MATLAB: An Introduction with Applications

6th Edition

ISBN: 9781119256830

Author: Amos Gilat

Publisher: John Wiley & Sons Inc

expand_more

expand_more

format_list_bulleted

Question

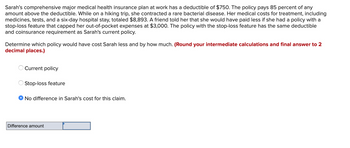

Transcribed Image Text:Sarah's comprehensive major medical health insurance plan at work has a deductible of $750. The policy pays 85 percent of any

amount above the deductible. While on a hiking trip, she contracted a rare bacterial disease. Her medical costs for treatment, including

medicines, tests, and a six-day hospital stay, totaled $8,893. A friend told her that she would have paid less if she had a policy with a

stop-loss feature that capped her out-of-pocket expenses at $3,000. The policy with the stop-loss feature has the same deductible

and coinsurance requirement as Sarah's current policy.

Determine which policy would have cost Sarah less and by how much. (Round your intermediate calculations and final answer to 2

decimal places.)

Current policy

Stop-loss feature

No difference in Sarah's cost for this claim.

Difference amount

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- i have no idea how to even start this problemarrow_forwardA boutique buys some merchandise with a list price of $3,200. If the wholesaler extends a 40% trade discount rate, find the trade discount (in $).arrow_forwardA boutique buys some merchandise with a list price of $3,400. If the wholesaler extends a 30% trade discount rate, find the trade discount (in $).arrow_forward

- Richard and Samantha are charting their monthly cash flow. They have some expenses like car repairs ($ 900 twice a year) and vacations ($ 1,500 for the year) that are not paid each month. How much should be set aside monthly to account for these non-monthly expenses?arrow_forwardSarah's insurance plan includes a $1,000 annual deductible, 20% coinsurance after the deductible is met, and a $5,000 out-of-pocket maximum. Sarah has already met her deductible and incurred an additional $2,000 in covered medical expenses. How much more will Sarah need to pay if she incurs another $4,000 in covered medical expenses?arrow_forwardThe new car costs $28,000 and can be financed with a three-yearloan at 6.72%. A three-year old model of the same car costs $13,000 and can be financed with a five-year loan at 7.27%. What is the difference in monthly payments between financing the new car and financing the used car?arrow_forward

- Jill lived and worked in North Carolina for the entire 2013 tax year. Her adjusted gross income was $78,000 and she qualifies for the standard deduction of $3000 and exemption of $2000. Use the following 2011-2013 NC tax rate schedule (taken from http://www.dor.state.nc.us/taxes/individual/rates.html) to calculate her 2013 NC tax. If your filing status is single; and taxable income is more than: $0 $12,750 $60,000 but not over: 1% $12,750 $60,000 Jill's 2013 NC tax is: $ (Round to the nearest dollar.) What is Jill's effective tax rate? [Tax paid divided by taxable income] (Write as a percent, rounded to one decimal place.) your tax is: 6% OF THE NC TAXABLE INCOME AMOUNT ON FORM D- 400 $765 + 7% OF THE AMOUNT OVER $12,750 $4,072.50 +7.75% OF THE AMOUNT OVER $60,000arrow_forwardIf your monthly salary is $5,167 and 28% is withheld for taxes and social Security, How much will be withheld from your check payday?arrow_forwardFind the gross income, the adjusted gross income, and the taxable income. A single man earned wages of $46,500, received $1850 in interest from a savings account, received $15,000 in winnings on a television game show, and contributed $2300 to a tax-deferred savings plan. He is entitled to a personal exemption of $3800 and a standard deduction of $5950. The interest on his home mortgage was $6500, he paid $2100 in property taxes and $1855 in state taxes, and he contributed $3000 to charity. O $63,350; $61,050; $43,795 O $63,350; $61,050; $51,300 O $63,350; $61,050; $38,845 $63,350; $61,050; $46,095arrow_forward

- Calculate the net price of merchandise listing for $5,700 less a trade discount rate of 35%.arrow_forwardBanner House Inc. gives all its sales people a base salary of $49,000 per annum and a commission of 13% on all banners that they sell over $5,000. Calculate Diana's salary last month if she sold $10,000 worth of banners.arrow_forwardIf your credit card balance is $ 410.35, what would be the minimum payment on your bill if you are required to pay the greater of $10 or 3% of what you owe? *arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning

Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning

Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON

Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman

The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman

Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman

MATLAB: An Introduction with Applications

Statistics

ISBN:9781119256830

Author:Amos Gilat

Publisher:John Wiley & Sons Inc

Probability and Statistics for Engineering and th...

Statistics

ISBN:9781305251809

Author:Jay L. Devore

Publisher:Cengage Learning

Statistics for The Behavioral Sciences (MindTap C...

Statistics

ISBN:9781305504912

Author:Frederick J Gravetter, Larry B. Wallnau

Publisher:Cengage Learning

Elementary Statistics: Picturing the World (7th E...

Statistics

ISBN:9780134683416

Author:Ron Larson, Betsy Farber

Publisher:PEARSON

The Basic Practice of Statistics

Statistics

ISBN:9781319042578

Author:David S. Moore, William I. Notz, Michael A. Fligner

Publisher:W. H. Freeman

Introduction to the Practice of Statistics

Statistics

ISBN:9781319013387

Author:David S. Moore, George P. McCabe, Bruce A. Craig

Publisher:W. H. Freeman