Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:1. EX. 14.01.ALGO

2. EX.14.02

3. EX.14.03

4. EX.14.04

5. EX.14.05.BLANKSHEET.AL...

6. EX.14.06.BLANKSHEET.AL...

7. EX.14.07.BLANKSHEET.AL...

8. EX.14.08.BLANKSHEET.AL...

9. EX.14.09.BLANKSHEET.AL...

10. EX.14.11.BLANKSHEET.A...

11. EX.14.14.ALGO

12. PR.14.04.BLANKSHEET.A...

13. PR.14.02.BLANKSHEET.A...

C

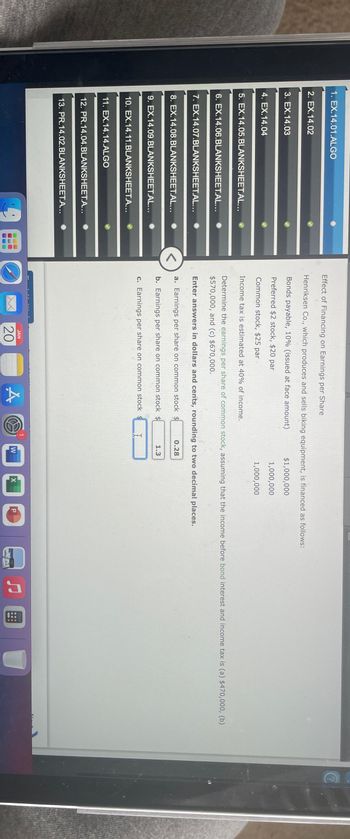

Effect of Financing on Earnings per Share

Henriksen Co., which produces and sells biking equipment, is financed as follows:

Bonds payable, 10% (issued at face amount)

$1,000,000

Preferred $2 stock, $20 par

1,000,000

Common stock, $25 par

1,000,000

Income tax is estimated at 40% of income.

Determine the earnings per share of common stock, assuming that the income before bond interest and income tax is (a) $470,000, (b)

$570,000, and (c) $670,000.

Enter answers in dollars and cents, rounding to two decimal places.

a. Earnings per share on common stock $

b. Earnings per share on common stock $

c. Earnings per share on common stock $

JAN

20

A

I

0.28

1.3

W

X

P

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- 1. BE.04.01.ALGO 2. BE.04.02.ALGO 3. BE.04.03.ALGO 4. BE.04.04 5. BE.04.05.ALGO 6. EX.04.04 7. EX.04.05.ALGO 8. EX.04.21 9. EX.04.18 10. EX.04.12 11. EX.04.02 ALGO 12. EX.04.08 Identifying Activity Bases in an Activity-Based Cost System Comfort Foods Inc. uses activity-based costing to determine product costs. For each activity listed in the left column, select an appropriate activity base from the right column. You may use items in the dropdown list more than once or not at all. Activity Cafeteria Customer return processing Electric power Human resources Inventory control Invoice and collecting Machine depreciation Materials handling Order shipping Payroll Performance reports Production control Production setup Purchasing Quality control Sales order processing Feedback Activity Base Engineering change orders. X Kilowatt hours used. X Number of purchase orders Number of sales orders Xarrow_forwardO O O O 0.021 0.000 0.059 0.081arrow_forward1. MC.14.81.ALGO 2. MC.14.96.ALGO 3. MC.11.69.ALGO 4. MC.11.112.ALGO 5. MC.15.86.ALGO 6. MC.15.125 7. MC.16.71.ALGO 8. MC.16.86.ALGO 9. MC.17.87.ALGO 10. MC.17.129 11. MC.18.58.ALGO 12. MC.18.45.ALGO 13. MC.20.81.ALGO Mocha Company manufactures a single product by a continuous process, involving three production departments. The records. indicate that direct materials, direct labor, and applied factory overhead for Department 1 were $100,000, $125,000, and $150,000, respectively. The records further indicate that direct materials, direct labor, and applied factory overhead for Department 2 were $50,000, $60,000, and $70,000, respectively. Department 2 has transferred-in costs of $390,000 for the current period. In addition, work in process at the beginning of the period for Department 2 totaled $75,000, and work in process at the end of the period totaled $90,000. The journal entry to record the flow of costs into Department 3 during the period is Oa. Work in Process-Department 3…arrow_forward

- * 0O T # 3 la Uni X L Grades for Cristian Catala: 22s X WP Ch7quiz with TF5 WP NWP Assessment Player UI Ap X + tion.wiley.com/was/ui/v2/assessment-player/index.html?launchld%3Dafd8fa6a-bc9b-4f11-82e4-3c0d1d4a7063#/question/8 TF5 Question 9 of 10 -/1 Cullumber Consulting Company is headquartered in Atlanta and has branch offices in Nashville and Birmingham. Cullumber uses an activity-based costing system. The Atlanta office has its costs for Administration and Legal allocated to the two branch offices. Cullumber has provided the following information: Activity Cost Pool Cost Driver Costs Administration % of time devoted to branch $703000 Legal Hours spent on legal research $141000 Hours % of time spend devoted to branch on legal research Nashville 000 Birmingham How much of Atlanta's cost will be allocated to Nashville? (round to nearest dollar) O $632900 O $670862 O $672962 O $675200 Save for Later Attemnts: 0 of 1 used MacBook Pro G Search or type URL 000 +, 000 %23 %24 7. 8. 4. 9-…arrow_forwardmation |x A Assignmenta: Corp Fin Reprtn x Question 2 Graded Assignme x HExam1-ep6778a@student.am x ezto.mheducation.com/ext/map/index.html?_con=con&external_browser%3D0&launchUrl=https%253A%252F%252FIms.mheducation.com%252F... M (no subject) - ellse.patipewe@ x signment #4 (Leases) i Saved Help es At the beginning of 2021, VHF Industries acquired a machine with a fair value of $9,415,785 by signing a four-year lease. The lease is payable in four annual payments of $3.1 million at the end of each year. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. What is the effective rate of interest implicit in the agreement? 2-4. Prepare the lessee's journal entries at the beginning of the lease, the first lease payment at December 31, 2021 and the second lease payment at December 31, 2022. 5. Suppose the fair value of the machine and the lessor's implicit rate were unknown at the time of the lease, but that…arrow_forwardAccounting Questionarrow_forward

- I-n-c-o-m-e- -t-a-x-a-t-i-o-n- -b-a-s-e-d- -i-n- -P-h-i-l-i-p-p-i-n-e- -L-a-w- A-n-s-w-e-r- -t-h-e- -a-t-t-a-c-h-e-d- -p-i-c-t-u-r-e-,- -p-l-e-a-s-e- -a-d-d- -s-o-l-u-t-i-o-n- -i-n- -e-v-e-r-y- -p-r-o-b-l-e-m- -a-l-s-o- -i-n-d-i-c-a-t-e- -t-h-e- -r-u-l-e- -o-r- -p-r-o-v-i-s-i-o-n-s- -o-f- -l-a-w- -u-n-d-e-r- -R-e-p-u-b-l-i-c- -A-c-t- -No. 8434arrow_forward0271 20161 122oint and wong liw vitorioss of 10 2016 621 570111507780002 Question 50 vd mwob 250g abnod to oulay jud asiduob loota to oulsy od viqinda WOT ST6 201611291910 e vibrd, col vimonces adt milt once and T: E renso2 You are given the following information for two assets Uno and Dos: u yo qu909 DOGO TO SLolato sulsv onT reda ai Expected rate of return Variance of return srüster2 (1) 0.0595 0.0384 0.0153 ort ano 0.0153 29:01 ano Asset Uno W bas Wydb Dos rifesw 0.2315 VISM 1 odtwob stiW bus x to noitonuts as zonesse sondt orlt to ross tot visvitsogasn 26 At a market risk premium of 3.5% and a risk-free rate of 2%, determine which asset is considered riskier by analyzing their systematic and unsystematic risks. mvilu a visM szoqquz W bas W. W to noitonuts as vilitu botooqxo a'vM to noia201qxs si nwob in W v bas xto esuley sri bait sidizzoq zi sim ooit-lain odi is gaibasl bas gniwonod goimwezA viilitu botoqxo a'vieM eximixem lliw jedi MOTarrow_forwardU-s-e- -E-x-h-i-b-i-t- -W-o-r-k-s-h-e-e-t- 6.1. A-n-a-l-y-n- -R-a-m-o-s- -i-s- -e-v-a-l-u-a-t-i-n-g- -h-e-r- -d-e-b-t- -s-a-f-e-t-y- -r-a-t-i-o-.- -H-e-r- -m-o-n-t-h-l-y- -t-a-k-e---h-o-m-e- -p-a-y- -i-s- - ₱166,000.00. E-a-c-h- -m-o-n-t-h-,- -s-h-e- -p-a-y-s- - ₱19,000.00 f-o-r- -a-n- -a-u-t-o- -l-o-a-n-, ₱6,000.00 -o-n- -a- -p-e-r-s-o-n-a-l- -l-i-n-e- -o-f- -c-r-e-d-i--t,-- ₱3,000.00 -o-n -a- -d-e-p-a-r-t-m-e-n-t- -s-t-o-r-e- -c-h-a-r-g-e- -c-a-r-d-,- -a-n-d- ₱4,250.00 -o-n- -h-e-r- --b-a-n-k- -c-r-e--d-i-t- -c-a-r-d-. C-o-m-p-l-e-t-e- -t-h-e- -w-o-r-k-s-h-e-e-t- -b-y- -l-i-s-t-i-n-g- -A-n-a-l-y-n-’-s- -o-u-t-s-t-a-n-d-i-n-g- -d-e-b-t-s-,- -a-n-d- -t-h-e-n- -c-a-l-c-u-l-a-t-e- -h-e-r- -d-e-b-t- -s-a-f-e-t-y- -r-a-t-i-o-.- -G-i-v-e-n- -h-e-r- -c-u-r-r--e-n-t- -t-a-k-e---h-o-m--e -p-a-y-,- -w-h-a-t- -i-s- -t-h-e-- -m-a-x-i-m-u-m- -a-m-o--un-t- -o-f- -m-o-n-t-h-l-y- -d-e-b-t- -p-a-y-m-e-n-t-s- -t-h-a-t- -A-n-a-l-y-n- -c-a-n-- h-a-v-e- -i-f- --s-h-e- -w-a-n-t-s- -h-e-r- -d-e-b-t-…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education