Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Calculate the dividend income is taxable

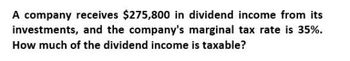

Transcribed Image Text:A company receives $275,800 in dividend income from its

investments, and the company's marginal tax rate is 35%.

How much of the dividend income is taxable?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Z C corporation earns $9.3 per share before taxes. The corporate tax rate is 40%, the personal tax rate on dividends is 14%, and the personal tax rate on non-dividend income is 45%. What is the total amount of taxes paid if the company pays a $7 dividend?arrow_forwardAn S corporation earns $ 7.20 per share before taxes. The corporate tax rate is 39%, the personal tax rate on dividends is 15%, and the personal tax rate on non-dividend income is 36%. What is the total amount of taxes paid if the company pays a $ 6.00 dividend?arrow_forwardBryon Brooks Inc. recently reported 15 million of net income. Its EBIT was 20.8 million, and its tax rate was 25%. What was its intrest expense?(Hint: Write out the headings for an income statement, and fill in the known values. Then divide 15 million of net income by (1-T)= 0.75 to find the pretax income. The difference between EBIT and taxable income must be intrest expense.arrow_forward

- Before-tax cost of debt for a company is 6.35%, while the after-tax cost of debt is 5.49%. What is the company's tax rate?arrow_forwardHow much will it owe in taxes on these financial accounting question?arrow_forwardThe Talley Corporation had a taxable income of $365,000 from operations after all operating costs but before: (1) interest charges of $50,000, (2) dividends received of $15,000, (3) dividends paid of $25,000, and (4) income taxes. a. What is the firm's taxable income? b. What is it marginal tax rate? c. What is its tax expense? d. What is its after-tax income?arrow_forward

- How much pre tax income must a company with a tax rate of 35% need to earn per share to pay out $2.35 per share?arrow_forwardAn S corporation earns $4.7 per share before taxes. The corporate tax rate is 35%, the personal tax rate on dividends is 20%, and the personal tax rate on non−dividend income is 39%. What is the total amount of taxes paid if the company pays a $2 dividend? A. $2.2 B. $1.83 C. $1.47 D. $2.57arrow_forwardFranklin Corporation just paid taxes of $152,000 on taxable income of... Franklin Corporation just paid taxes of $152,000 on taxable income of $512,000. The marginal tax rate is 35% for the company. What is the average tax rate for the Franklin Corporation?arrow_forward

- The tax rates for a particular year are shown below: Taxable Income Tax Rate $0 - 50,000 15% 50,001 - 75,000 25% 75,001 - 100,000 34% 100,001 - 335,000 39% What is the average tax rate for a firm with taxable income of $128,013?arrow_forwardSea Harbor, Inc. has a marginal tax rate of.... Please need answer the accounting questionarrow_forwardA C corporation earns $7.80 per share before taxes. The corporate tax rate is 39%, the personal tax rate on dividends is 15%, and the personal tax rate on non-dividend income is 36%. What is the total amount of taxes paid if the company pays a $4 dividend? A. $2.91 B. $4.37 C. $5.10 D. $3.64arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning