Calculus: Early Transcendentals

8th Edition

ISBN: 9781285741550

Author: James Stewart

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

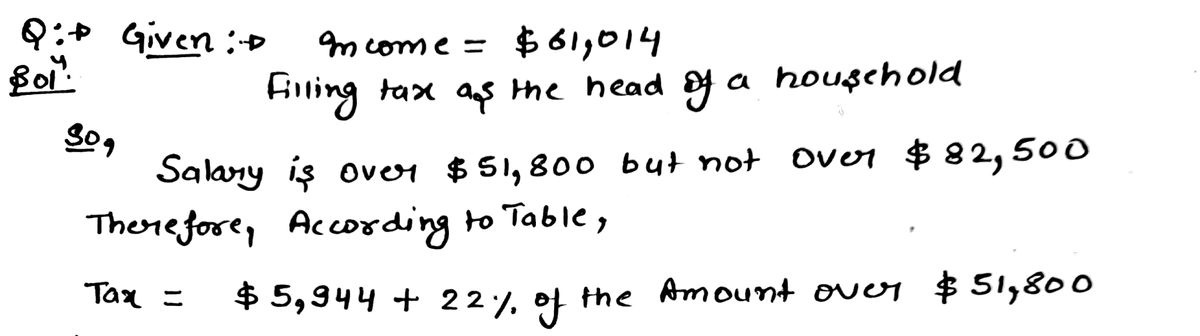

Mike is filing as the head of a household. Her taxable income is $61,014. Use the Tax Table, Exhibit 18-3 from your text to find the tax liability.

A. $6,940.68

B. $7,321.68

C. $7,971.08

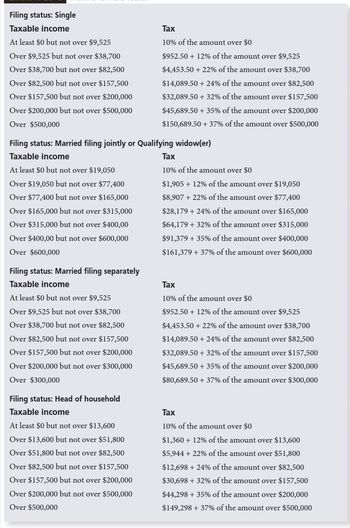

Transcribed Image Text:Filing status: Single

Taxable income

At least $0 but not over $9,525

Over $9,525 but not over $38,700

Over $38,700 but not over $82,500

Over $82,500 but not over $157,500

Over $157,500 but not over $200,000

Over $200,000 but not over $500,000

Over $500,000

Filing status: Married filing jointly or Qualifying widow(er)

Taxable income

At least $0 but not over $19,050

Over $19,050 but not over $77,400

Over $77,400 but not over $165,000

Over $165,000 but not over $315,000

Over $315,000 but not over $400,00

Over $400,00 but not over $600,000

Over $600,000

Filing status: Married filing separately

Taxable income

At least $0 but not over $9,525

Over $9,525 but not over $38,700

Over $38,700 but not over $82,500

Over $82,500 but not over $157,500

Over $157,500 but not over $200,000

Over $200,000 but not over $300,000

Over $300,000

Tax

10% of the amount over $0

$952.50 +12% of the amount over $9,525

$4,453.50 + 22% of the amount over $38,700

$14,089.50 +24% of the amount over $82,500

$32,089.50+ 32% of the amount over $157,500

$45,689.50 + 35% of the amount over $200,000

$150,689.50 +37% of the amount over $500,000

Filing status: Head of household

Taxable income

At least $0 but not over $13,600

Over $13,600 but not over $51,800

Over $51,800 but not over $82,500

Over $82,500 but not over $157,500

Over $157,500 but not over $200,000

Over $200,000 but not over $500,000

Over $500,000

Tax

10% of the amount over $0

$1,905 + 12% of the amount over $19,050

$8,907 + 22% of the amount over $77,400

$28,179 + 24% of the amount over $165,000

$64,179 + 32% of the amount over $315,000

$91,379 +35% of the amount over $400,000

$161,379 +37% of the amount over $600,000

Tax

10% of the amount over $0

$952.50 +12% of the amount over $9,525

$4,453.50 +22% of the amount over $38,700

$14,089.50 +24% of the amount over $82,500

$32,089.50 + 32% of the amount over $157,500

$45,689.50 + 35% of the amount over $200,000

$80,689.50 +37% of the amount over $300,000

Tax

10% of the amount over $0

$1,360 + 12% of the amount over $13,600

$5,944 + 22% of the amount over $51,800

$12,698 +24% of the amount over $82,500

$30,698 + 32% of the amount over $157,500

$44,298 + 35% of the amount over $200,000

$149,298 + 37% of the amount over $500,000

Expert Solution

arrow_forward

Step 1

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- Under the current tax plan, the person pays 26% flat income tax on their salary. Under a proposed new system, the person would pay 31% on their salary above $12,000. The person pays $980 more under the new system than the old. What is the person's salary? Previous Page Narrow_forwardTad hallway received a bill for $765 dated may 4th for goods received on june 10th. The terms of sale on the invoice were 2/10 ROG . What is the last day that Tad can receive a cash discount for this orderarrow_forwardA company had net sales of $306,000. The beginning inventory at retail was $124,000 and the ending inventory was $156,000. Find the turnover rate at retail. The turnover rate is __________arrow_forward

- A merchant pays a 3.5% fee to the Bank of Montreal on all MasterCard sales.a. What amount will she pay on sales of $17,564 for a month? (Round your answer to the nearest cent.)Merchant fee = $ b. What were her gross sales for a month in which the bank charged total fees of $732.88? (Round your answer to the nearest cent.)Gross sales = $arrow_forwardRichard spends $22.72 every month into mortgage at the end of 30 years he has a balance of 178,982,.64 what interests has accrued over 30 yearsarrow_forwardBased on the federal tax chart what are the taxes owed in the following situation Taxable income $45,000arrow_forward

- Joe I married and claims three allowances. The gross earnings on his last bi-weekly check were $1895. Find Joe's federal withholding taxes for this pay.arrow_forwardCalculate the amount of corporate income tax due and the net income after taxes (in $) for the corporation. (Assume the corporate tax rate is 21%.) Name TaxableIncome TaxLiability Net Incomeafter Taxes Corporation 3 $15,850,000arrow_forwardMason Industries purchased a drilling rig for $75,900. Delivery costs totaled $2,817. The useful life is 7 years and the salvage value is $12,952. Prepare a depreciation schedule using the straight-line method. Mason IndustriesDepreciation Schedule—Drilling End of Year Annual Depreciation ($) Accumulated Depreciation ($) Book Value ($) $78,717 (new) 1 $ $ $ 2 $ $ $ 3 $ $ $ 4 $ $ $ 5 $ $ $ 6 $ $ $ 7 $ $ $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Calculus: Early TranscendentalsCalculusISBN:9781285741550Author:James StewartPublisher:Cengage Learning

Calculus: Early TranscendentalsCalculusISBN:9781285741550Author:James StewartPublisher:Cengage Learning Thomas' Calculus (14th Edition)CalculusISBN:9780134438986Author:Joel R. Hass, Christopher E. Heil, Maurice D. WeirPublisher:PEARSON

Thomas' Calculus (14th Edition)CalculusISBN:9780134438986Author:Joel R. Hass, Christopher E. Heil, Maurice D. WeirPublisher:PEARSON Calculus: Early Transcendentals (3rd Edition)CalculusISBN:9780134763644Author:William L. Briggs, Lyle Cochran, Bernard Gillett, Eric SchulzPublisher:PEARSON

Calculus: Early Transcendentals (3rd Edition)CalculusISBN:9780134763644Author:William L. Briggs, Lyle Cochran, Bernard Gillett, Eric SchulzPublisher:PEARSON Calculus: Early TranscendentalsCalculusISBN:9781319050740Author:Jon Rogawski, Colin Adams, Robert FranzosaPublisher:W. H. Freeman

Calculus: Early TranscendentalsCalculusISBN:9781319050740Author:Jon Rogawski, Colin Adams, Robert FranzosaPublisher:W. H. Freeman

Calculus: Early Transcendental FunctionsCalculusISBN:9781337552516Author:Ron Larson, Bruce H. EdwardsPublisher:Cengage Learning

Calculus: Early Transcendental FunctionsCalculusISBN:9781337552516Author:Ron Larson, Bruce H. EdwardsPublisher:Cengage Learning

Calculus: Early Transcendentals

Calculus

ISBN:9781285741550

Author:James Stewart

Publisher:Cengage Learning

Thomas' Calculus (14th Edition)

Calculus

ISBN:9780134438986

Author:Joel R. Hass, Christopher E. Heil, Maurice D. Weir

Publisher:PEARSON

Calculus: Early Transcendentals (3rd Edition)

Calculus

ISBN:9780134763644

Author:William L. Briggs, Lyle Cochran, Bernard Gillett, Eric Schulz

Publisher:PEARSON

Calculus: Early Transcendentals

Calculus

ISBN:9781319050740

Author:Jon Rogawski, Colin Adams, Robert Franzosa

Publisher:W. H. Freeman

Calculus: Early Transcendental Functions

Calculus

ISBN:9781337552516

Author:Ron Larson, Bruce H. Edwards

Publisher:Cengage Learning