FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

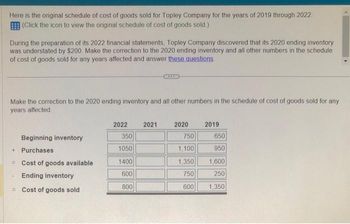

Transcribed Image Text:Here is the original schedule of cost of goods sold for Topley Company for the years of 2019 through 2022

(Click the icon to view the original schedule of cost of goods sold.)

During the preparation of its 2022 financial statements, Topley Company discovered that its 2020 ending inventory

was understated by $200. Make the correction to the 2020 ending inventory and all other numbers in the schedule

of cost of goods sold for any years affected and answer these questions

Make the correction to the 2020 ending inventory and all other numbers in the schedule of cost of goods sold for any

years affected.

+ Purchases

=

T

Beginning inventory

A

Cost of goods available

Ending inventory

Cost of goods sold

2022

350

1050

1400

600

800

2021

2020

750

1,100

1,350

750

600

2019

650

950

1,600

250

1,350

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- In 2020 Fy Co. decided to change to the FIFO method for inventory . The Cost of Goods Sold in 1919 was $300,000 under LIFO. Under FIFO it would have been $250,000 . In 2020 under FIFO Cost of Goods Sold would have been $360,000 whereas under LIFO It would have been $410,000. Journalize all necessary adjusting entries for 2020.arrow_forwardStep 1: Determine what the current account balance equals. Step 2: Determine what the current account balance should equal. Step 3: Record the December 31 adjusting entry to get from step 1 to step 2. Assume no other adjusting entries are made during the year. a. The Supplies account has a $300 debit balance to start the year. No supplies were purchased during the current year. A December 31 physical count shows $110 of supplies remaining. Supplies Step 1: Determine what the current account balance equals. Step 2: Determine what the current account balance should equal. Step 3: Record the December 31, adjusting entry to get from step 1 to step 2. b. The Supplies account has an $800 debit balance to start the year. Supplies of $2,100 were purchased during the current year and debited to the Supplies account. A December 31 physical count shows $650 of supplies remaining. Supplies ISten 1: Determine what the curent account halance enualsarrow_forward1. In 2021, Jules Company realized that its ending inventory was understated by P1,500 in 2019. How should Jules Company handle this? a. An adjustment to reduce inventory by P1,500 needs to be made b. An adjustment to increase cost of goods sold by P1,500 needs to be made. c. An adjustment to increase inventory by P1,500 needs to be made d. No adjustment needs to be made. 2. For interim reporting, a gain on disposal of land occurring in the third quarter is a. Recognized and allocated over the quarters b. Recognized and allocated over four quarters c. Recognized immediately in the third quarter d. Deferred until the annual reportingarrow_forward

- Flay Foods has always used the FIFO inventory costing method for both financial reporting and tax purposes. At the beginning of 2021, Flay decided to change to the LIFO method. As a result of the change, net income in 2021 was $76 million. If the company had used LIFO in 2020, its cost of goods sold would have been higher by $7 million that year. Flay's records of inventory purchases and sales are not available for 2019 and several previous years. Last year, Flay reported the following net income amounts in its comparative income statements: ($ in millions) Net income 2018 2019 2020 $76 $78 $80 Required: 1. Prepare the journal entry at the beginning of 2021 to record the change in accounting principle. (Ignore income taxes.) 3. What amounts will Flay report for net income in its 2019-2021 comparative income statements?arrow_forwardKeller Company began operations on January 1, 2019, adopting the conventional retail inventory system. None of the company's merchandise was marked down in 2019 and, because there was no beginning inventory, its ending inventory for 2019 of $38,100 would have been the same under either the conventional retail system or the LIFO retail system. On December 31, 2020, the store management considers adopting the LIFO retail system and desires to know how the December 31, 2020, inventory would appear under both systems. All pertinent data regarding purchases, sales, markups, and markdowns are shown below. There has been no change in the price level. Inventory, Jan. 1, 2020 Markdowns (net) Markups (net) Purchases (net) Sales (net) Cost $38,100 (b) Ending inventory LIFO retail method 130,900 Determine the cost of the 2020 ending inventory under both (a) the conventional retail method and (b) the LIFO retail method. (Round ratios for computational purposes to 2 decimal place, e.g. 78.72% and…arrow_forwardAt the end of 2018, the Biggie Company performed its annual physical inventory count. John Lawrence, themanager in charge of the physical count, was told that an additional $22,000 in inventory that had been sold andwas in transit to the customer should be included in the ending inventory balance. John was of the opinion that themerchandise shipped should be excluded from the ending inventory since Biggie was not in physical possessionof the merchandise.Required:Discuss the situation and indicate why John’s opinion might be incorrect.arrow_forward

- During 2021, P Company discovered that the ending inventories reported on its financial statements were incorrect by the following amounts: 2019 $ 120,000 understated 2020 $ 150,000 overstated *Note any error of 2019 ending inventory is carried over to 2020 as an error of the beginning inventory. P uses the periodic inventory system to ascertain year-end quantities that are converted to dollar amounts using the FIFO cost method. Prior to any adjustments for these errors and ignoring income taxes, P's retained earnings at January 1, 2021, would be: O Correct. O $30,000 overstated O $150,000 overstated. O $270,000 overstated.arrow_forwardIn January 2020, Susquehanna Inc. requested and secured permission from the commissioner of the Internal Revenue Service to compute inventories under the last-in, first-out (LIFO) method and elected to determine inventory cost under the dollar- value LIFO method. Susquehanna Inc. satisfied the commissioner that cost could be accurately determined by use of an index number computed from a representative sample selected from the company's single inventory pool. Instructions a. Why should inventories be included in (1) a balance sheet and (2) the computation of net income? b. The Internal Revenue Code allows some accountable events to be considered differently for income tax reporting purposes and financial accounting purposes, while other accountable events must be reported the same for both purposes. Discuss why it might be desirable to report some accountable events differently for financial accounting purposes than for income tax reporting purposes. c. Discuss the ways and…arrow_forwardPatel Bros. Grocery store recently completed their 2020 Inventory and realized that a truckload of merchandise that is valued at $18,000 was included in inventory, however this merchandise had yet to be received and was sold FOB destination. (a) What is the effect on 2020 Financial Statements including amounts (b) the effects on the 2021 financial statements including amounts; assume no errors are made in 2021.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education