FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

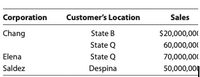

Chang Corporation is part of a three-corporation unitary business. The group has a water’s edge election in effect with respect to unitary State Q. State B does not apply the unitary concept with respect to its corporate income tax laws. Nor does Despina, a European country to which Saldez paid a $7,000,000 value added tax this year.

Saldez was organized in Despina and conducts all of its business there. Given the summary of operations that follows, determine Chang’s and Elena’s sales factors in States B and Q.

(info numbers attached)

Transcribed Image Text:Corporation

Customer's Location

Sales

Chang

State B

$20,000,000

State Q

60,000,000

Elena

State Q

70,000,000

Saldez

Despina

50,000,004

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Do not Give Solution in images formatarrow_forwardWhich of the following corporations would not be considered resident in Canada for tax purposes?1)Axem Inc. was incorporated in Manitoba on April 5, 1965 and has carried on business in Canada sincethat date. 2)Linco Ltd. was incorporated in Ontario on April 4, 1985 and, until the end of 1999,all of the operations and board of directors meetings were held in the southern United States. In 2000,all of the management and operations of the Company moved to Toronto. 3)Norad Inc. was incorporated in New York state on March 1, 1985 and, until the end of 1993, carried on business in Canada. At that time, all of the management and operations of the Company moved to the southern United States. 4)Rio Amgal Inc. was incorporated in Manitoba on September 3, 2010. While the Company hasoperations in both Canada and the U.S., the directors live in Calgary. As a consequence, all director’smeetings are held in that city. 5)In all cases the corporations would be considered residents of Canada.arrow_forwardSharon Incorporated is headquartered in State X and owns 100 percent of Carol Corporation, Josey Corporation, and Janice Corporation, which form a single unitary group. Assume sales operations are within the solicitation bounds of Public Law 86-272. Each of the corporations has operations in the following states: Domicile State Dividend income Business income Sales: State X Sales: State Y Sales: State Z Sales: State A Sales: State B Property: State X Property: State Y Property: State Z Property: State A Payroll: State X Payroll: State Y Payroll: State Z Payroll: State A Sharon Carol Josey Incorporated Corporation Corporation State X State Y State Z (throwback) (throwback) (nonthrowback) $ 1,490 $ 525 $ 580 46,250 15,500 59,750 20,300 60,500 75,200 21,900 15,900 60,000 65,000 12,300 28,400 93,500 15,500 55,750 13,400 12,500 7,850 28,000 43,500 3, 150 Janice Corporation State Z (nonthrowback) $ 485 15,700 18,600 12,500 11,700 14, 200 25,500 11,100 10, 200 Compute the following for State…arrow_forward

- This answer is wrong . please give me the right answer.arrow_forwardProblem 16-41 (LO. 6) Chang Corporation is part of a three-corporation unitary business. The group has a water's edge election in effect with respect to unitary State Q. State B does not apply the unitary concept with respect to its corporate income tax laws. Nor does Despina, a European country to which Saldez paid a $7,000,000 value added tax this year. Saldez was organized in Despina and conducts all of its business there. The following is a summary of operations: Corporation Customers' Location Sales Chang $20,000,000 60,000,000 70,000,000 50,000,000 Elena Saldez State B State Q State Q Despina Determine Chang's and Elena's sales factors in States B and Q. If required, round your final answers to the nearest whole number. State B sales factor: State Q sales factor: 40 X % 46.67 X %.arrow_forwardWhich of the following entities is taxed as a C corporation and will file Form 1120, U.S. Corporation Income Tax Return? (a) Kenneth, Inc., a pass-through entity taxed at the shareholder level. (b) Plushpuppies, Inc., which has made a valid subchapter S election. (c) Minors Financial, an unincorporated organization formed in 1995. Minors has been filing as a corporation since 1995. (d) Rescue Dogs, Inc., which has been recognized as a tax-exempt organizationarrow_forward

- Which of the following is one of the conditions necessary for an amalgamation to result in a tax-free/deferred combination? a. One of the corporations must be a Canadian Corporation. b. Fifty percent of the assets and liabilities of the old corporation must become assets and liabilities of the new corporation. c. The two corporations must be in a similar line of business. d. All of the shareholders of the old corporations must become shareholders of the new corporation.arrow_forwardThe S-corporation is a flow-through business entity under Subchapter S of the IRC. Go to the IRS websiteLinks to an external site. and search for a corporation's tax return (Form 1120) and an S-corporation tax return (Form 1120-S). Discuss one similarity or difference that you notice between the two returns. In that discussion, include why the similarity or difference exists.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education