FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

Transcribed Image Text:- Chapter Four

Activity Cost Pool

Machining

Machine setups

Production design

General factory

Activity Measure

Machining

Required information

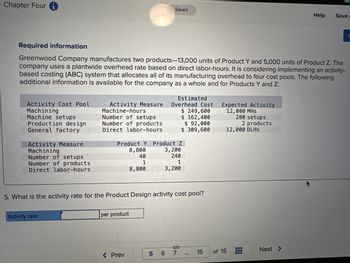

Greenwood Company manufactures two products-13,000 units of Product Y and 5,000 units of Product Z. The

company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity-

based costing (ABC) system that allocates all of its manufacturing overhead to four cost pools. The following

additional information is available for the company as a whole and for Products Y and Z:

Number of setups

Number of products

Direct labor-hours

Activity Measure

Machine-hours

Number of setups

Number of products

Direct labor-hours

Activity rate

Saved

Product Y Product Z

8,800

3,200

240

40

1

1

8,800

3,200

5. What is the activity rate for the Product Design activity cost pool?

per product

< Prev

Estimated

Overhead Cost

$ 249,600

$ 162,400

$ 92,000

$ 309,600

5 6

S₁

7

15

Expected Activity

12,000 MHS

280 setups

2 products

12,000 DLHS

of 15

‒‒‒

Help

Next >

Save

Expert Solution

arrow_forward

Step 1

Solution..

Total production design cost = $92,000

Estimated number of products = 2 products

Activity rate for product design cost pool = ?

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please do not give image formatarrow_forwardHelm Corporation uses an activity-based costing system with three activity cost pools. The company has provided the following data concerning its costs and its activity-based costing system: Costs: Manufacturing overhead Selling and administrative expenses Total Distribution of resource consumption: Manufacturing overhe Selling and administrative expenses Activity Cost Pools Customer Support 85% 20% Order Size 5% 60% S O $348,000 O $188,500 $29,000 O $84,000 S Other 10% 20% The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs. 480,000 100,000 580,000 You have been asked to complete the first-stage allocation of costs to the activity cost pools. Total 100% 100% How much cost, in total, would be allocated in the first-stage allocation to the Order Size activity cost pool? Next ▸arrow_forward3arrow_forward

- naion manufactures two models of office chairs, a standard and a deluxe model. The following activity and cost information has been compiled: Number of Number of Number of Product Setups Components Direct Labor Hours 16 Standard 265 Deluxe 34 14 245 Overhead costs $50,000 $58.900 Nrter of setups and number of components are identified as activity- cost drivers for overhead. Assuming an activity - based costing system is used, what is the total amount of overhead costs assigned to the standard modela OA $54,600 OB $77 400 OC. S54,450 O0 $31.500 O Time Remaining: 02:58:03 Nextarrow_forwardRequired information Greenwood Company manufactures two products-15,000 units of Product Y and 7,000 units of Product Z. The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity-based costing (ABC) system that allocates all of its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products Y and Z: Activity Cost Pool Machining Machine setups Production design General factory Activity Measure Machining Number of setups Number of products Direct labor-hours Activity Measure Machine-hours Number of setups Number of products Direct labor-hours Estimated Overhead Cost $ 227,700 $ 153,908 Product Y Product Z 8,700 60 1 8,700 2,300 210 1 1,300 Expected Activity 11,000 MHS 270 setups $ 91,000. $ 257,000 2 products 10,000 DLHS 14. Using the ABC system, what percentage of the Product Design cost is assigned to Product Y and Product Z? (Round your answers to 2…arrow_forwardRequlred Informatlon Greenwood Company manufactures two products-13,000 units of Product Y and 5,000 units of Product Z. The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity-based costing (ABC) system that allocates all of its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products Y and Z: Activity Cost Pool Machining Machine setups Production design General factory Activity Measure, Machine-hours Number of setups Number of products Direct labor-hours Estimated Overhead Cost $ 242,400 $ 114,400 86,000 $ 302,400 Expected Activity 12,000 MHs 220 setups 2 products 12,000 DLHS Activity Measure Machining Number of setups Number of products Direct labor-hours, Product Y 8,200 40 Product Z 3,800 180 1. 3,800 8,200 4. What is the activity rate for the Machine Setups activity cost pool? 灣灣彩 Activity rate per setup 15 of 15 Axt > < Prev 4 5 9. 92 F AQI…arrow_forward

- Helm Corporation uses an activity-based costing system with three activity cost pools. The company has provided the following data concerning its costs and its activity based costing system: Costs: Manufacturing overhead Selling and administrative expenses Total Distribution of resource consumption: Manufacturing overhead Selling and administrative expenses $304,500 $493,000 Activity Cost Pools Customer Support 85% 20% O $116,000 O $428,000 Order Size 5% 60% S S Other 10% 20% The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs. You have been asked to complete the first-stage allocation of costs to the activity cost pools. How much cost, in total, would be allocated in the first-stage allocation to the Customer Support activity cost 480,000 100,000 580,000 Total 100% 100%arrow_forwardRequlred Information Greenwood Company manufactures two products-13,000 units of Product Y and 5,000 units of Product Z. The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity-based costing (ABC) system that allocates all of its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products Y and Z Estimated Overhead Cost $ 242,400 $114,400 86,000 $ 302,400 Expected Activity Cost Pool Machining Machine setups Production design General factory Activity Measure Machine-hours Number of setups Number of products Direct labor-hours 12,000 MHs 220 setups 2 products 12,000 DLHS Activity Measure Machining, Number of setups Number of products Direct labor-hours Product Y 8,200 40 1. 8,200 Product Z 3,800 180 1. 3,800 Required: 1. What is the company's plantwide overhead rate? (Round your enswer to 2 declmal places.) Predetermined overhead rate, per DLH of 15 甜…arrow_forwardRequired information [The following information applies to the questions displayed below.] Hickory Company manufactures two products-13,000 units of Product Y and 5,000 units of Product Z. The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity-based costing (ABC) system that allocates all $829,500 of its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products Y and Z: Activity Cost Pool Machining Machine setups Product design Activity Measure Machine-hours Number of setups Number of products Direct labor-hours Estimated Overhead Cost $ 246,000 Expected Activity 12,000 MHS $ 89,000 $ 357,000 14,400 250 setups 2 products DLHS $ 137,500 General factory Activity Measure Machine-hours Number of setups Number of products Direct labor-hours Product Y Product Z 7,500 40 1 8,500 4,500 210 1 5,900 2. Using the plantwide overhead rate, how much manufacturing…arrow_forward

- Job Order Costing for a Service Company The Fly Company provides advertising services for clients across the nation. The Fly Company is presently working on four projects, each for a different client. The Fly Company accumulates costs for each account (client) on the basis of both direct costs and allocated indirect costs. The direct costs include the charged time of professional personnel and media purchases (air time and ad space). Overhead is allocated to each project as a percentage of media purchases. The predetermined overhead rate is 45% of media purchases. On August 1, the four advertising projects had the following accumulated costs: August 1 Balances $59,100 17,700 41,400 25,400 $143,600 Vault Bank Take Off Airlines Sleepy Tired Hotels Tastee Beverages Total During August, The Fly Company incurred the following direct labor and media purchase costs related to preparing advertising for each of the four accounts: Vault Bank Take Off Airlines Sleepy Tired Hotels Tastee Beverages…arrow_forwardAssume a company manufactures only two products—14,000 units of Product C and 6,000 units of Product D. It is considering implementing an activity-based costing (ABC) system that allocates all of its manufacturing overhead to three cost pools. The following additional information is available for the company as a whole and for Products C and D: Activity Cost Pool Activity Measure Estimated Overhead Cost Expected Activity Machining Machine-hours $ 300,000 15,000 MH Machine setups Number of setups $ 150,000 200 Setups Product design Number of products $ 78,000 2 Products Activity Measure Product C Product D Machine-hours 9,000 6,000 Number of setups 50 150 Number of products 1 1 Using the ABC system, how much overhead cost would be assigned from the Machine Setups cost pool to Product D? Multiple Choice $115,200 $112,500 $122,500 $102,500arrow_forwardRequlred Informatlon Greenwood Company manufactures two products-13,000 units of Product Y and 5,000 units of Product Z. The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity-based costing (ABC) system that allocates all of its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products Y and Z: Estimated Overhead Activity Cost Pool Machining Machine setups Production design General factory Activity Measure Machine-hours Number of setups Number of products Direct labor-hours Expected Activity 12, 000 МHs 220 setups 2 products 12,000 DLHS Cost $ 242,400 $ 114,400 $ 86,000 $ 302,400 Activity Measure! Machining Number of setups Number of products Direct labor-hours, Product Y 8,200 40 1. 8,200 Product Z 3,800 180 3,800 3. What is the activity rate for the Machining activity cost pool? (Round your answer to2 declmal places.) Activity rate per MH 15…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education