Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

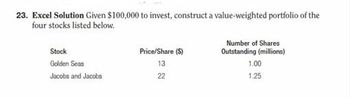

Transcribed Image Text:23. Excel Solution Given $100,000 to invest, construct a value-weighted portfolio of the

four stocks listed below.

Stock

Golden Seas

Jacobs and Jacobs

Price/Share ($)

13

22

Number of Shares

Outstanding (millions)

1.00

1.25

Transcribed Image Text:Stock

MAG

PDJB

Price/Share ($)

43

5

Number of Shares

Outstanding (millions)

30.00

10.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Ulmer Company is considering the following alternative financing plans: Plan 1 Plan 2 Issue 8% bonds at face value $2,000,000 $1,000,000 Issue preferred stock, $15 par — 1,500,000 Issue common stock, $10 par 2,000,000 1,500,000 Income tax is estimated at 35% of income. Dividends of $1 per share were declared and paid on the preferred stock. Determine the earnings per share of common stock, assuming income before bond interest and income tax is $600,000. Round your answers to two decimal places. Earnings per Shareon Common Stock Plan 1 $fill in the blank 1 Plan 2 $fill in the blank 2arrow_forwardPReview Homework unting II - W21 - Summer 2023 K earson.com/Student/PlayerTest.aspx?testid=253859028 When 4,000 shares of $1 stated value common stock is issued at $17 per share, % 5 X A. the accounting is exactly the same as the accounting for par value stock O B. the difference between the issue price and the stated value is credited to Paid - In Capital i O C. the account titled Paid - In Capital in Excess of Stated - Common is used to record the issu OD. Common Stock - $1 Stated is credited for $68,000 20 Q Search 40 6 P Chapter 13 Test ayer/Player.aspx?cultureld=&theme=accounting & style=highered&disableStandbyIndicator=true&assignmentHandles Locale Question 35 of 36 & 7 8 *** 144 no + 11 11 twarrow_forwardA stock market comprises 2300 shares of stock A and 2300 shares of stock B. The share prices for stocks A and B are $20 and $10, respectively. What proportion of the market portfolio is comprised of each stock? A. Stock A is 66.7% and Stock B is 33.3% B. Stock A is $46,000 and Stock B is $23,000 C. Stock A is 200% and Stock B is 100% O D. Stock A is 33.3% and Stock B is 66.7%arrow_forward

- Question 1 The following information relates to a company listed on Luse- Mungwi PLC ZMK Issued share capital (1000 shares) Share premium. Reserves. Share holders funds. 6% Irredeemable Debentures. 9% Redeemable Debentures. Bank loan. Total Long Term Liabilities. Million 4 000 2 600 290 6,890 2,800 2,900 1 000 6 700 The current cum interest market value per k100 units is k103 and k105 fir the 6% and 9% Debentures respectively. The 9% Debenture is redeemable at par in 10 years time. The bank loan bears interest rate of 2% above the base rate (current base rate is 15%). The current ex-div market price of shares is k1, 100 and a dividend of K100 per share which is expected to grow at a rate of 5% per year has just been paid. The effective corporation tax rate for Mungwi is 30%. Required: A) Calculate the effective after tax weighted Average Cost of Capital (WACC) fir Mungwi PLCarrow_forward# 1 A firm issues preferred stock with a dividend of $3.42. If the appropriate discount rate is 7.05% what is the value of the preferred stock? Submit Answer format: Currency: Round to: 2 decimal places. unanswered not_submitted Attempts Remaining: Infinity %23arrow_forwardEffect of financing on earnings per sharearrow_forward

- Question content area top Part 1 (Preferred stock valuation) What is the value of a preferred stock where the dividend rate is 13 percent on a $100 par value, and the market's required yield on similar shares is 9 percent? Question content area bottom Part 1 The value of the preferred stock is $enter your response here per share. (Round to the nearest cent.)arrow_forwardQuestion 3 Zion has 121 shares of company LMN stock. LMN issued dividend payments every quarter that totaled $1.19 per share for the entire year. The current price for LMN stock is $34.87 per share. What is the current dividend yield for LMN stock? Round your answer to the hundredth of a percent. Input just the number. Do not input the percent sign. Do not use a comma. Example: 3.27arrow_forwardCost of preferred stockarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education