Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

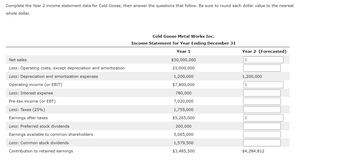

Transcribed Image Text:Complete the Year 2 income statement data for Cold Goose, then answer the questions that follow. Be sure to round each dollar value to the nearest

whole dollar.

Net sales

Less: Operating costs, except depreciation and amortization

Less: Depreciation and amortization expenses

Operating income (or EBIT)

Less: Interest expense

Pre-tax income (or EBT)

Less: Taxes (25%)

arnings after taxes

Less: Preferred stock dividends

Earnings available to common shareholders

Less: Common stock dividends

Contribution to retained earnings

Cold Goose Metal Works Inc.

Income Statement for Year Ending December 31

Year 1

$30,000,000

21,000,000

1,200,000

$7,800,000

780,000

7,020,000

1,755,000

$5,265,000

200,000

5,065,000

1,579,500

$3,485,500

Year 2 (Forecasted)

$

1,200,000

$

$

$4,284,812

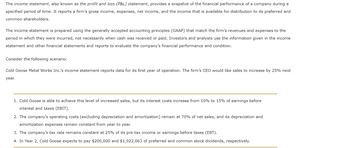

Transcribed Image Text:The income statement, also known as the profit and loss (P&L) statement, provides a snapshot of the financial performance of a company during a

specified period of time. It reports a firm's gross income, expenses, net income, and the income that is available for distribution to its preferred and

common shareholders.

The income statement is prepared using the generally accepted accounting principles (GAAP) that match the firm's revenues and expenses to the

period in which they were incurred, not necessarily when cash was received or paid. Investors and analysts use the information given in the income

statement and other financial statements and reports to evaluate the company's financial performance and condition.

Consider the following scenario:

Cold Goose Metal Works Inc.'s income statement reports data for its first year of operation. The firm's CEO would like sales to increase by 25% next

year.

1. Cold Goose is able to achieve this level of increased sales, but its interest costs increase from 10% to 15% of earnings before

interest and taxes (EBIT).

2. The company's operating costs (excluding depreciation and amortization) remain at 70% of net sales, and its depreciation and

amortization expenses remain constant from year to year.

3. The company's tax rate remains constant at 25% its pre-tax income or earnings before taxes (EBT).

4. In Year 2, Cold Goose expects to pay $200,000 and $1,922,063 of preferred and common stock dividends, respectively.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

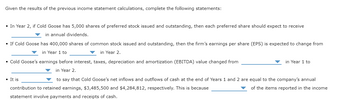

Transcribed Image Text:Given the results of the previous income statement calculations, complete the following statements:

• In Year 2, if Cold Goose has 5,000 shares of preferred stock issued and outstanding, then each preferred share should expect to receive

in annual dividends.

• If Cold Goose has 400,000 shares of common stock issued and outstanding, then the firm's earnings per share (EPS) is expected to change from

in Year 2.

in Year 1 to

• Cold Goose's earnings before interest, taxes, depreciation and amortization (EBITDA) value changed from

in Year 2.

in Year 1 to

• It is

to say that Cold Goose's net inflows and outflows of cash at the end of Years 1 and 2 are equal to the company's annual

contribution to retained earnings, $3,485,500 and $4,284,812, respectively. This is because

of the items reported in the income

statement involve payments and receipts of cash.

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

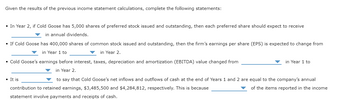

Transcribed Image Text:Given the results of the previous income statement calculations, complete the following statements:

• In Year 2, if Cold Goose has 5,000 shares of preferred stock issued and outstanding, then each preferred share should expect to receive

in annual dividends.

• If Cold Goose has 400,000 shares of common stock issued and outstanding, then the firm's earnings per share (EPS) is expected to change from

in Year 2.

in Year 1 to

• Cold Goose's earnings before interest, taxes, depreciation and amortization (EBITDA) value changed from

in Year 2.

in Year 1 to

• It is

to say that Cold Goose's net inflows and outflows of cash at the end of Years 1 and 2 are equal to the company's annual

contribution to retained earnings, $3,485,500 and $4,284,812, respectively. This is because

of the items reported in the income

statement involve payments and receipts of cash.

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Larger Company had originally expected to earn operating income ofPhp130,000 in the coming year. Its degree of operating leverage is 2.4.Recently, larger revised its plan and now expects to increase sales by 20%next year. What is the percentage change in operating income for thecoming year? a. 8.33%b. 48.00%c. 20.00%d. 54.17%arrow_forwardHalliford Corporation expects to have earnings this coming year of $2.73 per share. Halliford plans to retain all of its earnings for the next two years. Then, for the subsequent two years, the firm will retain 45% of its earnings. It will retain 21% of its earnings from that point onward. Each year, retained earnings will be invested in new projects with an expected return of 18.1% per year. Any earnings that are not retained will be paid out as dividends. Assume Halliford's share count remains constant and all earnings growth comes from the investment of retained earnings. If Halliford's equity cost of capital is 10.3%, what price would you estimate for Halliford stock? The stock price will be $ (Roun to the nearest cent.)arrow_forwardPhilip Inc. expects their sales to increase by $900,000 next month. If their CMR is calculated as 48%, operating income of the next month would be expected to: Group of answer choices Increase by $432,000 Decrease by $468,000 Decrease by $432,000 Increase by $468,000arrow_forward

- Steber Packaging Inc. expects sales next year of $40 million. Of this total, 45 percent is expected to be for cash and the balance will be on credit, payable in 30 days. Operating expenses are expected to total $17 million. Accelerated depreciation is expected to total $12 million, although the company will only report $8 million of depreciation on its public financial reports. The marginal tax rate for Steber is 34 percent. Current assets now total $26 million and current liabilities total $14 million. Current assets are expected to increase to $29 million over the coming year. Current liabilities are expected to increase to $20 million. Compute the projected after-tax operating cash flow for Steber during the coming year. Enter your answer in millions. For example, an answer of $1.2 million should be entered as 1.2, not 1,200,000. Round your answer to two decimal places. $ millionarrow_forwardThe following tables contain financial statements for Dynastatics Corporation. Although the company has not been growing, it now plans to expand and will increase net fixed assets (i.e., assets net of depreciation) by $200,000 per year for the next 5 years, and it forecasts that the ratio of revenues to total assets will remain at 1.50. Annual depreciation is 10% of net fixed assets at the beginning of the year. Fixed costs are expected to remain at $60 and variable costs at 80% of revenue. The company's policy is to pay out two- thirds of net income as dividends and to maintain a book debt ratio of 20% of total capital. INCOME STATEMENT, 2019 (Figures in $ thousands) Revenue $1,800 Fixed costs Variable costs (80% of revenue) Depreciation Interest (8% of beginning-of-year debt) Taxable income Taxes (at 40%) 60 1,440 80 24 196 78 Net income 118 Dividends Addition to retained earnings $ 79 $ 39 BALANCE SHEET, YEAR-END (Figures in $ thousands) 2019 Assets Net working capital Fixed assets…arrow_forwardSolano Company has sales of $840,000, cost of goods sold of $540,000, other operating expenses of $70,000, average invested assets of $2,450,000, and a hurdle rate of 11 percent. Required: Determine Solano's return on investment (ROI), investment turnover, profit margin, and residual income. Several possible changes that Solano could face in the upcoming year follow. Determine each scenario's impact on Solano's ROI and residual income. (Note: Treat each scenario independently.) Company sales and cost of goods sold increase by 40 percent. Operating expenses decrease by $12,000. Operating expenses increase by 10 percent. Average invested assets increase by $470,000. Solano changes its hurdle rate to 17 percent.arrow_forward

- Flamengo Co is a sporting goods manufacturing company. Last year, report the following information: Sales S700,000 Cost of goods sold $130,000 Selling and administrative expense $260,000 At the beginning of the year, the value of operating assets was $800,000. At the end of the year, the value of operating assets was $1,200,000. Flamengo- Co. requires a minimum rate of return of 15%. Calculate the Margin. Round all numbers to two decimal places. Do not answer as a percentage. For example, if the Margin is 17.63%, you should type 0.18.arrow_forwardThe best example of a well-stated, specific financial objective is to increase ROA (return on asset) by 0.5 percent annually. maximize total company profits and return on investment. achieve lower costs than any other industry competitor. gradually boost market share from 10 percent to 15 percent over the next several years.arrow_forwardA company has $2.5 million of sales today, SG&A costs of $2 million excluding depreciation, annual depreciation of $0.6 million, and a COGS of 70%. Management estimates that if there is a large growth in sales, then the increase of SG&A excluding depreciation will equal to 5% of sales increment, and the increase of depreciation will equal to 4% of sales increment. No other income during this time. • Then what are the cash breakeven sales? $ • Then what are the book breakeven sales? $ thousand thousandarrow_forward

- Cold Goose Metal Works Inc.’s income statement reports data for its first year of operation. The firm’s CEO would like sales to increase by 25% next year. 1. Cold Goose is able to achieve this level of increased sales, but its interest costs increase from 10% to 15% of earnings before interest and taxes (EBIT). 2. The company’s operating costs (excluding depreciation and amortization) remain at 70% of net sales, and its depreciation and amortization expenses remain constant from year to year. 3. The company’s tax rate remains constant at 25% of its pre-tax income or earnings before taxes (EBT). 4. In Year 2, Cold Goose expects to pay $200,000 and $1,922,063 of preferred and common stock dividends, respectively. Complete the Year 2 income statement data for Cold Goose, then answer the questions that follow. Be sure to round each dollar value to the nearest whole dollar. Cold Goose Metal Works Inc. Income Statement for Year Ending December 31…arrow_forwardThe following tables contain financial statements for Dynastatics Corporation. Although the company has not been growing, it now plans to expand and will increase net fixed assets (i.e., assets net of depreciation) by $350,000 per year for the next 4 years, and it forecasts that the ratio of revenues to total assets will remain at 1.50. Annual depreciation is 20% of net fixed assets at the beginning of the year. Fixed costs are expected to remain at $86 and variable costs at 70% of revenue. The company’s policy is to pay out one-half of net income as dividends and to maintain a book debt ratio of 20% of total capital. INCOME STATEMENT, 2019(Figures in $ thousands) Revenue $ 2,160 Fixed costs 86 Variable costs (70% of revenue) 1,512 Depreciation 280 Interest (6% of beginning-of-year debt) 18 Taxable income 264 Taxes (at 35%) 92 Net income $ 172 Dividends $ 86 Addition to retained…arrow_forwardVikings Inc., is developing a pro forma income statement for the coming year. The chief financial officer estimates that sales will be $150,000,000. If gross profits are historically 36% of sales, what is the expected cost of goods sold (in dollars)? a) $36,000,000 b) $54,000,000 c) $64,000,000 d) $96,000,000 NOTE: In your Excel spreadsheet, all calculations must be includedarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education