Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

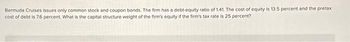

Transcribed Image Text:Bermuda Cruises issues only common stock and coupon bonds. The firm has a debt-equity ratio of 1.41. The cost of equity is 13.5 percent and the pretax

cost of debt is 7.6 percent. What is the capital structure weight of the firm's equity if the firm's tax rate is 25 percent?

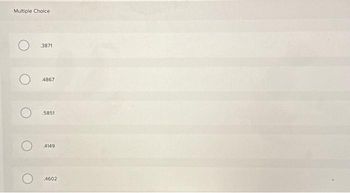

Transcribed Image Text:Multiple Choice

O

O

3871

4867

5851

4149

4602

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- 4. North Inc has a perpetual expected EBIT of $200. The interest rate on debt is 12%. Assume that there are no taxes. a. what is the value of North Inc if the debt/equity ratio is .25 and its weighted average cost of capital is 16%? What's the value of North's equity? What is the value of North's debt? What is the firm's cost of equity? b. Suppose the corporate tax is 30% and North has $400 in debt outstanding. If the unlevered cost is 20%, what's the value of North? What is the value of the firm's equity? What is the Wacc?arrow_forwardBermuda Cruises issues only common stocks and coupon bonds. The firm has a debt-equity ratio of 0.45. The cost of equity is 17.6 percent. Please answer:What is the pre-tax cost of the company debt if weighted average costs of the company is 13.5% and the firm's tax rate is 35 percent?arrow_forwardLuLu In. wants to utilize a different debt-equity ratio than it had previously. It is planning to increase the firm’s current debt-equity ratio of 0.4 to a higher value of 0.8 by issuing debt to repurchase a portion of its common stock. LuLu In. currently has $12 million worth of debt outstanding and faces a pretax cost of debt of 8 percent per year. The firm expects to have an EBIT of $3.6 million per year in perpetuity and pays no taxes. Use the Modigliani and Miller propositions to determine the expected rate of return on the firm’s equity after the issue is announced.arrow_forward

- Bermuda Cruises issues only common stocks and coupon bonds. The firm has a debt-equity ratio of 0.45. The cost of equity is 17.6 percent.Required:What is the pre-tax cost of the company debt if weighted average costs of the company is 13.5% and the firm's tax rate is 35 percent?arrow_forwardBermuda Cruises issues only common stock and coupon bonds. The firm has a debt–equity ratio of .85. The cost of equity is 12.1 percent and the pretax cost of debt is 6.9 percent. What is the capital structure weight of the firm's equity if the firm's tax rate is 39 percent? Multiple Choice .6123 .5127 .5405 .4595 .5858arrow_forwardBermuda Cruises issues only common stock and coupon bonds. The firm has a debt-equity ratio of 1.29. The cost of equity is 12.9 percent and the pretax cost of debt is 7.3 percent. What is the capital structure weight of the firm's equity if the firm's tax rate is 39 percent? Multiple Choice 5633 4820 5085 4089 4367 < Prev 9 of 40 Next earrow_forward

- Lamont Corp. is debt-free and has a weighted average cost of capital of 12.7 percent. The current market value of the equity is $2.3 million and there are no taxes. According to M&M Proposition I, what will be the value of the company if it changes to a debt-equity ratio of .85?arrow_forwardBermuda Cruises issues only common stock and coupon bonds. The firm has a debt-equity ratio of .45. The cost of equity is 17.6 percent and the pretax cost of debt is 8.9 percent. What is the capital structure weight of the firm's equity if the firm's tax rate is 35 percent?arrow_forwardRefi Corporation is planning to repurchase part of its common stock by issuing corporate debt. As a result, the firm’s debt-equity ratio is expected to rise from 35 percent to 50 percent. The firm currently has $3.1 million worth of debt outstanding. The cost of this debt is 8 percent per year. The firm expects to have an EBIT of $1.3 million per year in perpetuity and pays no taxes. a. What is the market value of the firm before and after the repurchase announcement? (Do not round intermediate calculations and enter your answers in dollars, not millions of dollars, rounded to the nearest whole number, e.g., 1,234,567.) b. What is the expected return on the firm’s equity before the announcement of the stock repurchase plan? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) c. What is the expected return on the equity of an otherwise identical all-equity firm? (Do not round intermediate calculations and…arrow_forward

- Question 2: Bermuda Cruises issues only common stock and couponbonds. The firm has a debt-equity ratio of .45. The cost of equity is 17.6percent and.Required: What is the pre-tax cost of the company debt if weightedaverage costs of the company is 13.5% and the firm's tax rate is 35percent?arrow_forwardBermuda Cruises issues only common stock and coupon bonds. The firm has a debt-equity ratio of 1.37. The cost of equity is 13.3 percent and the pretax cost of debt is 7.5 percent. What is the capital structure weight of the firm's equity if the firm's tax rate is 23 percent?. Multiple Choice O O 4219 4937 5781 4672 2941arrow_forwardAspen's Distributors has a levered cost of equity of 13.84 percent and an unlevered cost of capital of 12.5 percent. The company has $5,000 in debt that is selling at par. The levered value of the firm is $14,600 and the tax rate is 25 percent. What is the pretax cost of debt? A) 7.92 percent B) 9.07 percent C) 8.16 percent D) 8.84 percentarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education