FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:ESPAÑOL

INGLÉS

FRANCÉS

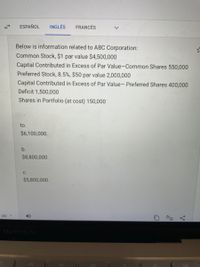

Below is information related to ABC Corporation:

Common Stock, $1 par value $4,500,000

Capital Contributed in Excess of Par Value-Common Shares 550,000

Preferred Stock, 8.5%, $50 par value 2,000,000

Capital Contributed in Excess of Par Value- Preferred Shares 400,000

Deficit 1,500,000

Shares in Portfolio (at cost) 150,000

to.

$6,100,000.

b.

$8,800,000.

C.

$5,800,000.

MacBook Air

DII

PP

V.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- yby external tool Using the information below, compute ending retained earnings. Additional Paid-in Capital, Common $ 9,000 Accounts Payable 1,100 Total Expenses 7,800 Preferred Stock, at par 1,750 Common Stock, at par 400 Sales 10,000 Treasury Stock 250 Dividends 700 Retained Earnings (beginning) 1,000 Additional Paid-in Capital, Prefeered 50 O $2.500 $2.750 O$11.250 O$2.250 O$11.500 On what date does a declared cash dividend become a liability to be recordearrow_forwardDividend constraints The Howe Company's stockholders' equity account is as follows: have been included as part of the $2.1 million retained earnings. a. What is the maximum dividend per share that the firm can pay? (Assume that legal capital includes all paid-in capital.) b. If the firm has $180,000 in cash, what is the largest per-share dividend it can pay without borrowing? The earnings available for common stockholders from this period's operations are $100,000, which c. Indicate the accounts and changes, if any, that will result if the firm pays the dividends indicated in parts a and b. d. Indicate the effects of an $80,000 cash dividend on stockholders' equity. a. The maximum dividend per share that the firm can is $ (Round to the nearest cent.)arrow_forwardTotal assets Notes payable (6% interest) Common stock Preferred 2.5% stock, $100 par (no change during year) Retained earnings 20Y7 $5,200,000 2,500,000 250,000 Return on total assets December 31 20Y6 $5,000,000 2,500,000 250,000 500,000 1,222,000 500,000 1,574,000 < The 20Y7 net income was $411,000, and the 20Y6 net income was $462,500. No dividends on common stock were declared between 201 and 20Y7. Preferred dividends were declared and paid in full in 20Y6 and 20Y7. 20Y7 a. Determine the return on total assets, the return on stockholders' equity, and the return on common stockholders' equity for the years 20Y6 and 20Y7. Round percentages to one decimal place. 19.13 % X % 20Y5 $4,800,000 2,500,000 250,000 Return on stockholders' equity Return on common stockholders' equity h The profitability ratios indicate that the company's profitability has deteriorated % 500,000 750,000 20Y6 94.0 X % % % ✓. Because the return on commonarrow_forward

- Godoarrow_forwardon 18 yet wered ints out of t 00 Rag question Assume a $100 cash dividend is declared; 70% of the dividend is a liquidating dividend. Indicate the change in Dividends Payable and Additional Paid-in-Capital respectively. Select one: O a. Decrease $70, Decrease $100 Ob Decrease $30, Decrease $100 Oc Increase $100, Decrease $70 Od. Decrease $30, Decrease $30 Oe. Increase $70, Decrease $70arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education