FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

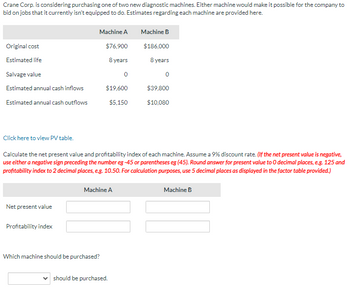

Transcribed Image Text:Crane Corp. is considering purchasing one of two new diagnostic machines. Either machine would make it possible for the company to

bid on jobs that it currently isn't equipped to do. Estimates regarding each machine are provided here.

Machine A

Machine B

Original cost

$76,900

$186,000

Estimated life

8 years

8 years

Salvage value

0

0

Estimated annual cash inflows

$19,600

$39,800

Estimated annual cash outflows

$5,150

$10,080

Click here to view PV table.

Calculate the net present value and profitability index of each machine. Assume a 9% discount rate. (If the net present value is negative,

use either a negative sign preceding the number eg-45 or parentheses eg (45). Round answer for present value to O decimal places, e.g. 125 and

profitability index to 2 decimal places, e.g. 10.50. For calculation purposes, use 5 decimal places as displayed in the factor table provided.)

Net present value

Profitability index

Machine A

Which machine should be purchased?

should be purchased.

Machine B

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Tassie Ltd is considering replacing an old management system with a new one. Use the following information to determine the feasibility of this replacement plan and explain your decision in detail. Costs of new system: $80,000 Costs of old system: $95,000 Depreciations of new system: Prime cost to zero Depreciations of old system: $5,000 per year Life of old system: will be written off in 5 years if no replacement Life of new system: 5 years Salvage value of new system at the end of its life: $18,000 Salvage value of old system at the end of its life: $0 Market value of the old system now: $55,000 Total savings from the new system:…arrow_forwardmn.3arrow_forwardAn oil company is planning to install a new pipeline to connect storage tanks to a processing plant 1500m away. The connection will be needed for the foreseeable future. Both 80mm and 120mm pipes are being considered. 80 mm pipe 120mm pipe Initial cost $1500 $2500 Service life 12 yrs 12 yrs Salvage value $200 $300 Annual maintenance $400 $300 Pump cost/hour $2.50 $1.40 Pump operation 600 hours/yr 600 hours/yr For this analysis, the company will use an annual interest rate of 8%. Annual maintenance and pumping costs may be considered to be paid in their entireties at the end of the years in which their costs are incurred. Disregarding the the initial and replacement pipe costs, what is the capitalized cost($) of the maintenance and pumping costs for the 80mm pipe?arrow_forward

- Please do not give solution in image format ? And Explain Proper Step by Step.arrow_forwardFoster Company wants to buy a special automated machine to replace an existing manual system. The initial outlay (cost) is $3,500,000. The new machine will last 5 years with no expected salvage value. The expected annual cash flows are as follows: Year Cash Inflow Cash Outflow 0 $ - $ 3,500,000.00 1 $ 3,900,000.00 $ 3,000,000.00 2 $ 3,900,000.00 $ 3,000,000.00 3 $ 3,900,000.00 $ 3,000,000.00 4 $ 3,900,000.00 $ 3,000,000.00 5 $ 3,900,000.00 $ 3,000,000.00 Foster has a cost of capital equal to 10%. 1. Calculate the payback period. Payback period: yearsarrow_forwardCity Towing is considering the purchase of a new tow truck. The garage currently has no tow truck, and the $100,000 price tag for a new truck would be a major expenditure. The expected useful life is 7 years. The owner of the garage has compiled the following estimates in trying to determine whether the tow truck should be purchased: Purchase of truck $100,000 Salvage value $15,000 Additional net inflows per year $16,000 Repairs required at the end of year 3 $5,000 Minimum required return on investments 12%arrow_forward

- Please answer net present value and profitability index:arrow_forwardCitrus Enterprises is upgrading its fruit washing/separating machine. Citrus Enterprises has narrowed the decision down to two machines: Machine A and Machine B. Pertinent information about each machine includes:arrow_forwardReplace equipment A machine with a book value of $86,000 has an estimated five-year life. A proposal is offered to sell the old machine for $40,500 and replace it with a new machine at a cost of $67,000. The new machine has a five-year life with no residual value. The new machine would reduce annual direct labor costs from $10,300 to $9,700. This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below. Prepare a differential analysis dated April 11 on whether to continue with the old machine (Alternative 1) or replace the old machine (Alternative 2). If an amount is zero, enter "0". Use a minus sign to indicate costs, losses, or negative differential effect on income.arrow_forward

- Uramilabenarrow_forwardPlease view the following video before answering this question. Video Solution: 11.01-PR007 A pipeline contractor can purchase a needed truck for $44,000. Its estimated life is 6 years, and it has no salvage value. Maintenance is estimated to be $2,100 per year. Operating expense is $60 per day. The contractor can hire a similar unit for $130 per day. MARR is 7%. Click here to access the TVM Factor Table Calculator Part a How many days per year must the truck's services be needed such that the two alternatives are equally costly? days Carry all interim calculations to 5 decimal places and then round your final answer up to the nearest day. The tolerance is 14. Attempts: 0 of 3 used Save for Later Submit Answerarrow_forwardJarett Motors is trying to decide whether it should keep its existing car washing machine or purchase a new one that has technological advantages (which translate into cost savings) over the existing machine. Information on each machine follows: Old machine New machine Original cost $9,000 $20,000 Accumulated depreciation 5,000 0 Annual cash operating costs 9,000 4,000 Current salvage value of old machine 2,000 Salvage value in 10 years 500 1,000 Remaining life 10 yrs 10 yrs Refer to Jarett Motors. The $20,000 cost of the new machine represents a(n) Select one: a. future relevant cost b. future irrelevant cost c. opportunity cost d. sunk costarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education