Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

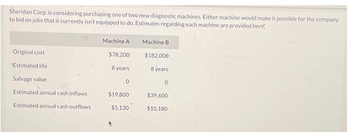

Transcribed Image Text:Sheridan Corp. is considering purchasing one of two new diagnostic machines. Either machine would make it possible for the company

to bid on jobs that it currently isn't equipped to do. Estimates regarding each machine are provided here.

Original cost

Estimated life

Salvage value

Estimated annual cash inflows

Estimated annual cash outflows.

Machine A

$78,200

8 years

0

$19,800

$5,130

Machine B

$182,000

8 years

0

$39,600

$10,180

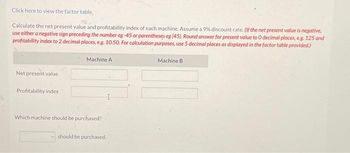

Transcribed Image Text:Click here to view the factor table,

Calculate the net present value and profitability index of each machine. Assume a 9% discount rate. (If the net present value is negative,

use either a negative sign preceding the number eg -45 or parentheses eg (45). Round answer for present value to 0 decimal places, e.g. 125 and

profitability index to 2 decimal places, e.g. 10.50. For calculation purposes, use 5 decimal places as displayed in the factor table provided.)

Net present value

Profitability index

Machine A

Which machine should be purchased?

should be purchased.

Machine B

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Alliance Manufacturing Company is considering the purchase of a new automated drill press to replace an older one. The machine now in operation has a book value of zero and a salvage value of zero. However, it is in good working condition with an expected life of 10 additional years. The new drill press is more efficient than the existing one and, if installed, will provide an estimated cost savings (in labor, materials, and maintenance) of $6,000 per year. The new machine costs $25,000 delivered and installed. It has an estimated useful life of 10 years and a salvage value of $1,000 at the end of this period. The firm’s cost of capital is 14 percent, and its marginal income tax rate is 40 percent. The firm uses the straight-line depreciation method. Complete the following table to compute the net present value (NPV) of the investment. (Hint: Remember that, in Year 10, Alliances also receives the salvage value of the machine.) Year Cash Flow PV Interest Factor at 14%…arrow_forwardSandhill Corp, is considering purchasing one of two new diagnostic machines. Either machine would make it possible for the company to bid on jobs that it currently isn't equipped to do. Estimates regarding each machine are provided here. Original cost Estimated life Salvage value Estimated annual cash inflows Estimated annual cash outflows Machine A $77,300 8 years 0 $20,200 $4,970 Machine B $180,000 8 years 0 $40,000 $9,860arrow_forwardmn.3arrow_forward

- An oil company is planning to install a new pipeline to connect storage tanks to a processing plant 1500m away. The connection will be needed for the foreseeable future. Both 80mm and 120mm pipes are being considered. 80 mm pipe 120mm pipe Initial cost $1500 $2500 Service life 12 yrs 12 yrs Salvage value $200 $300 Annual maintenance $400 $300 Pump cost/hour $2.50 $1.40 Pump operation 600 hours/yr 600 hours/yr For this analysis, the company will use an annual interest rate of 8%. Annual maintenance and pumping costs may be considered to be paid in their entireties at the end of the years in which their costs are incurred. Disregarding the the initial and replacement pipe costs, what is the capitalized cost($) of the maintenance and pumping costs for the 80mm pipe?arrow_forwardFollow the format shown in Exhibit 12B.1 and Exhibit 12B.2 as you complete the requirement below. Woodard Company wants to buy a numerically controlled (NC) machine to be used in producing specially machined parts for manufacturers of trenching machines. The outlay required is $700,000. The NC equipment will last five years with no expected salvage value. The expected after-tax cash flows associated with the project follow: Year Cash Revenues Cash Expenses 1 2 3 4 5 $1,400,000 1,400,000 1,400,000 1,400,000 1,400,000 $1,200,000 1,200,000 1,200,000 1,200,000 1,200,000 Required: Compute the investment's Net Present Value, assuming a required rate of return of 8 percent. Round present value calculations and your final answer to the nearest dollar. NPV = $ Xarrow_forwardPlease do not give solution in image format ? And Explain Proper Step by Step.arrow_forward

- Alliance Manufacturing Company is considering the purchase of a new automated drill press to replace an older one. The machine now in operation has a book value of zero and a salvage value of zero. However, it is in good working condition with an expected life of 10 additional years. The new drill press is more efficient than the existing one and, if installed, will provide an estimated cost savings (in labor, materials, and maintenance) of $6,000 per year. The new machine costs $25,000 delivered and installed. It has an estimated useful life of 10 years and a salvage value of $1,000 at the end of this period. The firm’s cost of capital is 14 percent, and its marginal income tax rate is 40 percent. The firm uses the straight-line depreciation method.a. What is the net cash flow in year 0 (i.e., initial outlay)?b. What are the net cash flows after taxes in each of the next 10 years?c. What is the NPV of the investment?d. Should Alliance replace its existing drill press?arrow_forwardAnswer complete please,,, answer in text form without imagearrow_forward7arrow_forward

- Please answer net present value and profitability index:arrow_forwardMotor City Rentals is trying to decide whether it should keep its existing car detailing machine or purchase a new one that has state of the art technological advancements (which translate into cost savings) over the existing machine. Information on each machine follows: - Old machine New machine Original cost $9,000 $20,000 Accumulated depreciation 5,000 0 Annual cash operating costs 9,000 4,000 Current salvage value of old machine 2,000 Salvage value in 10 years 500 1,000 Remaining life 10 yrs. 10 yrs. The incremental cost to purchase the new machine is Group of answer choices $11,000 $18,000. $20,000. $13,000.arrow_forwardJarett Motors is trying to decide whether it should keep its existing car washing machine or purchase a new one that has technological advantages (which translate into cost savings) over the existing machine. Information on each machine follows: Old machine New machine Original cost $9,000 $20,000 Accumulated depreciation 5,000 0 Annual cash operating costs 9,000 4,000 Current salvage value of old machine 2,000 Salvage value in 10 years 500 1,000 Remaining life 10 yrs 10 yrs Refer to Jarett Motors. The $20,000 cost of the new machine represents a(n) Select one: a. future relevant cost b. future irrelevant cost c. opportunity cost d. sunk costarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education