FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Pena Company is considering an investment of $27,215 that provides net

(a) If Pena Company requires a 8% return on its investments, what is the

(b) Based on net present value, should Pena Company make this investment?

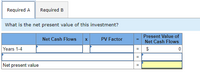

Transcribed Image Text:Required A

Required B

What is the net present value of this investment?

Present Value of

Net Cash Flows

Net Cash Flows x

PV Factor

Years 1-4

$

Net present value

%24

Transcribed Image Text:Required A

Required B

Based on net present value, should Pena Company make this investment?

Based on net present value, should Pena Company make this investment?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Calculate the APR of the following investment, entered as a percentage (Example: if your answer is 14.5%, enter 14.5 and not 0.145) Year Number Cashflow 0 -11000 1 3000 2 3500 3 2900 4 2800arrow_forward) Assuming a 9% cost of capital, find the modified internal rate of return for the following cash flows: a. 19.78% b. 6.95% c. 13.64% d. 7.86% Year Cash Flow 0 1 2 3 -$175 $167 $240 -$120arrow_forwardThe table below gives the expected cash inflows of a firm for a period of 9 years. Time 3 6 9 Cash inflow (£) 45000 90000 120000 Assume the present value of the cash outflows is £87000, and the applicable cost of capital is 13%. Calculate the (a) Future value of the cash inflows (b) Modified internal rate of return (MIRR)arrow_forward

- Yuri Co. operates a chain of gift shops. The company maintains a defined contribution pension plan for its employees. The plan requires quarterly installments to be paid to the funding agent, Whims Funds, by the fifteenth of the month following the end of each quarter. Assume that the pension cost is $143,200 for the quarter ended December 31. Question Content Area a. Journalize the entry to record the accrued pension liability on December 31. If an amount box does not require an entry, leave it blank. Dec. 31 - Select - - Select - - Select - - Select - Question Content Area Journalize the entry to record the accrued pension liability payment to the funding agent on January 15. If an amount box does not require an entry, leave it blank. Jan. 15 - Select - - Select - - Select - - Select - Question Content Area b. The pension plan where a company pays the employee a fixed annual amount based on a formula is aarrow_forwardWhat is the present worth (P) of all the cash flows if F=16000, n=6 years, and i= 8% per year? Select one: O a. $16,480.00 b. $103,824.00 O c. $10,082.71 O d. $34,608.00arrow_forwardTake me to the text The following table indicates the net cash flows of a capital asset: Year Net Cash Flow 0 $-13,900 1 $5,500 2 $9,600 Do not enter dollar signs or commas in the input boxes. Use the negative sign where appropriate. Round the factor to 4 decimal places and the NPV to the nearest whole number. Assume the required rate of return is 13%. Determine the net present value of this asset. Year Net Cash Flow 0 1 2 Total $-13,900 $5,500 $9,600 Factor Net Present Value SA $ Aarrow_forward

- 3. If a capital investment is $28,752.7 and equal annual cash inflows are 69,943.5, state the internal rate of return factor rounded to two decimal places.arrow_forwardDetermine the future value of the following single amounts. Note: Use tables, Excel, or a financial calculator. Round your final answers to nearest whole dollar amount. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Invested Amount i- n Future Value 1. $ 11,500 7% 15 23 $ 15,000 6% 14 $ 28,000 12% 14 4. S 48,000 8% 6arrow_forwardSuppose an investor is interested in purchasing the following income producing property at a current market price of $ 1,490,000. The prospective buyer has estimated the expected cash flows over the next five years to be as follows: Year 1 = $88,000, Year 2 = $90,662, Year 3 = $91,923, Year 4 = $95,778, Year 5 = $97,000. Assuming that the required rate of return is 15% and the estimated proceeds from selling the property at the end of year five is $1,860,000, what is the NPV of the project? What is the IRR of the project?arrow_forward

- Munabhaiarrow_forwardAn arithmetic cash flow gradient series equals $450 in year 1, $550 in year 2, and amounts increasing by $100 per year through year 12. At i= 9% per year, determine the present worth of the cash flow series in year 0. The present worth of the cash flow series in year O is $ 944.15arrow_forwardPV of Cash flows for the next 6 years as follows (1500,2000,2500,3000,3500,4000) at 8.8% discount rate.Formula?Excel Function?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education