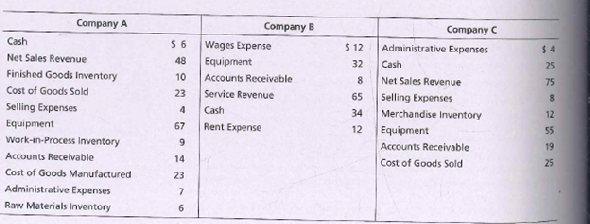

Use the following data for Exercises E16-16, E16-17, and E16-18.

Selected data for three companies are given below. All inventory amounts are ending balances and all amounts are in millions.

Identifying differences between service, merchandising, and manufacturing companies

Using the above data, determine the company type. Identify each company as a service company, merchandising company, or manufacturing company.

Transcribed Image Text:Company A

Company B

Company C

Cash

Net Sales Revenue

Wages Experse

$ 12

Administrative Expenses

48

32

Cash

25

Equipment

Finished Goods Inventory

Cost of Goods Sold

Selling Expenses

Equipment

10

Accounts Receivable

23

Service Revenue

Net Sales Revenue

75

65

Selling Expenses

34

Merchandise Inventory

12

Cash

Rent Expense

67

12

55

work-in-Process Inventory

Accounts Recelvable

Equipment

Accounts Receivable

19

14

23

Cost of Goods Sold

25

Cost of Goods Manufactured

Administrative Expenses

Raw Materials Inventory

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Prepare an income statement for Rex Manufacturing for the year ended December 31 using the following information. Hint. Not all Information given is needed for the solution. Finished goods inventory, ending General and administrative expenses Accounts receivable Finished goods inventory, beginning Cost of goods manufactured Selling expenses Cash Land Sales Equipment Sales Cost of goods sold Finished goods inventory, beginning Cost of goods manufactured Goods available for sale Less: Finished goods inventory, ending Cost of goods sold $ 16, 600 14, 600 18, 600 19, 609 40, 600 12, 600 55, 600 REX MANUFACTURING Income Statement For Year Ended December 31 Gross profit General and administrative expenses Selling expenses 28,690 93, 200 1,600 $ 19,600 40,600 60,200 16,600 $ 93,200arrow_forwardUse the following information for a manufacturer to compute cost of goods manufactured and cost of goods sold: (Click the icon to view account balances.) (Click the icon to view other information.) Data table Balances: Direct Materials Work-in-Process Inventory Finished Goods Inventory Print Beginning S 21,000 $ 44,000 14.000 Done Ending 32,000 30,000 23,000 - X ... Data table Other information: Purchases of direct materials Direct labor Manufacturing overhead Print S Done 71,000 84.000 45,000 - Xarrow_forwardAccountingarrow_forward

- All information includedarrow_forwardA manufacturer reports the information below. Finished goods inventory, beginning Finished goods inventory, ending Depreciation on factory equipment Direct labor Indirect labor Factory utilities Selling expenses Direct materials used Indirect materials used Office rent expense Work in process inventory, beginning Work in process inventory, ending Complete this question by entering your answers in the tabs below. Required A Required B Compute cost of goods sold for the period. Goods available for sale Cost of goods sold $ 8,200 9,140 4,800 84,000 36,700 3,200 750 55,900 700 1,200 1,600 2,400 $ 0arrow_forwardHello, I need help solving this accounting problem.arrow_forward

- Vaiarrow_forwardThe Majors Company collected the following information (in days): Inspecting product Transporting product Storing product Manufacturing product 20 22 31 56 What is the manufacturing cycle efficiency?arrow_forwardInterdepartment Services: Step Method O'Brian's Department Stores allocates the costs of the Personnel and Payroll departments to three retail sales departments, Housewares, Clothing, and Furniture. In addition to providing services to the operating departments, Personnel and Payroll provide services to each other. O'Brian's allocates Personnel Department costs on the basis of the number of employees and Payroll Department costs on the basis of gross payroll. Cost and allocation information for June is as follows: Direct department cost Number of employees Gross payroll Personnel Payroll Housewares Clothing Furniture $7,300 $3,800 $12,300 $20,000 $15,650 5 Total costs $ 2 $6,100 $2,800 Payroll 0 (a) Determine the percentage of total Personnel Department services that was provided to the Payroll Department. (Round your answer to one decimal place.) 12.5 X% (b) Determine the percentage of total Payroll Department services that was provided to the Personnel Department. (Round your answer…arrow_forward

- a. Prepare a schedule of cost of goods manufactured. b. Prepare an income statement.arrow_forwardVishnuarrow_forwardPrepare an income statement for Rex Manufacturing for the year ended December 31 using the following information. Hint. Not all information given is needed for the solution. 0 Finished goods inventory, ending General and administrative expenses Accounts receivable Finished goods inventory, beginning Cost of goods manufactured Selling expenses Cash Land Sales. Equipment Cost of goods sold $ 17,900 15,900 19,900 20,900 41,900 13,900 56,900 29,900 95,800 2,900 REX MANUFACTURING Income Statement For Year Ended December 31arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education