FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

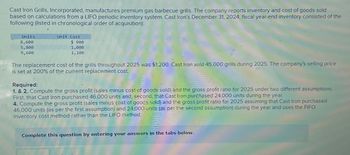

Transcribed Image Text:Cast Iron Grills, Incorporated, manufactures premium gas barbecue grills. The company reports inventory and cost of goods sold

based on calculations from a LIFO periodic inventory system. Cast Iron's December 31, 2024, fiscal year-end inventory consisted of the

following (listed in chronological order of acquisition):

Units

8,600

5,800

9,600

Unit Cost

$ 900

1,000

1,100

The replacement cost of the grills throughout 2025 was $1,200. Cast Iron sold 45,000 grills during 2025. The company's selling price

is set at 200% of the current replacement cost.

Required:

1. & 2. Compute the gross profit (sales minus cost of goods sold) and the gross profit ratio for 2025 under two different assumptions.

First, that Cast Iron purchased 46,000 units and, second, that Cast Iron purchased 24,000 units during the year.

4. Compute the gross profit (sales minus cost of goods sold) and the gross profit ratio for 2025 assuming that Cast Iron purchased

46,000 units (as per the first assumption) and 24,000 units (as per the second assumption) during the year and uses the FIFO

inventory cost method rather than the LIFO method.

Complete this question by entering your answers in the tabs below.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Sagararrow_forwardBombers Corporation began operations in 2026. Its ending inventory at cost and at LCNRV at the end of 2025 and 2026 is presented below: Cost Net Realizable Value 12/31/26 $926, 000 $ 922,000 12/31/27 910, 000 920, 000 Prepare the journal entries (if any) required at December 31, 2026, and December 31, 2027, assuming that the inventory is recorded at LCNRV and that Schubert uses a perpetual inventory system and the cost of - goods - sold method.arrow_forwardThe Cecil Booker Vending Company changed is method of valuing inventory from the average cost method to the FIFO cost method at the beginning of 2021. At December 31, 2020, inventories were $130,000 (average cost basis) and were $134,000 a year earlier. Cecil-Booker’s accountants determined that the inventories would have totaled $175,000 at December 31, 2020, and $180,000 at December 31, 2019, if determined on a FIFO basis. A tax rate of 25% is in effect for all years. One hundred thousand common shares were outstanding each year. Income from continuing operations was $500,000 in 2020 and $625,000 in 2021. There were no discontinued operations either year. Required: Prepare the journal entry at January 1, 2021, to record the change in accounting principle. (All tax effects should be reflected in the deferred tax liability account) Prepare the 2021-2020 comparative income statements beginning with income from continuing operations (adjusted for any revisions) include per share…arrow_forward

- On January 1, 2024, a Company adopted the dollar-value LIFO method for its one inventory pool. The pool’s value on this date was $750,000. The 2024 and 2025 ending inventory valued at year-end costs were $793,000 and $882,000, respectively. The appropriate cost indexes are 1.04 for 2024 and 1.05 for 2025. Required: Complete the below table to calculate the inventory value at the end of 2024 and 2025 using the dollar-value LIFO method. Note: Round "Year end cost index" to 2 decimal places. Round other final answer values to the nearest whole dollars.arrow_forwardOn January 1, 2024, a Company adopted the dollar-value LIFO method for its one inventory pool. The pool’s value on this date was $660,000. The 2024 and 2025 ending inventory valued at year-end costs were $690,000 and $760,000, respectively. The appropriate cost indexes are 1.04 for 2024 and 1.08 for 2025. Required: Complete the below table to calculate the inventory value at the end of 2024 and 2025 using the dollar-value LIFO method.arrow_forwardCast Iron Grills, Incorporated, manufactures premium gas barbecue grills. The company reports inventory and cost of goods sold based on calculations from a LIFO periodic inventory system. Cast Iron’s December 31, 2024, fiscal year-end inventory consisted of the following (listed in chronological order of acquisition): Units Unit Cost 6,200 $ 300 4,600 400 7,200 500 The replacement cost of the grills throughout 2025 was $600. Cast Iron sold 33,000 grills during 2025. The company's selling price is set at 200% of the current replacement cost. Required: 1. & 2. Compute the gross profit (sales minus cost of goods sold) and the gross profit ratio for 2025 under two different assumptions. First, that Cast Iron purchased 34,000 units and, second, that Cast Iron purchased 18,000 units during the year. 4. Compute the gross profit (sales minus cost of goods sold) and the gross profit ratio for 2025 assuming that Cast Iron purchased 34,000 units (as per the first assumption) and…arrow_forward

- A company adopted dollar - value LIFO on January 1, 2024, when the inventory value was $367,000 and the cost index was 1.35. On December 31, 2024, the inventory was valued at year-end cost of $402,000 and the cost index was 1.40. The company would report a LIFO inventory of: Note: Round your final answer to the nearest whole dollar amount.arrow_forwardBoulder, Incorporated is computing its inventory at December 31, 2022. The following information relates to the five major inventory items regularly stocked for resale: Item A B C D E Item A B Required: Using the lower of cost or net realizable value, compute the total valuation for each inventory item at December 31 2022, and the total inventory valuation. C Ending Inventory, Quantity on December 31, 2022 Unit Hand 140 190 45 340 740 D E Total Inventory Valuation $ Net Realizable Value (Market) at Cost when Acquired (FIFO) December 31, 2022 $44 $39 $54 $56 $104 $84 $66 $16 0 $64 $19arrow_forwardPlease complete all requirement and Do not give solution in image formatarrow_forward

- 7. Taylor Corporation reports inventory and cost of goods sold based on calculations from a LIFO periodic inventory system. The company’s records under this system reveal the following inventory layers at the beginning of 2021 (listed in chronological order of acquisition): 17,500 units @ $15 $ 262,500 22,500 units @ $20 450,000 Beginning inventory $ 712,500 During 2021, 45,000 units were purchased for $25 per unit. Due to unexpected demand for the company's product, 2021 sales totaled 55,000 units at various prices, leaving 30,000 units in ending inventory. Required:1. Calculate the amount to report for cost of goods sold for 2021.2. Determine the amount of LIFO liquidation profit that the company must report in a disclosure note to its 2021 financial statements. Assume an income tax rate of 25%.3. If the company decided to purchase an additional 10,000 units at $25 per unit at the end of the year, how much income tax currently payable would be saved?arrow_forwardDo not give solution in imagearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education