Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

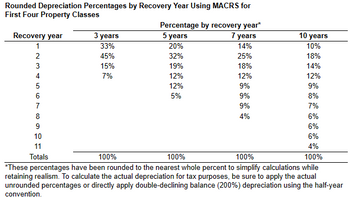

Transcribed Image Text:Rounded Depreciation Percentages by Recovery Year Using MACRS for

First Four Property Classes

Recovery year

1

2

3

4

7

8

9

10

11

Totals

3 years

33%

45%

15%

7%

Percentage by recovery year*

5 years

20%

32%

19%

12%

12%

5%

7 years

14%

25%

18%

12%

9%

9%

9%

4%

10 years

10%

18%

14%

12%

9%

8%

7%

6%

6%

6%

4%

100%

100%

100%

100%

*These percentages have been rounded to the nearest whole percent to simplify calculations while

retaining realism. To calculate the actual depreciation for tax purposes, be sure to apply the actual

unrounded percentages or directly apply double-declining balance (200%) depreciation using the half-year

convention.

Transcribed Image Text:Depreciation In early 2019, Sosa Enterprises purchased a new machine for $11,800 to make cork stoppers for wine bottles. The machine has a 3-year recovery period and is expected to have a salvage value of $1,980. Develop a depreciation schedule for this asset using the

MACRS depreciation percentages in the table i

Complete the depreciation schedule for the asset below:

(Round the percentage to the nearest integer and the depreciation to the nearest dollar.)

Depreciation Schedule

Year

1

Cost

(1)

$11,800

Percentage

(2)

%

Depreciation

(1) × (2)

$

C

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Similar questions

- Early-July 2021: A significant renovation of the building was completed at a cost of $30,000. The renovation is expected to provide the building with a useful life of 25 years. This involved the scrapping of an old kitchen with carrying value of $4,000.what is the entry for building depreciation and show working of calculation.arrow_forwardHaresharrow_forwardDetermine depreciation for that first year using both the Straight-Line Method and the Units of Activity Method as well as determine if there was a gain or loss on disposal from the problem below. On February 1, 2021, Harper Brewing Co. purchased a truck for $20,000. It's expected salvage value is $500. The estimated useful life (in years) is 5 years. And the estimated useful life (in miles) is 100,000. On December 31, 2021, Harper Brewing Co. sells the truck for $10,000 after driving it for 30,000 miles.arrow_forward

- help mearrow_forwardFreeport-McMoRan Copper and Gold has purchased a new ore grading unit for $80,000. The unit has an anticipated life of 10 years and a salvage value of $ 10,000. Use the DB and DDB methods to compare the schedule of depreciation and book values for each year. Solve by hand and by spreadsheet.arrow_forwardA piece of equipment is purchased for $110,000 and has an estimated salvage value of $10,000 at the end of the recovery period. Prepare a depreciation schedule for the piece of equipment using the sum-of-the-years method with a recovery period of seven years. Please answer in excel with each cells formula.arrow_forward

- Please show all your workarrow_forwardA plant asset acquired on October 1, 2020, at a cost of $500,000 has an estimated useful life of 10 years. The salvage value is estimated to be $50,000 at the end of the asset's useful life. Instructions: determine the depreciation expense and accumulated depreciation for the first five years using: a. straight-line method b. double-declining-balance methodarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education