FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

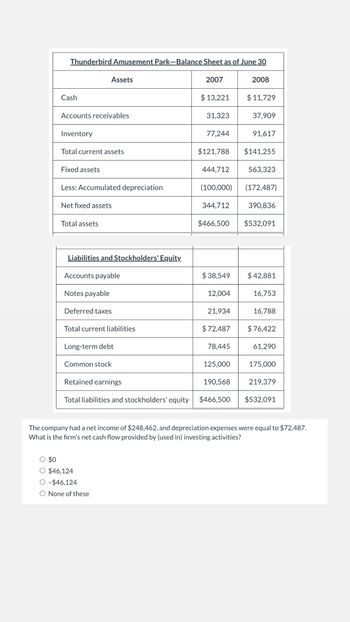

Transcribed Image Text:Thunderbird Amusement Park-Balance Sheet as of June 30

Cash

Accounts receivables

Inventory

Total current assets

Fixed assets

Less: Accumulated depreciation

Assets

Net fixed assets

Total assets

Liabilities and Stockholders' Equity.

Accounts payable

Notes payable

Deferred taxes

Total current liabilities

Long-term debt

Common stock

$0

O $46,124

O-$46,124

2007

None of these

$ 13,221

31,323

444,712

77,244

$121,788 $141,255

$466,500

$ 38,549

12,004

21,934

(100,000) (172,487)

344,712

$72,487

78,445

Retained earnings

Total liabilities and stockholders' equity $466,500

125,000

2008

$11,729

190,568

37,909

91,617

563,323

390,836

$532,091

$42,881

16,753

16,788

$76,422

61,290

175,000

219,379

The company had a net income of $248,462, and depreciation expenses were equal to $72,487.

What is the firm's net cash flow provided by (used in) investing activities?

$532,091

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- How do I compute the operating cash flow to capital expenditure ratio?arrow_forwardLand costing $138,463 was sold for $175,514 cash. The gain on the sale was reported on the income statement as other income. On the statement of cash flows, what amount should be reported as an investing activity from the sale of land?arrow_forwardSuppose during 2022 that Cypress Semiconductor Corporation reported net cash provided by operating activities of $99,126,330, cash used in investing of $47,869,860, and cash used in financing of $8,178,480. In addition, cash spent for fixed assets during the period was $28,663,530. No dividends were paid. Calculate free cash flow. (Show a negative free cash flow with either a - sign e.g. -15,000 or in parenthesis e.g. (15,000).) Free cash flow %24arrow_forward

- Kutcher Systems sold land, investments, and issued their own common stock for $10 million, $16 million, and $21 million, respectively. Kutcher also purchased treasury stock, equipment, and a patent for $2 million, $3 million, and $4 million, respectively. Required: 1. What amount should the company report as net cash flows from investing activities? 2. What amount should the company report as net cash flows from financing activities? Complete this question by entering your answers in the tabs below. Required 1 Required 2 What amount should the company report as net cash flows from investing activities? (Negative value should be indicated by a minus sign. Enter your answer in millions.) Net cash flow from investing activities million Required 1 23 of 34 *** Telp Nextarrow_forwardStaley Inc. reported the following data: Net income $338,400 Depreciation expense 66,700 Loss on disposal of equipment 31,900 Increase in accounts receivable 25,200 Increase in accounts payable 10,100 Prepare the Cash Flows from Operating Activities section of the statement of cash flows, using the indirect method. Use the minus sign to indicate cash outflows, cash payments, decreases in cash, or any negative adjustments. what is the answer to this?arrow_forwardWhich of the following should be deducted from net income in calculating net cash flow from operating activities using the indirect method? a. a loss on the sale of equipment b. gain on sale of land c. depreciation expense d. dividends declared and paidarrow_forward

- Assume net income was $230,000, depreciation expense was $6,400, accounts receivable decreased by $11,500, and accounts payable decreased by $3,100. The amount of net cash flows from operating activities is:arrow_forwardSuppose your company sells services of $310 in exchange for $200 cash and $110 on account. Depreciation of $130 relating to equipment also is recorded. Calculate the amount that should be reported as net cash flow from operating activities. Calculate the amount that should be reported as net income. Show how the indirect method would convert net income (requirement 3) to net cash flow from operating activities (requirement 2).arrow_forwardMicro Manufacturing reports net income of $866,000. Depreciation Expense is $74,000, Accounts Receivable increases $36,000 and Accounts Payable decreases $11,000. Calculate net cash flows from operating activities using the indirect method. (Negative value should be indicated by minus sign.) Net cash flows from operating activitiesarrow_forward

- First three sub-part is solvedarrow_forwardAnalyze this transaction as an asset, liability, paid in capital or retained earnings(plus or a negative) collected $235,000 in cash from credit customers.arrow_forward1. Why does the company add back depreciation to compute net cash flows from operating activities? 2. Why are there changes in accounts receivable and inventories as adjustments to net earnings. Are accounts receivable and inventories balances increasing or decreasing during the year? 3. It is reported that the company invested $572 million in property, plant, and equipment. Is this an appropriate type of expenditure for the company to make? What relation should expenditures for PPE have with depreciation expense? 4. Stryker paid $300 million to repurchase its common stock in fiscal 2018 and, in addition, paid dividends of $703 million. Thus, it paid $1.003 million of cash to its stockholders during the year. How do we evaluate that use of cash relative to other possible uses for the company's cash? 5. Provide an overall assessment of the company's cash flows for fiscal 2018. In the analysis, consider the sources and uses of cash.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education