FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

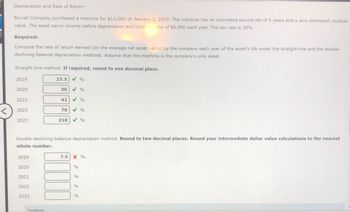

Transcribed Image Text:Depreciation and Rate of Return

Burrell Company purchased a machine for $12,000 on January 2, 2019. The machine has an estimated service life of 5 years and a zero estimated residual

value. The asset earns income before depreciation and income taxes of $6,000 each year. The tax rate is 30%.

Required:

Compute the rate of return earned (on the average net asset value) by the company each year of the asset's life under the straight-line and the double-

declining-balance depreciation methods. Assume that the machine is the company's only asset.

Straight-line method. If required, round to one decimal place.

2019

23.3

%

2020

30

%

2021

42

%

<

2022

70

%

2023

210

%

Double-declining-balance depreciation method. Round to two decimal places. Round your intermediate dollar value calculations to the nearest

whole number.

2019

7.5 X %

2020

%

2021

%

2022

%

2023

%

Feedback

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 3 images

Knowledge Booster

Similar questions

- Book value and taxes on sale of assets Troy Industries purchased a new machine 4 year(s) ago for $82,000. It is being depreciated under MACRS with a 5-year recovery period using the schedule. Assume 21% ordinary and capital gains tax rates. a. What is the book value of the machine? b. Calculate the firm's tax liability if it sold the machine for each of the following amounts: $98,400; $57,400; $13,940; and $9,800. a. The remaining book value is $ (Round to the nearest dollar.) Data table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes Recovery year 1 2 3 4 10 years 10% 18% 14% 12% 9% 8% 7% 6% 6% 6% 4% 100% 100% 100% 100% *These percentages have been rounded to the nearest whole percent to simplify calculations while retaining realism. To calculate the actual depreciation for tax purposes, be sure to apply the actual unrounded percentages or…arrow_forwardDepreciation for Partial Periods Malone Delivery Company purchased a new delivery truck for $36,000 on April 1, 2019. The truck is expected to have a service life of 10 years or 180,000 miles and a residual value of $3,000. The truck was driven 12,000 miles in 2019 and 20,000 miles in 2020. Malone computes depreciation expense to the nearest whole month. Required: 1. Compute depreciation expense for 2019 and 2020 using the following methods: (Round your answers to the nearest dollar.) a. Straight-line method 2019 2020 b. Sum-of-the-years'-digits method 2019 2020 c. Double-declining-balance method 2019 2020 d. Activity method 2019 2020 2. For each method, what is the book value of the machine at the end of 2019? At the end of 2020? (Round your answers to the nearest dollar.) a. Straight-line method 2019 2020 b. Sum-of-the-years'-digits method 2019 2020 c. Double-declining-balance method 2019 2020 d. Activity method 2019 2020arrow_forwardDepreciation for Partial Periods Bean Delivery Company purchased a new delivery truck for $42,000 on April 1, 2019. The truck is expected to have a service life of 5 years or 120,000 miles and a residual value of $3,000. The truck was driven 8,000 miles in 2019 and 16,000 miles in 2020. Bean computes depreciation expense to the nearest whole month. Required: 1. Compute depreciation expense for 2019 and 2020 using the following methods: (Round your answers to the nearest dollar.) a. Straight-line method 2019 2020 b. Sum-of-the-years'-digits method 2019 2020 c. Double-declining-balance method 2019 2020 d. Activity method 2019 2020 2. For each method, what is the book value of the machine at the end of 2019? At the end of 2020? (Round your answers to the nearest dollar.) a. Straight-line method 2019 2020 b. Sum-of-the-years'-digits method 2019 2020 c. Double-declining-balance method 2019 2020 d. Activity method 2019 2020 $arrow_forward

- Depreciation and Rate of Return Burrell Company purchased a machine for $31,000 on January 2, 2019. The machine has an estimated service life of 5 years and a zero estimated residual value. The asset earns income before depreciation and income taxes of $15,500 each year. The tax rate is 20%. Required: Compute the rate of return earned (on the average net asset value) by the company each year of the asset's life under the straight-line and the double-declining-balance depreciation methods. Assume that the machine is the company's only asset. Straight-line method. If required, round to one decimal place. 2019 26.7 % 2020 34.3 % 2021 48 % 2022 80 % 2023 240 % Double-declining-balance depreciation method. Round to two decimal places. Round your intermediate dollar value calculations to the nearest whole number. 2019 10 % 2020 43.33 % 2021 98.89 % 2022 191.49 % 2023 350 X %arrow_forwardDepreciation and Rate of Return Burrell Company purchased a machine for $20,000 on January 2, 2019. The machine has an estimated service life of 5 years and a zero estimated residual value. The asset earns income before depreciation and income taxes of $10,000 each year. The tax rate is 21%. Required: Compute the rate of return earned (on the average net asset value) by the company each year of the asset's life under the straight-line and the double-declining-balance depreciation methods. Assume that the machine is the company's only asset. Straight-line method. If required, round to one decimal place. 2019 fill in the blank 1 % 2020 fill in the blank 2 % 2021 fill in the blank 3 % 2022 fill in the blank 4 % 2023 fill in the blank 5 % Double-declining-balance depreciation method. Round to two decimal places. Round your intermediate dollar value calculations to the nearest whole number. 2019 fill in the blank 6 % 2020 fill in the blank 7 % 2021 fill in the blank 8…arrow_forwardRevision of Depreciation On January 1, 2021, Blizzards-R-Us purchased a snow-blowing machine for $85,000. The machine was expected to have a residual value of $5,000 at the end of its 5-year useful life. On January 1, 2023, Blizzards-R-Us concluded that the machine would have a remaining useful life of 6 years with a residual value of $770. Required: Determine the revised annual depreciation expense for 2023 using the straight-line method.arrow_forward

- Book value and taxes on sale of assets Troy Industries purchased a new machine 4 year(s) ago for $80,000. It is being depreciated under MACRS with a 5-year recovery period using the schedule. Assume 21% ordinary and capital gains tax rates. a. What is the book value of the machine? b. Calculate the firm's tax liability if it sold the machine for each of the following amounts: $96,000; $56,000; $13,600; and $9,500. a. The remaining book value is $ (Round to the nearest dollar.) ...arrow_forwardDepreciation for Partial Periods Storm Delivery Company purchased a new delivery truck for $45,000 on April 1, 2019. The truck is expected to have a service life of 10 years or 90,000 miles and a residual value of $3,000. The truck was driven 8,000 miles in 2019 and 14,000 miles in 2020. Storm computes depreciation expense to the nearest whole month. Required: Compute depreciation expense for 2019 and 2020 using the following methods: (Round your answers to the nearest dollar.) Straight-line method 2019 $ fill in the blank 1 2020 $ fill in the blank 2 Sum-of-the-years'-digits method 2019 $ fill in the blank 3 2020 $ fill in the blank 4 Double-declining-balance method 2019 $ fill in the blank 5 2020 $ fill in the blank 6 Activity method 2019 $ fill in the blank 7 2020 $ fill in the blank 8 For each method, what is the book value of the machine at the end of 2019? At the end of 2020? (Round your answers to the nearest dollar.) Straight-line method…arrow_forwardAn asset costs $290,000 and is classified as a ten-year asset. What is the annual depreciation expense for the first three years under the straight-line and the modified accelerated cost recovery systems of depreciation? Be sure to apply the half-year convention to straight-line depreciation. Use Exhibit 9.4 to answer the question. Round your answers to the nearest dollar. Straight-line depreciation: Year Depreciation expense 1 $ 2 $ 3 $ Accelerated cost recovery system of depreciation: Year Depreciation expense 1 $ 2 $ 3 $arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education