Concept explainers

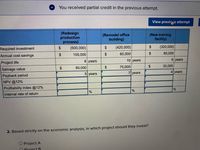

Citco Company is considering investing up to $500,000 in a sustainability-enhancing project. Its managers have narrowed their choices to three potential projects.

- Project A would redesign the production process to recycle raw materials waste back into the production cycle, saving on direct materials costs and reducing the amount of waste sent to the landfill.

- Project B would remodel an office building, utilizing solar panels and natural materials to create a more energy-efficient and healthy work environment.

- Project C would build a new training center in an underserved community, providing jobs and economic security for the local community.

Required:

1. Assuming the cost of capital is 12%, complete the table below by computing the payback period,

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

- The city is installing a new swimming pool in the east end recreation centre. One design being considered is a reinforced concrete pool that will cost $5000000 to install. Thereafter, the inner surface of the pool will need to be refinished and painted every 10 years at a cost of $450000 per refinishing. Assuming that the pool will have essentially an infinite life, what is the present worth of the costs associated with the pool design? The city uses a MARR of 6%. Review the following table and calculate the present worth of the project for a +5% change in refinishing costs. Round your answer to the nearest dollar. Parameter Construction Costs Refinishing Costs MARR [%] -10% -5% Base Case +5% +10% $5000000 $450000 6 Present Worth of -10% -5% 0% +5% Costs +10% Changes to Construction Costs Changes to refinishing Costs Changes to MARR ????? ?arrow_forwardAt times firms will need to decide if they want to continue to use their current equipment or replace the equipment with newer equipment. The company will need to do replacement analysis to determine which option is the best financial decision for the company. Price Co. is considering replacing an existing piece of equipment. The project involves the following: • The new equipment will have a cost of $2,400,000, and it is eligible for 100% bonus depreciation so it will be fully depreciated at t = 0. • The old machine was purchased before the new tax law, so it is being depreciated on a straight-line basis. It has a book value of $200,000 (at year 0) and four more years of depreciation left ($50,000 per year). • The new equipment will have a salvage value of $0 at the end of the project's life (year 6). The old machine has a current salvage value (at year 0) of $300,000. • Replacing the old machine will require an investment in net operating working capital (NOWC) of…arrow_forwardi need the answer quicklyarrow_forward

- Oil from a specific type of marine microalgae can be converted into biodiesel that may serve as an alternate transportable fuel for automobiles and trucks. If lined ponds are used to grow the algae, the construction cost is $12 million and the M&O cost is estimated at $1.6 million per year. Alternatively, if long plastic tubes are used for growing the algae, the initial cost will be higher at $16 million, but less contamination will render the M&O cost lower at $0.4 million per year. At an interest rate of 10% per year and a 5-year project period, which system is better—ponds or tubes? Use a present worth analysis. The present worth of lined ponds is $ ____million and that of plastic tubes is $ ____million. ____ (Lined ponds or plastic tubes) are used to grow algae.arrow_forwardPerez Auto Repair, Inc. is evaluating a project to purchase equipment that will not only expand the company's capacity but also improve the quality of its repair services. The board of directors requires all capital investments to meet or exceed the minimum requirement of a 10 percent rate of return. However, the board has not clearly defined the rate of return. The president and controller are pondering two different rates of return: unadjusted rate of return and internal rate of return. The equipment, which costs $109,000, has a life expectancy of five years. The increased net profit per year will be approximately $6,600, and the increased cash inflow per year will be approximately $28,023. (PV of $1 and PVA of $1) (Use appropriate factor(s) from the tables provided.) Required a-1. Determine the unadjusted rate of return and (use average investment) to evaluate this project. (Round your answer to 2 decimal places. (i.e., 0.2345 should be entered as 23.45).) a-2. Based on the…arrow_forwardWhich of the following is an example of a sunk cost? Select one: a. The firm pays to replant trees following the clear cutting of 1,000 acres during a timber harvest. b. The firm spends $20 million on heart medication research and discovers a promising drug. c. The firm replaces a piece of manufacturing equipment to maintain current manufacturing capacity. d. A bank opens a new office, and the new office leads to a decline in deposits at the bank's other offices. e. All of the above are examples of sunk costs.arrow_forward

- A large city in the midwest needs to acquire a street-cleanıng machine to keep its roads looking nice year round A used cleaning vehicle will cost $75,000 and have a $20,000 market (salvage) value at the end of its five-year Iife. A new system with advanced features will cost $150,000 and have a $50,000 market value at the end of its five-year life. The new system is expected to reduce labor hours compared with the used system. Current street-cleaning activity requires the used system to operate 8 hours per day for 20 days per month Labor costs $40 per hour (including fringe benefits), and MARR is 12% per year compounded monthly a. Find the breakeven percent reduction in labor hours for the new system b. If the new system is expected to be able to reduce labor hours by 20% compared with the used system, which machine should the city purchase? a. The breakeven reduction in lebor hours for the new system is ________% (Round to one decimal place)arrow_forwardYou have been given the construction and marketing studies for the proposed project. Several sites have been selected, but a decision has not been made. Your boss needs to know how much he can afford to pay for the land and still manage to return 16% on the entire project. The strategic plan calls for a construction phase of 1 year and an operation phase of 5 years, after which time the property will be sold. The staff says that a 1.3-acre site will be adequate because the studies indicate that this site will support the project with a gross leasable area (GLA) of 26,520 square feet. The gross building area (GBA) will be 31,200 square feet, giving a leasable ratio of 85%. The staff further assures you that the space can be rented for $20.4 per square foot. The head of the construction division maintains that all direct costs (excluding interest carry and all loan fees) will be $3.5 million. The Grace bank will provide the construction loan for the project. The bank will finance all of…arrow_forwardBaghibenarrow_forward

- Parker & Stone, Incorporated, is looking at setting up a new manufacturing plant in South Park to produce garden tools. The company bought some land six years ago for $7.4 million in anticipation of using it as a warehouse and distribution site, but the company has since decided to rent facilities elsewhere. If the land were sold today, the company would net $10.2 million. The company now wants to build its new manufacturing plant on this land; the plant will cost $21.4 million to build, and the site requires $890,000 worth of grading before it is suitable for construction. What is the proper cash flow amount to use as the initial investment in fixed assets when evaluating this project? Note: Do not round intermediate calculations and enter your answer in dollars, not millions, rounded to the nearest whole number, e.g., 1,234,567. Answer is complete but not entirely correct. Cash flow $ 32,490,000 xarrow_forwardWhispering Winds Company manufactures automobile components for the worldwide market. The company has three large production facilities in Virginia, New Jersey, and California, which have been operating for many years. Brett Harker, vice president of production, believes it is time to upgrade operations by implementing computer-integrated manufacturing (CIM) at one of the plants. Brett has asked corporate controller Connie Carson to gather information about the costs and benefits of implementing CIM. Carson has gathered the following data: Initial equipment cost $ 6,174,000 Working capital required at start-up $ 600,000 Salvage value of existing equipment 76,350 Annual operating cost savings 855,120 Salvage value of new equipment at end of its useful life 203,600 Working capital released at end of its useful life 600,000 Useful life of equipment 10 years Whispering Winds Company uses a 12% discount rate. Click here to view the factor table $ $ $ $arrow_forwardArnold Inc. is considering a proposal to manufacture high-end protein bars used as food supplements by body builders. The project requires use of an existing warehouse, which the firm acquired three years ago for $3 million and which it currently rents out for $137,000. Rental rates are not expected to change going forward. In addition to using the warehouse, the project requires an upfront investment into machines and other equipment of $1.4 million. This investment can be fully depreciated straight-line over the next 10 years for tax purposes. However, Arnold Inc. expects to terminate the project at the end of eight years and to sell the machines and equipment for $440,000. Finally, the project requires an initial investment into net working capital equal to 10% of predicted first-year sales. Subsequently, net working capital is 10% of the predicted sales over the following year. Sales of protein bars are expected to be $4.7 million in the first year and to stay constant for eight…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education