FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

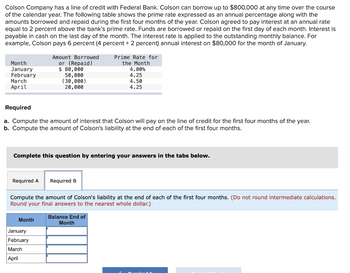

Transcribed Image Text:Colson Company has a line of credit with Federal Bank. Colson can borrow up to $800,000 at any time over the course

of the calendar year. The following table shows the prime rate expressed as an annual percentage along with the

amounts borrowed and repaid during the first four months of the year. Colson agreed to pay interest at an annual rate

equal to 2 percent above the bank's prime rate. Funds are borrowed or repaid on the first day of each month. Interest is

payable in cash on the last day of the month. The interest rate is applied to the outstanding monthly balance. For

example, Colson pays 6 percent (4 percent + 2 percent) annual interest on $80,000 for the month of January.

Month

January

February

March

April

Amount Borrowed

or (Repaid)

$ 80,000

50,000

(30,000)

20,000

Required

a. Compute the amount of interest that Colson will pay on the line of credit for the first four months of the year.

b. Compute the amount of Colson's liability at the end of each of the first four months.

Required A Required B

Complete this question by entering your answers in the tabs below.

Month

Prime Rate for

the Month

January

February

March

April

4.00%

4.25

4.50

4.25

Compute the amount of Colson's liability at the end of each of the first four months. (Do not round intermediate calculations.

Round your final answers to the nearest whole dollar.)

Balance End of

Month

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Campus Flights takes out a bank loan in the amount of $210,000 on March 1. The terms of the loan include a repayment of principal in ten equal installments, paid annually from March 1. The annual interest rate on the loan is 9 percent, recognized on December 31. A. Compute the interest recognized as of December 31 in year 1. 15,750 ✔ 3. Compute the principal due in year 1.arrow_forwardOn January 1, YR01, Toyota Co. issued a two-year $1,000 note payable. The note bears interest of 7% paid yearly each December 31st. In addition, the principal amount will be paid back in two installments as follows: $400 will be paid back with the interest payment on December 31, YR01 and $600 will be paid back with the interest payment on December 31, YR02. At the date the note was issued, the market rate for similar notes payable was 6%. What is the present value of the note payable at the issue date of January 1, YR01 (assume an annual discounting period and round your final answer to the nearest penny)? a. $1,000.00 b. $1,014.77 c. $1,026.25 d. $ 1, 103.23 e. None of the answers provided are correctarrow_forwardColson Company has a line of credit with Federal Bank, Colson can borrow up to $386,000 at any time over the course of the calendar year. The following table shows the prime rate expressed as an annual percentage along with the amounts borrowed and repaid during the first four months of the year. Colson agreed to pay interest at an annual rate equal to 2.50 percent above the bank's prime rate. Funds are borrowed or repaid on the first day of each month. Interest is payable in cash on the last day of the month. The interest rate is applied to the outstanding monthly balance. For example, Colson pays 6.25 percent (3.75 percent + 2.50 percent) annual interest on $81,000 for the month of January. Month January February March April Amount Borrowed or (Repaid). $ 81,000 117,900 (24,400) 27,600 Required a. Compute the amount of interest that Colson will pay on the line of credit for the first four months of the year. b. Compute the amount of Colson's liability at the end of each of the first…arrow_forward

- Somber Company borrows $892,000 from Silver Financing Associates by securing a revolving line of credit at a 9% interest rate on April 15. Interest is due and payable at the end of each month based on the outstanding balance at the beginning of the month. Somber assigns $939,000 of its accounts receivable as collateral for the lending arrangement. Assume that accounts receivable are collected at the end of the month and the proceeds are remitted to Silver at the end of the month. Month Accounts Receivable Collected April 140,000 May 490,000 June 117,000 Requirements a. Compute the balance of notes payable at the end of each month. b. Prepare the necessary journal entries for these transactions. c. If the accounts receivable had been pledged as collateral, what entry would be made at April 15? A: Notes Notes Payable Accounts Payable Beginning Interest Receivable Cash Paid Ending Month…arrow_forwardOn the June 12 interest payment date, the outstanding balance on Delta Nurseries’ revolving loan was $65,000. The floating interest rate on the loan stood at 6.25% on June 12, but rose to 6.5% on July 3, and to 7% on July 29. If Delta made principal payments of $10,000 on June 30 and July 31, what were the interest charges to its bank account on July 12 and August 12? Present a repayment schedule supporting the calculations. (Round your final answers to 2 decimal places.) Date Number of days Interest rate (%) Interest ($) Accrued interest ($) Payment (Advance) ($) Principal portion ($) Balance ($) 12-Jun -- -- -- -- -- 65,000 30-Jun 18 6.25 10,000.00 10,000 55,000 3-Jul 3 6.25 55,000 12-Jul 9 6.50 55,000 29-Jul 17 6.50 55,000 31-Jul 2 7.00 10,000.00 10,000 45,000 12-Aug 12 7.00 45,000arrow_forwardOn January 1, Year 1, Niagara Corporation arranges a $6,000 line of credit with Centennial Bank. It accepted the bank's offer of 1% above the prime rate with interest payments on December 31 of each year. All borrowings and repayments are to take place on January 1 of each year. Niagara begins its loan transactions with Centennial Bank by borrowing $2,000 on January 1, Year 1. Which of the following shows the effect of this event on the financial statements? Assets A. 2,000 B. 2,000 C. 2,000 D. 2,000 Multiple Choice O OOO Balance Sheet Liabilities + 2,000 n/a n/a 2,000 Option B Option D Option A Option C Stockholders' Equity n/a 2,000 2,000 n/a Revenue n/a 2,000 2,000 n/a Income Statement Expense n/a n/a n/a n/a = Net Income n/a 2,000 2,000 n/a Statement of Cash Flows 2,000 IA 2,000 IA 2,000 OA 2,000 FAarrow_forward

- On January 1, year 8 Harper Co. finances the purchase of equipment by issuing a $15,000 non-interest-bearing note payable. The note will be paid off in 10 equal annual installments beginning on December 31, year 8. The market rate of interest for notes of this type is 5%. Considering the information below, at what amount should Harper Co. report the equipment on its balance sheet dated December 31, year 8? The present value of $1 at 5% for 10 periods 0.61391 The present value of an ordinary annuity of $1 at 5% for 10 periods 7.72173 The present value of an annuity due of $1 at 5% for 10 periods is 8.10782 8.10782arrow_forwardFranklin Company obtained a $110,000 line of credit from the State Bank on January 1, Year 1. The company agreed to accept a variable interest rate that was set at 2% above the bank's prime lending rate. The bank's prime rate of interest and the amounts borrowed or repaid during the first three months of Year 1 are shown in the following table. Assume that Franklin borrows or repays on the first day of each month. Borrowing is shown as a positive amount and repayments are shown as negative amounts indicated by parentheses. 1-January 1-February 1-Marchi Amount Borrowed Prime Rate for the Month 4.08 4.58 5.08 Based on this information alone, the amount of interest expense recognized in March would be closest to: (Do not round intermediate calculations. Round your answer to the nearest whole number.) Multiple Choice $177, $309. (Repaid) $ 32,000 (11,000) 32,000 $199.arrow_forwardNYJ, Inc. borrowed $800,000 on July 1, 20X1, and signed a ten-month note bearing interest at 5%. Principal and interest are payable in full at maturity. In connection with this note, NYJ, Inc. should record interest expense in 20X2 in the amount of:arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education