FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

1. Find the Ratio of FIxed Assets to long term liabilities

2. Find the ratio of liabilities to

Look at the pictures, then answer the question please! thank you in adavance.

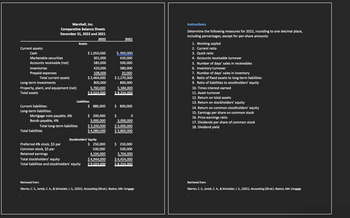

Transcribed Image Text:Current assets:

Cash

Marketable securities

Accounts receivable (net)

Inventories

Prepaid expenses

Marshall, Inc.

Comparative Balance Sheets

December 31, 2022 and 2021

2022

Total current assets

Long-term investments

Property, plant, and equipment (net)

Total assets

Current liabilities:

Long-term liabilities:

Mortgage note payable, 6%

Bonds payable, 4%

Total liabilities

Total long-term liabilities

Preferred 4% stock, $5 par

Common stock, $5 par

Retained earnings

Assets

$ 1,050,000

301,000

585,000

420,000

108,000

$ 2,464,000

Liabilities

Total stockholders' equity

Total liabilities and stockholders' equity

800,000

5,760,000

$9.024.000

$ 880,000

$ 200,000

3,000,000

$3,200,000

$ 4,080,000

Stockholders' Equity

$ 250,000

500,000

4,194,000

$ 4,944,000

$9.024.000

2021

$ 950,000

420,000

500,000

380,000

20,000

$ 2,270,000

800,000

5,184,000

$ 8.254.000

$ 800,000

$

0

3,000,000

$3,000,000

$ 3,800,000

$ 250,000

500,000

3,704,000

$ 4,454,000

$ 8.254.000

Retrieved from:

Warren, C. S., Jonick, C. A., & Schneider, J. S., (2021). Accounting (28 ed.). Boston, MA: Cengage

Instructions

Determine the following measures for 2022, rounding to one decimal place,

including percentages, except for per-share amounts:

1. Working capital

2. Current ratio

3. Quick ratio

4. Accounts receivable turnover

5. Number of days' sales in receivables

6. Inventory turnover

7. Number of days' sales in inventory

8. Ratio of fixed assets to long-term liabilities

9. Ratio of liabilities to stockholders' equity

10. Times interest earned

11. Asset turnover

12. Return on total assets

13. Return on stockholders' equity

14. Return on common stockholders' equity

15. Earnings per share on common stock

16. Price-earnings ratio

17. Dividends per share of common stock

18. Dividend yield

Retrieved from:

Warren, C. S., Jonick, C. A., & Schneider, J. S., (2021). Accounting (28 ed.). Boston, MA: Cengage

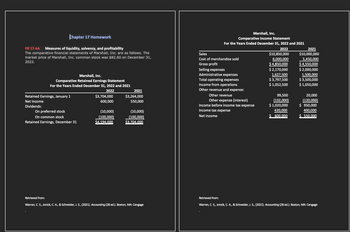

Transcribed Image Text:Chapter 17 Homework

PR 17-4A Measures of liquidity, solvency, and profitability

The comparative financial statements of Marshall, Inc. are as follows. The

market price of Marshall, Inc. common stock was $82.60 on December 31,

2022.

Marshall, Inc.

Comparative Retained Earnings Statement

For the Years Ended December 31, 2022 and 2021

2022

Retained Earnings, January 1

Net Income

Dividends:

On preferred stock

On common stock

Retained Earnings, December 31

$3,704,000

600,000

(10,000)

(100,000)

$4.194.000

2021

$3,264,000

550,000

(10,000)

(100,000)

$3.704.000

Retrieved from:

Warren, C. S., Jonick, C. A., & Schneider, J. S., (2021). Accounting (28 ed.). Boston, MA: Cengage

Marshall, Inc.

Comparative Income Statement

For the Years Ended December 31, 2022 and 2021

2022

$10,850,000

6.000.000

$ 4,850,000

$ 2,170,000

1,627,500

$ 3,797,500

$ 1,052,500

Sales

Cost of merchandise sold

Gross profit

Selling expenses

Administrative expenses

Total operating expenses

Income from operations

Other revenue and expense:

Other revenue

Other expense (interest)

Income before income tax expense

Income tax expense

Net Income

99,500

(132,000)

$ 1,020,000

420,000

$ 600.000

2021

$10,000,000

5,450,000

$ 4,550,000

$ 2,000,000

1,500,000

$ 3,500,000

$ 1,050,000

20,000

(120,000)

$ 950,000

400,000

$ 550.000

Retrieved from:

Warren, C. S., Jonick, C. A., & Schneider, J. S., (2021). Accounting (28 ed.). Boston, MA: Cengage

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Which of the following will result when a dividend is paid? A debit to dividends payable. A credit to dividends payable. A debit to capital. A credit to capital.arrow_forwardDirections: Fill in the following table using the equation: ∆Cash = - ∆Noncash Assets + ∆Liabilities + ∆Stockholders Equity. Indicate the name of the noncash asset, liability, or equity account affected by the transaction and if change in cash is classified as operating (O), investing (I), financing (F), or noncash (NC). The first line has been completed for you as an exampleItem∆Cash = - ∆Noncash Assets + ∆Liabilities + ∆Stockholders Equity1. Prepaid office rent for cash -O = - + Prepaid Rent + + 2. Sale of land held for cash = - + + 3. Cash payment of taxes payable = - + + 4. Issue preferred stock to investors for cash = - + + 5. Purchase equipment that is financed directly by the seller = - + + 6. Paid cash dividend = - + + 7. Pay notes payable = - + + 8. Pay interest payable = - + +arrow_forwardfind assets, liabilities, and stockholders equityarrow_forward

- How to calculate working capital, current assests, current liabilities, quick assets, quick ratio and current ratio.arrow_forwardIdentify whether the statement are True or False. 1. Insurance companies use replacement value as a basis to determine the appropriate insurance premium to be charged to their clients. * 2. To get book value per share, total liabilities are deducted from total assets, and the resulting figure is divided by total authorized shares * 3. For real properties, it is more important to look at the age of the asset than its size. * 4. Fair Market value is the term used to describe the value derived from the amounts reflected in the financial statements. * 5. Risk identification is important to allow investors to assess the impact of the risk on their investment. * 6. Brownfield investments are easier to evaluate as information is already available from prior years * 7. The book value method is a transparent approach since value can be easily verified by looking at the financial statements * 8. If there are no comparable assets found in the market, it is more appropriate to use the replacement…arrow_forwardWhich among the following is an example of a personal financial statement? Select one: O a. Budgeting b. None of the option c. Insurance O d. Income and Expense Statement O e. Bank Loan Clear my choicearrow_forward

- a) Calculate the equity (total asset – total liability) to asset ratio of the bank (Hint: equity to asset ratio = total equity/total asset) %3D b) Calculate the duration and convexity of the both asset and liability sidesarrow_forward(participation expected < You would find asset, liability, and equity accounts on which of the following statements? OA. Statement of cash flows B. Balance sheet OC. Statement of retained earnings OD. Income statementarrow_forwardPlease help with a, b, and c.arrow_forward

- Which are the Important Issues in Accounting and Financial Disclosure: Equity REITs2arrow_forwardQ: Explain Following Financial terms•:1) Financial Environment2) Financial planning3) Annuity & itstypes4) TVM5) Business Riskarrow_forwardMost of the users of financial statements are concerned about what will happen in the future. Explain the statement with an example?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education