Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Data table

(Click on the icon here in order to copy the contents of the data table below

into a spreadsheet.)

Year

2019

2018

2017

2016

2015

2014

2013

Print

Dividend per Share

$1.88

$1.76

$1.64

$1.53

$1.43

$1.34

$1.25

Done

X

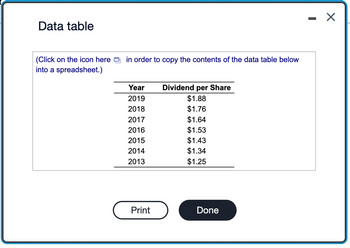

Transcribed Image Text:Integrative Risk and valuation Giant Enterprises' stock has a required return of 13.9%. The company, which plans to pay a dividend of $2.01 per share in the coming year, anticipates that its

future dividends will increase at an annual rate consistent with that experienced over 2013-2019 period, when the following dividends were paid:

a. If the risk-free rate is 3%, what is the risk premium on Giant's stock?

b. Using the constant-growth model, estimate the value of Giant's stock. (Hint: Round the computed dividend growth rate to the nearest whole percent.)

c. Explain what effect, if any, a decrease in the risk premium would have on the value of Giant's stock.

a. If the risk-free rate is 3%, the risk premium on Giant's stock is %. (Round to one decimal place.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Pls answer with explanations return on common stockholders equity for 2016 and 2017 thxarrow_forward1. Spark has paid the following dividends during 2021-2022: Date 9 April 2021 1 October 2021 8 April 2022 7 October 2022 The price of Spark shares at the start of 2021, 2022, and 2023 are Date 5 January 2021 5 January 2022 4 January 2023 (a) What is the HPR for 2021? What is the HPR for 2022? Dividend 12.5c 12.5c 12.5c 12.5c Price 4.80 4.49 5.34arrow_forwardPlease help with questionarrow_forward

- Please see attachedarrow_forwardPresented below are data for Caracas Corp. 2017 2018 Assets, January 1 $6,840 ? Liabilities, January 1 ? $4,104 Stockholders' Equity, Jan. 1 ? $4,125 Dividends 855 969 Common Stock 912 975 Stockholders' Equity, Dec. 31 ? 3,399 Net Income 1,026 ? Net income for 2018 is... $243 loss. $726 income. $180 income. $726 loss. Please show work.arrow_forwardPlease solve this question with calculationarrow_forward

- annual growth rate of the dividends for each firm listed in the following table: E ge annual growth rate of the dividends naid by Loowen2 wo decimal places.) i Data Table Cancel (Click on the following icon O in order to copy its contents into a spreadsheet.) Dividend Payment per Year Fim 2007 $1.07 $0.97 $2.25 2006 2008 $1.30 $0.80 $3.70 $2.60 2009 2010 $1.25 $1.20 $3.90 $2.80 2011 Loewen $1.03 $1.20 $1.31 $1.40 Morse $1.10 $1.10 Huddleston $1.25 $2.40 $3.90 $2.73 $5.00 $2.90 Meyer $2.10 Print Donearrow_forwardplease help me analyze and asnwer the questions with formula so that i can learn and get ready for my exam :<arrow_forward1. Find the Ratio of FIxed Assets to long term liabilities 2. Find the ratio of liabilities to stockholders equity Look at the pictures, then answer the question please! thank you in adavance.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education