FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

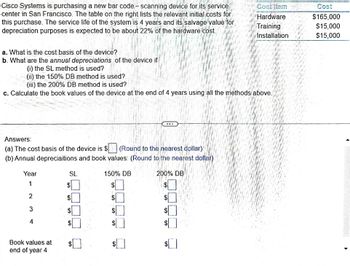

Transcribed Image Text:**Problem Description:**

Cisco Systems is purchasing a new barcode-scanning device for its service center in San Francisco. The table on the right lists the relevant initial costs for this purchase. The service life of the system is 4 years, and its salvage value for depreciation purposes is expected to be about 22% of the hardware cost.

| Cost Item | Cost |

|---------------|------------|

| Hardware | $165,000 |

| Training | $15,000 |

| Installation | $15,000 |

**Questions:**

a. What is the cost basis of the device?

b. What are the annual depreciations of the device if:

(i) the SL method is used?

(ii) the 150% DB method is used?

(iii) the 200% DB method is used?

c. Calculate the book values of the device at the end of 4 years using all the methods above.

**Answers:**

(a) The cost basis of the device is $____ (Round to the nearest dollar)

(b) Annual depreciations and book values: (Round to the nearest dollar)

| Year | SL | 150% DB | 200% DB |

|------|---------|----------|----------|

| 1 | $_____ | $_____ | $_____ |

| 2 | $_____ | $_____ | $_____ |

| 3 | $_____ | $_____ | $_____ |

| 4 | $_____ | $_____ | $_____ |

Book values at end of year 4: $____

**Explanation:**

- **Cost Basis Calculation:** The cost basis involves summing up the hardware, training, and installation costs.

- **Depreciation Methods:**

- **SL (Straight Line):** This method spreads the cost evenly over the service life.

- **150% DB (Declining Balance):** Accelerated depreciation method using 150% of the straight-line rate.

- **200% DB (Double Declining Balance):** Accelerated depreciation method using 200% of the straight-line rate.

- **Book Value Calculation:** The book value at the end of each year is calculated by subtracting the cumulative depreciation from the cost basis.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 8 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The table given below lists the relevant cost items for a specific system purchase. The operating expenses for the new system are $10,000 per year, and the useful life of the system is expected to be five years. The salvage value for depreciation purposes is equal to 25% of the hardware cost. Cost Item Cost Hardware $160,000 Training $15,000 Installation $15,000 a) What is the Book Value (BV) of the device at the end of year three if the Straight Line (SL) depreciation method is used? b) Suppose that after depreciating the device for two years with the SL method, the firm decides to switch to the double declining balance depreciation method for the remainder of the device's life (the remaining three years). What is the device's BV at the end of four years?arrow_forwardI have the answer and question below but I just needf to know how to work it out Solve the problem. Round unit depreciation to nearest cent when making the schedule, and round final results to the nearest cent. A construction company purchased a piece of equipment for $1,710. The expected life is 7,000 hours, after which it will have a salvage value of $280. Find the amount of depreciation for the first year if the piece of equipment was used for 1,600 hours. Use the units-of-production method of depreciation. Answer: ($320)arrow_forwardhaarrow_forward

- Using the information in the following table , what is the depreciation expense per year created by the project? Dunaway Industries is evaluating the idea of expanding their production facility in Cobb County The CFO gathered the following data. Dunaway Industries spent $ 500,000 researching other sites for their expansion. The equipment needed for the expansion will cost $ 25,600,000 fully installed . The equipment will be depreciated over 20 years to a salvage value of $ 1,000,000 . Dunaway Industries uses straight -line depreciation . If Dunaway accepts the project , the company will sell the equipment for salvage value ( i.e.$ 1,000,000 ) at the end of the life of the project . If Dunaway Industries adds the new equipment , sales are expected to increase by 17,400,000 and costs are expected to increase by $ 10,000,000 . The appropriate tax rate for Dunaway Industries is 30% The capital of the firm includes 70% of equity and 30% of debt . Dunaway Industries recently issued a bond…arrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardBAK Corp. is considering purchasing one of two new diagnostic machines. Either machine would make it possible for the company to bid on jobs that it currently isn't equipped to do. Estimates regarding each machine are provided below. Machine A Machine B Original cost $ 77,500 $ 186,000 Estimated life 8 years 8 years Salvage value $ 19,500 $ 39,600 Estimated annual cash inflows $ 5,040 $ 9,800 Estimated annual cash outflows Click here to view the factor table. Calculate the net present value and profitability index of each machine. Assume a 9% discount rate. (If the net present value is negative, use either a negative sign preceding the number eg -45 or parentheses eg (45). Round answer for present value to 0 decimal places, e.g. 125 and profitability index to 2 decimal places, e.g. 10.50. For calculation purposes, use 5 decimal places as displayed in the factor table provided.) Machine A Machine B Net present value Profitability index Which machine should be purchased? should be…arrow_forward

- Calligraphy Pens is deciding when to replace its old machine. The machine's current salvage value is $3,050,000. Its current book value is $1,800,000. If not sold, the old machine will require maintenance costs of $710,000 at the end of the year for the next five years. Depreciation on the old machine is $360,000 per year. At the end of five years, it will have a salvage value of $155,000 and a book value of $0. A replacement machine costs $4,650,000 now and requires maintenance costs of $380,000 at the end of each year during its economic life of five years. At the end of the five years, the new machine will have a salvage value of $745,000. It will be fully depreciated by the straight-line method. In five years, a replacement machine will cost $3,650,000. The company will need to purchase this machine regardless of what choice it makes today. The corporate tax rate is 25 percent and the appropriate discount rate is 7 percent. The company is assumed to earn sufficient revenues to…arrow_forwardA portable concrete test instrument used in construction for evaluating and profiling concrete surfaces (MACRS-GDS 5-year property class) is under consideration by a construction firm for $22,000. The instrument will be used for 6 years and be worth $2,000 at that time. The annual cost of use and maintenance will be $9,500. Alternatively, a more automated instrument (same property class) available from the manufacturer costs $29,000, with use and maintenance costs of only $7,500 and salvage value after 6 years of $3,000. The income-tax rate is 25% and MARR is an after-tax 12%. Determine which alternative is less costly, based upon comparison of after-tax annual worth.arrow_forwardSheridan Corp. is considering purchasing one of two new diagnostic machines. Either machine would make it possible for the company to bid on jobs that it currently isn't equipped to do. Estimates regarding each machine are provided here. Original cost Estimated life Salvage value Estimated annual cash inflows Estimated annual cash outflows. Machine A $78,200 8 years 0 $19,800 $5,130 Machine B $182,000 8 years 0 $39,600 $10,180arrow_forward

- Your company is considering the purchase of a new 623K Wheel Tractor-Scraper. Use the following information to calculate the hourly owning costs, hourly operating costs, and total owning and operating costs. - Delivered price (with tires): $420,000 - Cost of Tires: $30,000 and their life is determined by the average operation in zone B. - Salvage value is zero - the equipment is new and it is anticipated to be used for 5 years, until end of its service life. - Anticipated operating hours per year: 2,000 hrs/yr - Simple interest rate for purchase loan: 12% - Annual cost of Insurance: $5,500 (See optional method) - Property tax rate: 2% - Fuel use will be average value in medium range - Cost of fuel: $3.10 per gallon - Hourly Maintenance Cost: $5.00 per hour - Repair cost: $11.00 per hour - Operator cost (with fringes): $75 per hour - No undercarriage or special wear items costs…arrow_forwardThe management of Jasper Equipment Company is planning to purchase a new milling machine that will cost $160,000 installed. The old milling machine has been fully depreciated but can be sold for $15,000. The new machine will be depreciated on a straight-line basis over its 10-year economic life to an estimated salvage value of $10,000. If this milling machine will save Jasper $20,000 a year in production expenses, what are the annual net cash flows associated with the purchase of this machine? Assume a marginal tax rate of 40 percent. a. $15,000 b. $27,000 c. $21,000 d. $18,000arrow_forwardCrane Corp. is considering purchasing one of two new processing machines. Either machine would make it possible for the company to produce its products more efficiently than it is currently equipped to do. Estimates regarding each machine are provided below: Machine A Machine B Original cost $113,900 $278,300 Estimated life 10 years 10 years Salvage value -0- -0- Estimated annual cash inflows $29,700 $60,100 Estimated annual cash outflows $7,600 $14,800 Calculate the net present value and profitability index of each machine. Assume an 8% discount rate. Machine A Machine B Net present value top row, profitability index bottom row Which machine should be purchased? Crane Corp. should purchase select a machine .arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education