Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

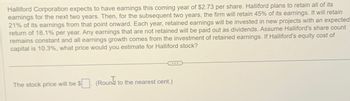

Transcribed Image Text:Halliford Corporation expects to have earnings this coming year of $2.73 per share. Halliford plans to retain all of its

earnings for the next two years. Then, for the subsequent two years, the firm will retain 45% of its earnings. It will retain

21% of its earnings from that point onward. Each year, retained earnings will be invested in new projects with an expected

return of 18.1% per year. Any earnings that are not retained will be paid out as dividends. Assume Halliford's share count

remains constant and all earnings growth comes from the investment of retained earnings. If Halliford's equity cost of

capital is 10.3%, what price would you estimate for Halliford stock?

The stock price will be $

(Roun

to the nearest cent.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- EmKay Inc. has $1,000,000 available to invest. It has narrowed its choices to two investments, and each is expected to generate income over a 10-year period. Investment A is expected to generate a net income of $100,000 at the end of year one with an annual increase of $20,000 each year in net annual income over the subsequent 9 years. Investment B is expected to generate a net income of $80,000 at the end of year one and the net annual income over each of the next 9 years is expected to be 20% larger than the previous year's net annual income. The company's TVOM is 8% per year compounded annually. a) b) c) any? Explain. Compute the present worth of the net income from Investment A over the 10-year period. Compute the present worth of the net income from Investment B over the 10-year period. Based on the above present worth calculations, which investment should EmKay, Inc. choose, ifarrow_forwardBlessing Ltd., a manufacturing firm, is growing at a phenomenal rate of 20% due to its discovery of a new drug. Analysts believe this grow will last for four years. After that it is predicted the firm will grow by 10% per annum indefinitely. Last year Blessing Ltd. paid a dividend of GH¢10. Shareholders require 20% return on their investment in similar firms. Determine the value of Blessing Ltd.arrow_forwardAn oil well is estimated to yield returns of $12,000 monthly (end of month) for eleven years. To develop the well, it is estimated that a company will have to spend $600,000 today, $250,000 in three years and $5,000 (for maintenance) at the beginning of the month for 6 years BUT starting in 3 years from today. If the company’s cost of capital (interest rate) is 14% compounded annually, what is the Net Present Value of this potential project?arrow_forward

- A company will need $70,000 in 6 years for a new addition. To meet this goal, the company deposits money in an account today that pays 11% annual interest compounded quarterly. Find the amount that should be invested to total $70,000 in 6 years.arrow_forwardHalliford Corporation expects to have earnings this coming year of $3.18 per share. Halliford plans to retain all of its earnings for the next two years. For the subsequent two years, the firm will retain 50% of its earnings. It will then retain 17% of its earnings from that point onward. Each year, retained earnings will be invested in new projects with an expected return of 21.81% per year. Any earnings that are not retained will be paid out as dividends. Assume Halliford's share count remains constant and all earnings growth comes from the investment of retained earnings. If Halliford's equity cost of capital is 8.3%, what price would you estimate for Halliford stock? Note: Remenber that growth rate is computed as: retention rate×rate of return.arrow_forwardNikularrow_forward

- A business worth $180,000 is expected to grow at 12% per year compounded annually for the next 4 years. (a) Find the expected future value. (b) If funds from the sale of the business today would be placed in an account yielding 8% compounded semiannually, what would be the minimum acceptable price for the business at this time?arrow_forwardHalliford Corporation expects to have earnings this coming year of $3.000 per share. Halliford plans to retain all of its earnings for the next two years. Then, for the subsequent two years, the firm will retain 50% of its earnings. It will retain 20% of its earnings from that point onward. Each year, retained earnings will be invested in new projects with an expected return of 25.0% per year. Any earnings that are not retained will be paid out as dividends. Assume Halliford's share count remains constant and all earnings growth comes from the investment of retained earnings. If Halliford's equity cost of capital is 10.0%, what price would you estimate for Halliford stock?arrow_forwardYou have looked at the current financial statements for J&R Homes, Company. The company has an EBIT of $3,850,000 this year. Depreciation, the increase in net working capital, and capital spending were $275,000, $133,000, and $525,000, respectively. You expect that over the next five years, EBIT will grow at 20 percent per year, depreciation and capital spending will grow at 10 per year, and NWC will grow at 15 per year. The company has $22,500,000 in debt and 430,000 shares outstanding. After Year 5, the adjusted cash flow from assets is expected to grow at 3.3 percent, indefinitely. The company's WACC is 9.35 percent and the tax rate is 21 percent. What is the price per share of the company's stock? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. Answer is complete but not entirely correct. Share price S 226.59arrow_forward

- PQR Corporation expects to have earnings this coming year of $3 per share (year 1). It plans to retain all of its earnings for the next two years (year 1 and year 2). For the subsequent two years ( year 3 and year 4), the firm will retain 50% of its earnings. It will then retain 20% of its earnings from that point onward. Each year, retained earnings will be invested in new projects with an expected return of 25% per year. Any earnings that are not retained will be paid out as dividends. Assume PQR's share count remains constant and all earnings growth comes from reinvestment of retained earnings. 4.1) Project dividends for years 1 to 6. 4.2) If PQR's equity cost of capital is 10%, what price would you estimate for PQR's stock?arrow_forwardShabbona Partners expects to have free cash flows of $38,950,000 next year, and free cash flows are expected to grow at a constant rate of 3% per year. If the firm's WACC is 9% per year, what is the value of Shabbona's operations?arrow_forwardYou have looked at the current financial statements for J&R Homes, Company. The company has an EBIT of $5,250,000 this year. Depreciation, the increase in net working capital, and capital spending were $345,000, $175,000, and $595,000, respectively. You expect that over the next five years, EBIT will grow at 15 percent per year, depreciation and capital spending will grow at 20 per year, and NWC will grow at 10 per year. The company has $29,500,000 in debt and 500,000 shares outstanding. After Year 5, the adjusted cash flow from assets is expected to grow at 3.3 percent, indefinitely. The company's WACC is 9.45 percent and the tax rate is 25 percent. What is the price per share of the company's stock? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. Share pricearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education