Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

The monster truck operates serveral specialty

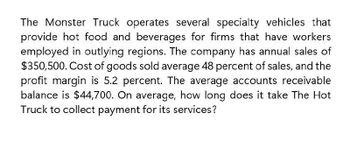

Transcribed Image Text:The Monster Truck operates several specialty vehicles that

provide hot food and beverages for firms that have workers

employed in outlying regions. The company has annual sales of

$350,500. Cost of goods sold average 48 percent of sales, and the

profit margin is 5.2 percent. The average accounts receivable

balance is $44,700. On average, how long does it take The Hot

Truck to collect payment for its services?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- R&R Savings Bank finds that its basic transaction account, which requires a $1000 minimum balance, costs this savings bank an average of $3.25 per month in servicing costs (including labor and computer time) and $1.25 per month in overhead expenses. The savings bank also tries to build in a $0.50 per month profit margin on these accounts. Further analysis of customer accounts reveals that for each $100 above the $500 minimum in average balance maintained in its transaction accounts, R&R Savings saves about 5 percent in operating expenses with each account. (Note: If the bank saves about 5 percent in operating expenses for each $100 held in balances above the $500 minimum, then a customer maintaining an average monthly balance of $1,000 should save the bank 25 percent in operating costs) For a customer who consistently maintains an average balance of $1,200 per month, how much should the bank charge in order to protect its profit margin? 05.00 4.68 O 0.32 325arrow_forwardColleen Company has gathered the following data pertaining to activities it performed for two of its major customers. Jerry, Inc. Number of orders Units per order Sales returns: Number of returns Total units returned Number of sales calls Activity Sales calls Order processing Deliveries Sales returns Sales salary 3 1,000 1 50 11 olleen sells its products at $190 per un The firm's gross margin ratio is 25%. Both Jerry and Kate pay their accounts promptly and no accounts receivable is over 30 days. After using business analytics software to carefully analyze the operating data for the past 30 months, the firm has determined the following activity costs: Kate Co. 60 400 Required 1 Required 2 5 130 3 Cost Driver and Rate $ 600 per visit 270 per order 180 per order 210 per return and $4 per unit returned 95,000 per month Required: 1. Using customers as the cost objects, classify the activity costs into cost categories (unit-level, batch-level, etc.) and compute the total cost for Colleen…arrow_forwardBob's Product Company takes 20 days to convert its raw materials to finished goods, 15 days to sell it, and 25 days to collect its credit sales. What is the company’s days receivable period? Group of answer choices 60 35 25 10 15 A bank letter of credit, sometimes called a standby letter of credit, is a written promise by a bank that it will make a payment on behalf of the customer. This is different than a line of credit, which is a akin to a credit card….a line of credit allows the company to borrow funds as needed to pay any bills. A LETTER of credit is specific to the party that the company might owe money to. Group of answer choices True Falsearrow_forward

- Colleen Company has gathered the following data pertaining to activities it performed for two of its major customers. Number of orders Units per order Sales returns: Number of returns Total units returned Jerry, Incorporated 6 Kate Company 60 3,000 460 4 50 15 3 190 4 es Number of sales calls Colleen sells its products at $230 per unit. The firm's gross margin ratio is 25%. Both Jerry and Kate pay their accounts promptly and no accounts receivable is over 30 days. After using business analytics software to carefully analyze the operating data for the past 30 months, the firm has determined the following activity costs: Activity Sales calls Deliveries Cost Driver and Rate $800 per visit 280 per order. 440 per order Order processing 240 per return and $3 per unit returned 83,000 per month. Sales returns Sales salary Required: 1. Using customers as the cost objects, classify the activity costs into cost categories (unit-level, batch-level, etc.) and compute the total cost for Colleen…arrow_forwardColleen Company has gathered the following data pertaining to activities it performed for two of its major customers. Number of orders Units per order Sales returns: Number of returns Total units returned Number of sales calls Jerry, Incorporated Kate Company 6 30 1,000 420 4 5 50 13 140 5 Colleen sells its products at $290 per unit. The firm's gross margin ratio is 20%. Both Jerry and Kate pay their accounts promptly and no accounts receivable is over 30 days. After using business analytics software to carefully analyze the operating data for the past 30 months, the firm has determined the following activity costs: Activity Sales calls Cost Driver and Rate $800 per visit Order processing Deliveries Sales returns Sales salary Required: 180 per order 410 per order 270 per return and $3 per unit returned 107,000 per month 1. Using customers as the cost objects, classify the activity costs into cost categories (unit-level, batch-level, etc.) and compute the total cost for Colleen Company…arrow_forwardColleen Company has gathered the following data pertaining to activities it performed for two of its major customers. Number of orders Units per order Sales returns: Number of returns Total units returned Jerry, Incorporated 5 Kate Company 60 2,000 220 3 30 13 5 190 6 Number of sales calls Colleen sells its products at $290 per unit. The firm's gross margin ratio is 25%. Both Jerry and Kate pay their accounts promptly and no accounts receivable is over 30 days. After using business analytics software to carefully analyze the operating data for the past 30 months, the firm has determined the following activity costs: Activity Sales calls Deliveries Cost Driver and Rate $1,000 per visit 200 per order 440 per order Order processing 290 per return and $6 per unit returned 99,000 per month Sales returns Sales salary Required: 1. Using customers as the cost objects, classify the activity costs into cost categories (unit-level, batch-level, etc.) and compute the total cost for Colleen Company…arrow_forward

- The Cycle Shoppe has decided to offer credit to its customers during the spring selling season. Sales are expected to be 330 bicycles. The average cost to the shop of a bicycle is $300. The owner knows that only 93 percent of the customers will be able to make their payments. To identify the remaining 7 percent, she is considering subscribing to a credit agency. The initial charge for this service is $540, with an additional charge of $6 per individual report. What is the amount of the net savings from subscribing to the credit agency? A. $3,790 B. $3,920 C. $4,080 D. $4,410 E. $4,950arrow_forwardGypsy Joe’s operates a chain of coffee shops. The company pays rent of $10,000 per year for each shop. Supplies (napkins, bags and condiments) are purchased as needed. The managers of each shop are paid a salary of $2,500 per month and all other employees are paid on an hourly basis. The costs of supplies relative to the number of customers in a particular shop and relative to the number of customers in the entire chain of shops is which kind of cost, respectively? Variable cost / fixed cost Fixed cost / fixed cost Variable cost / fixed cost Variable cost / variable costarrow_forwardElliott, Inc., has four salaried clerks to process purchase orders. Each clerk is paid a salary of 25,750 and is capable of processing as many as 6,500 purchase orders per year. Each clerk uses a PC and laser printer in processing orders. Time available on each PC system is sufficient to process 6,500 orders per year. The cost of each PC system is 1,100 per year. In addition to the salaries, Elliott spends 27,560 for forms, postage, and other supplies (assuming 26,000 purchase orders are processed). During the year, 25,350 orders were processed. Required: 1. Classify the resources associated with purchasing as (1) flexible or (2) committed. 2. Compute the total activity availability, and break this into activity usage and unused activity. 3. Calculate the total cost of resources supplied (activity cost), and break this into the cost of activity used and the cost of unused activity. 4. (a) Suppose that a large special order will cause an additional 500 purchase orders. What purchasing costs are relevant? By how much will purchasing costs increase if the order is accepted? (b) Suppose that the special order causes 700 additional purchase orders. How will your answer to (a) change?arrow_forward

- Gerard Appliances, Inc., is a small manufacturer of washing machines and dryers. It sells its products to large, established discount retailers that market the appliances under their own names. Gerard generally sells the appliances on trade credit terms ofn/60, but if a customer wants a longer term, it will accept a note with a term of up to nine months. At present, the company is having cash flow troubles and needs $10 million immediately. Its Cash balance is $400,000, its Accounts Receivable balance is $4.6 million, and its Notes Receivable balance is $7.4 million.(a) How might Gerard Appliances use its accounts receivable and notes receivable to raise the cash it needs?(b) What are its prospects for raising the needed cash?arrow_forwardColleen Company has gathered the following data pertaining to activities it performed for two of its major customers. Number of orders Units per order Sales returns: Number of returns. Total units returned. Number of sales calls Activity Sales calls Order processing Deliveries Sales returns Sales salary Colleen sells its products at $200 per unit. The firm's gross margin ratio is 25%. Both Jerry and Kate pay their accounts promptly and no accounts receivable is over 30 days. After using business analytics software to carefully analyze the operating data for the past 30 months, the firm has determined the following activity costs: Required 1 Required 2 Jerry, Inc. Kate Co. 5 1,000 Customer unit level costs: Required: 1. Using customers as the cost objects, classify the activity costs into cost categories (unit-level, batch-level, etc.) and compute the total cost for Colleen Company to service Jerry, Inc. and Kate Co. 2. Compare the profitability of these two customers. Customer batch…arrow_forwardCan you please give answer for accounting questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning