FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

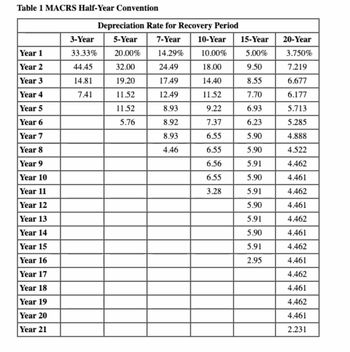

Transcribed Image Text:Clay LLC placed in service machinery and equipment (seven-year property) with a basis of $3,450,000 on June 6, 2023. Assume that Clay has sufficient income to avoid any

limitations. Calculate the maximum depreciation expense including §179 expensing (ignoring any possible bonus depreciation). (Use MACRS Table 1.)

Note: Round final answer to the nearest whole number.

Multiple Choice

$1,160,000

$493,005

$407,265

$1,007,265

None of the choices are correct.

Transcribed Image Text:Table 1 MACRS Half-Year Convention

Year 1

Year 2

Year 3

Year 4

Year 5

Year 6

Year 7

Year 8

Year 9

Year 10

Year 11

Year 12

Year 13

Year 14

Year 15

Year 16

Year 17

Year 18

Year 19

Year 20

Year 21

Depreciation Rate for Recovery Period

3-Year 5-Year 7-Year 10-Year 15-Year

33.33%

20.00% 14.29%

10.00%

5.00%

44.45

32.00

24.49

18.00

9.50

14.81

19.20

17.49

14.40

8.55

7.41

11.52

12.49

11.52

7.70

11.52

8.93

9.22

6.93

5.76

8.92

7.37

6.23

8.93

6.55

5.90

4.46

6.55

5.90

6.56

5.91

6.55

5.90

3.28

5.91

5.90

5.91

5.90

5.91

2.95

20-Year

3.750%

7.219

6.677

6.177

5.713

5.285

4.888

4.522

4.462

4.461

4.462

4.461

4.462

4.461

4.462

4.461

4.462

4.461

4.462

4.461

2.231

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Kansas Enterprises purchased equipment for $74,500 on January 1, 2021. The equipment is expected to have a ten-year service life, with residual value of $6,750 at the end of ten years. Using the straight-line method, depreciation expense for 2022 and the book value at December 31, 2022, would be: Multiple Choice $6,775 and $60,950. $7450 and $52,850. $6,775 and $54,200. $7.450 and $59,600.arrow_forwardClay LLC placed in service machinery and equipment (seven-year property) with a basis of $3,370,000 on June 6, 2022. Assume that Clay has sufficient income to avoid any limitations. Calculate the maximum depreciation expense including §179 expensing (ignoring any possible bonus depreciation). (Use MACRS Table 1.) Note: Round final answer to the nearest whole number. Multiple Choice $1,080,000 $481,573 $422,984 $832,984 None of the choices are correct.arrow_forwardA-7arrow_forward

- 1) Kristine sold one asset on March 20th of 2023. It was a computer with an original basis of $10,000, purchased in May of 2021 and depreciated under the half-year convention. What is Kristine's depreciation deduction for 2023? Note: Round final answer to the nearest whole number. Blank] Blank 1 Add your answerarrow_forwardAqua Corporation purchases nonresidential real property on May 8, 2019, for $1,650,000. Straight-line cost recovery is taken in the amount of $165,000 before the property is sold on November 27, 2022, for $2,475,000. Question Content Area a. Compute the amount of Aqua's recognized gain on the sale of the realty $_______________ Determine the amount of the recognized gain that is treated as § 1231 gain and the amount that is treated as § 1250 recapture (ordinary income due to § 291). b. § 1231 gain: $_____________ § 1250 recapture (ordinary income due to § 291): $_______________________arrow_forwardFinance Assume that Tim Corporation has 2020 taxable income of $240,000 for purposes of computing the $179 expense. It acquired the following assets in 2020: (Use MACRS Table 1, Table 2, Table 3, Table 4 and Table 5.) ASSET PURCHASE DATE BASIS Furniture (7-year) December 1$ 450,000 Computer equipment (5-year) February 28 $90,000 Copier (5-year) July 15 $30,000 Machinery (7-year) May 22 480,000 Total $ 1,050,000 c. What would Tim's maximum depreciation expense deduction be for 2020 if the machinery cost $3,500,000 instead of 480,000 and assuming no bonus depreciation?arrow_forward

- Dengerarrow_forwardin blasting and removing buildings, purchased and took delivery of a new c E10-8 On January 1, 2020, Murray Demolition, a Hamilton, Ontario, company specializing four years, at which time it should be able to be sold for $60,000. Murray Demoli- $140,000 plus HST on the truck, which is expected to be useful to the business for tion has always used the straight-line basis of calculating amortization. The new uses only the best and newest equipment on their worksites. The business spent truck to add to its growing fleet. Murray Demolition has a high-class reputation and dump owners want to see the amortization schedules for the straight-line, UOP. and D methods just to be sure this makes sense. The business expects the truck to he ful for 200,000 kilometres-60,000 kilometres in Year 1, 50,000 kilometres in eache Years 2 and 3, and 40,000 kilometres in Year 4. Is there a problem with continuing to use the straight-line method?arrow_forwardSalem Company buys a building for $1,000,000 on 1st January 2019. Its estimated useful life in the business is 20 years, after which it will be sold for an estimated residual value of $200,000. Under the Straight-line method of depreciation, Accumulated depreciation at December 31, 2020 will be Multiple Choice O $40,000 $80,000 $200,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education