MATLAB: An Introduction with Applications

6th Edition

ISBN: 9781119256830

Author: Amos Gilat

Publisher: John Wiley & Sons Inc

expand_more

expand_more

format_list_bulleted

Question

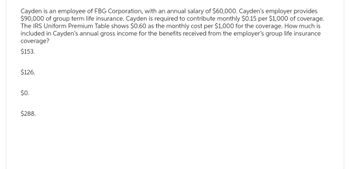

Transcribed Image Text:Cayden is an employee of FBG Corporation, with an annual salary of $60,000. Cayden's employer provides

$90,000 of group term life insurance. Cayden is required to contribute monthly $0.15 per $1,000 of coverage.

The IRS Uniform Premium Table shows $0.60 as the monthly cost per $1,000 for the coverage. How much is

included in Cayden's annual gross income for the benefits received from the employer's group life insurance

coverage?

$153.

$126.

$0.

$288.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- You own a home that was recently appraised for $390,000. The balance on your existing mortgage is $125,450. If your bank is willing to loan up to 70% of the appraised value, what is the potential amount (in $) of credit available on a home equity loan? $arrow_forwardJill lived and worked in North Carolina for the entire 2013 tax year. Her adjusted gross income was $78,000 and she qualifies for the standard deduction of $3000 and exemption of $2000. Use the following 2011-2013 NC tax rate schedule (taken from http://www.dor.state.nc.us/taxes/individual/rates.html) to calculate her 2013 NC tax. If your filing status is single; and taxable income is more than: $0 $12,750 $60,000 but not over: 1% $12,750 $60,000 Jill's 2013 NC tax is: $ (Round to the nearest dollar.) What is Jill's effective tax rate? [Tax paid divided by taxable income] (Write as a percent, rounded to one decimal place.) your tax is: 6% OF THE NC TAXABLE INCOME AMOUNT ON FORM D- 400 $765 + 7% OF THE AMOUNT OVER $12,750 $4,072.50 +7.75% OF THE AMOUNT OVER $60,000arrow_forwardMitchie borrowed $23,000 from Meridian Credit Union at 4% per year and agreed to repay the loan in monthly instalments of $3,000 each, such payments to cover interest due and repayment of principal. Please calculate the total interest paid after three months.arrow_forward

- If your monthly salary is $5,167 and 28% is withheld for taxes and social Security, How much will be withheld from your check payday?arrow_forwardCalculate the net price of merchandise listing for $5,700 less a trade discount rate of 35%.arrow_forwardBanner House Inc. gives all its sales people a base salary of $49,000 per annum and a commission of 13% on all banners that they sell over $5,000. Calculate Diana's salary last month if she sold $10,000 worth of banners.arrow_forward

- Joe I married and claims three allowances. The gross earnings on his last bi-weekly check were $1895. Find Joe's federal withholding taxes for this pay.arrow_forwardIn 2010, the U.S. Congress passed the Affordable Care Act. This law requires most Americans to purchase health insurance for themselves and members of their family. The Juarez family has a health insurance plan that will reimburse them for 70% of their health care expenses after they pay a $5,200 deductible. Last year, the Juarez family had medical expenses that totaled $16,384. What is the amount paid by the Juarez family’s insurance company?Answer: Work/Explain: Please write clearly so i can read itarrow_forwardA credit card company offers an annual 2% cash-back rebate on all gasoline purchases. If a family spent $7250 on gasoline purchases over the course of a year, what was the family's rebate at the end of the year?arrow_forward

- Calculate the amount of corporate income tax due and the net income after taxes (in $) for the corporation. (Assume the corporate tax rate is 21%.) Name TaxableIncome TaxLiability Net Incomeafter Taxes Corporation 3 $15,850,000arrow_forwardSarah's comprehensive major medical health insurance plan at work has a deductible of $750. The policy pays 85 percent of any amount above the deductible. While on a hiking trip, she contracted a rare bacterial disease. Her medical costs for treatment, including medicines, tests, and a six-day hospital stay, totaled $8,893. A friend told her that she would have paid less if she had a policy with a stop-loss feature that capped her out-of-pocket expenses at $3,000. The policy with the stop-loss feature has the same deductible and coinsurance requirement as Sarah's current policy. Determine which policy would have cost Sarah less and by how much. (Round your intermediate calculations and final answer to 2 decimal places.) Current policy Stop-loss feature No difference in Sarah's cost for this claim. Difference amountarrow_forwardJoshua repairs tubs and jacuzzis for $340 per job. His fixed costs are $1,250 per month and variable costs are $40 per job. a. Calculate the contribution margin on each job. b. Calculate the number of orders he needs to get per month to break even.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning

Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning

Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON

Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman

The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman

Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman

MATLAB: An Introduction with Applications

Statistics

ISBN:9781119256830

Author:Amos Gilat

Publisher:John Wiley & Sons Inc

Probability and Statistics for Engineering and th...

Statistics

ISBN:9781305251809

Author:Jay L. Devore

Publisher:Cengage Learning

Statistics for The Behavioral Sciences (MindTap C...

Statistics

ISBN:9781305504912

Author:Frederick J Gravetter, Larry B. Wallnau

Publisher:Cengage Learning

Elementary Statistics: Picturing the World (7th E...

Statistics

ISBN:9780134683416

Author:Ron Larson, Betsy Farber

Publisher:PEARSON

The Basic Practice of Statistics

Statistics

ISBN:9781319042578

Author:David S. Moore, William I. Notz, Michael A. Fligner

Publisher:W. H. Freeman

Introduction to the Practice of Statistics

Statistics

ISBN:9781319013387

Author:David S. Moore, George P. McCabe, Bruce A. Craig

Publisher:W. H. Freeman