FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

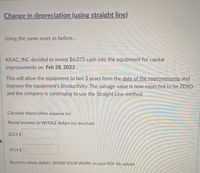

Transcribed Image Text:Change in depreciation (using straight line)

Using the same asset as before...

KKAC, INC decided to invest $6,075 cash into the equipment for capital

improvements on Feb 28, 2023.

This will allow the equipment to last 3 years from the date of the improvements and

improve the equipment's productivity. The salvage value is now expected to be ZERO

and the company is continuing to use the Straight Line method.

Calculate depreciation expense for:

Round answers to WHOLE dollars (no decimals)

2023 $

2024 $

Round to whole dollars. SHOW YOUR WORK on your PDF file upload

Transcribed Image Text:DEPRECIATION OF FIXED ASSETS:

ASSET INFO: use the following information for all of the depreciation related questions that follow.

Keeping Kids Active Company, Inc makes playground balls for children. KKAC, Inc

purchased and began using (placed in service) a piece of equipment to help the

company make the balls on September 1, 2020. The equipment cost $56,000 to

purchase, $4,000 for delivery and installation (combined).

At the time of purchase, KKAC estimates this equipment will be used for 4 years and

have a salvage value of $6,00O.

KKAC expects to make 250,000 playground balls in total with this equipment.

*** Determine the Asset Cost (acquisition cost) of this asset.

Show your calculations on your PDF upload.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- VIEW PUncles Current Attempt in Progress On December 31, 2025, Vaughn Inc. has a machine with a book value of $1,222,000. The original cost and related accumulated depreciation at this date are as follows. Machine Less: Accumulated depreciation Book value (a) $1,690,000 Depreciation is computed at $78,000 per year on a straight-line basis. Presented below is a set of independent situations. For each independent situation, indicate the journal entry to be made to record the transaction. Make sure that depreciation entries are made to update the book value of the machine prior to its disposal. Date 468,000 Aug. 31, 2026 $1,222,000 A fire completely destroys the machine on August 31, 2026. An insurance settlement of $559,000 was received for this casualty. Assume the settlement was received immediately. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the…arrow_forwardA company paid $50,000 for some research equipment, which it believes will have zero salvage value at the end of its 5-year life. What is the book value of the equipment after 3 years? Next, supposing that the equipment is sold for $30,000 at the end of the third year, how much gain or depreciation capture is there? Answer questions using a)100% bonus depreciation b) Modified accelerated cost system (MACRS); research equipment belongs to the 5-year MACRS classarrow_forwardDepreciation and Rate of Return Burrell Company purchased a machine for $11, 000 on January 2, 2019. The machine has an estimated service life of 5 years and a zero estimated residual value. The asset earns income before depreciation and income taxes of $5,500 each year. The tax rate is 25%. Required: Compute the rate of return earned (on the average net asset value) by the company each year of the asset's life under the straight - line and the double declining - balance depreciation methods. Assume that the machine is the company's only asset. Straight - line method. If required, round to one decimal place. 2019 fill in the blank 1% 2020 fill in the blank 2% 2021 fill in the blank 3% 2022 fill in the blank 4% 2023 fill in the blank 5% Double - declining - balance depreciation method. Round to two decimal places. Round your intermediate dollar value calculations to the nearest whole number. 2019 fill in the blank 6% 2020 fill in the blank 7% 2021 fill in the blank 8% 2022 fill in the…arrow_forward

- Haresharrow_forwardDepreciation and Rate of Return Burrell Company purchased a machine for $12,000 on January 2, 2019. The machine has an estimated service life of 5 years and a zero estimated residual value. The asset earns income before depreciation and income taxes of $6,000 each year. The tax rate is 30%. Required: Compute the rate of return earned (on the average net asset value) by the company each year of the asset's life under the straight-line and the double- declining-balance depreciation methods. Assume that the machine is the company's only asset. Straight-line method. If required, round to one decimal place. 2019 23.3 % 2020 30 % 2021 42 % < 2022 70 % 2023 210 % Double-declining-balance depreciation method. Round to two decimal places. Round your intermediate dollar value calculations to the nearest whole number. 2019 7.5 X % 2020 % 2021 % 2022 % 2023 % Feedbackarrow_forwardDepreciation Stahmann Products paid $350,000 for a numerical controller during the last month of 2007 and had it installed at a cost of $50,000. The recovery period was 7 years with an estimated salvage value of 10% of the original purchase price. Stahmann sold the system at the end of 2011 for $45,000. Determine the Book Value at the end of 2011 using a. Straight line method and DDB b. Can you use Sum of Years Digit method? Why? c. Was the sale at $45,000 profitable? Show your complete solution and box your answers.arrow_forward

- Qw.25.arrow_forwardProvide step by step manual solution, given, and depreciation table for below mentioned problem. Make sure yet that your answer is the same as the given answer before sending your solution. An asset costing P50,000 has a life expectancy of 6 years and an estimated salvage value of P8,000. Calculate the depreciation charge at the end of the fourth period using fixed-percentage method. Answer. P5,263.87arrow_forwardDepreciation and Rate of Return Burrell Company purchased a machine for $31,000 on January 2, 2019. The machine has an estimated service life of 5 years and a zero estimated residual value. The asset earns income before depreciation and income taxes of $15,500 each year. The tax rate is 20%. Required: Compute the rate of return earned (on the average net asset value) by the company each year of the asset's life under the straight-line and the double-declining-balance depreciation methods. Assume that the machine is the company's only asset. Straight-line method. If required, round to one decimal place. 2019 26.7 % 2020 34.3 % 2021 48 % 2022 80 % 2023 240 % Double-declining-balance depreciation method. Round to two decimal places. Round your intermediate dollar value calculations to the nearest whole number. 2019 10 % 2020 43.33 % 2021 98.89 % 2022 191.49 % 2023 350 X %arrow_forward

- am Warren Company plans to depreciate a new building using the double declining balance depreciation method. The building cost is $780,000. The estimated residual value of the building is $48,000 and it has an expected useful life of 25 years. What is the building's book value at the end of the first year? Grew H Multiple Choice O $717,600 $62,400 $31,200 $33.850 < Prevarrow_forwardWhat is the straight line method, Depreciation Expense, accumulation depreciation? What is the umit of activity, depreciation expense and accumulation depreciation for the problem below? October 1, 2020 - purchased a vehicle for $50,000. Its expected salvage value is $700. The estimated useful life is 4 years, and the estimated useful life is 90,000 miles. Oct 1, 2025 - sells the vehicle for $30,000 after driving it for 20,000 milesarrow_forwardDepreciation and Rate of Return Burrell Company purchased a machine for $57,000 on January 2, 2019. The machine has an estimated service life of 5 years and a zero estimated residual value. The asset earns income before depreciation and income taxes of $28,500 each year. The tax rate is 30%. Required: Compute the rate of return earned (on the average net asset value) by the company each year of the asset's life under the straight-line and the double-declining-balance depreciation methods. Assume that the machine is the company's only asset. Straight-line method. If required, round to one decimal place. 2019 fill in the blank 1 % 2020 fill in the blank 2 % 2021 fill in the blank 3 % 2022 fill in the blank 4 % 2023 fill in the blank 5 % Double-declining-balance depreciation method. Round to two decimal places. Round your intermediate dollar value calculations to the nearest whole number. 2019 fill in the blank 6 % 2020 fill in the blank 7 % 2021 fill in the blank 8…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education