Concept explainers

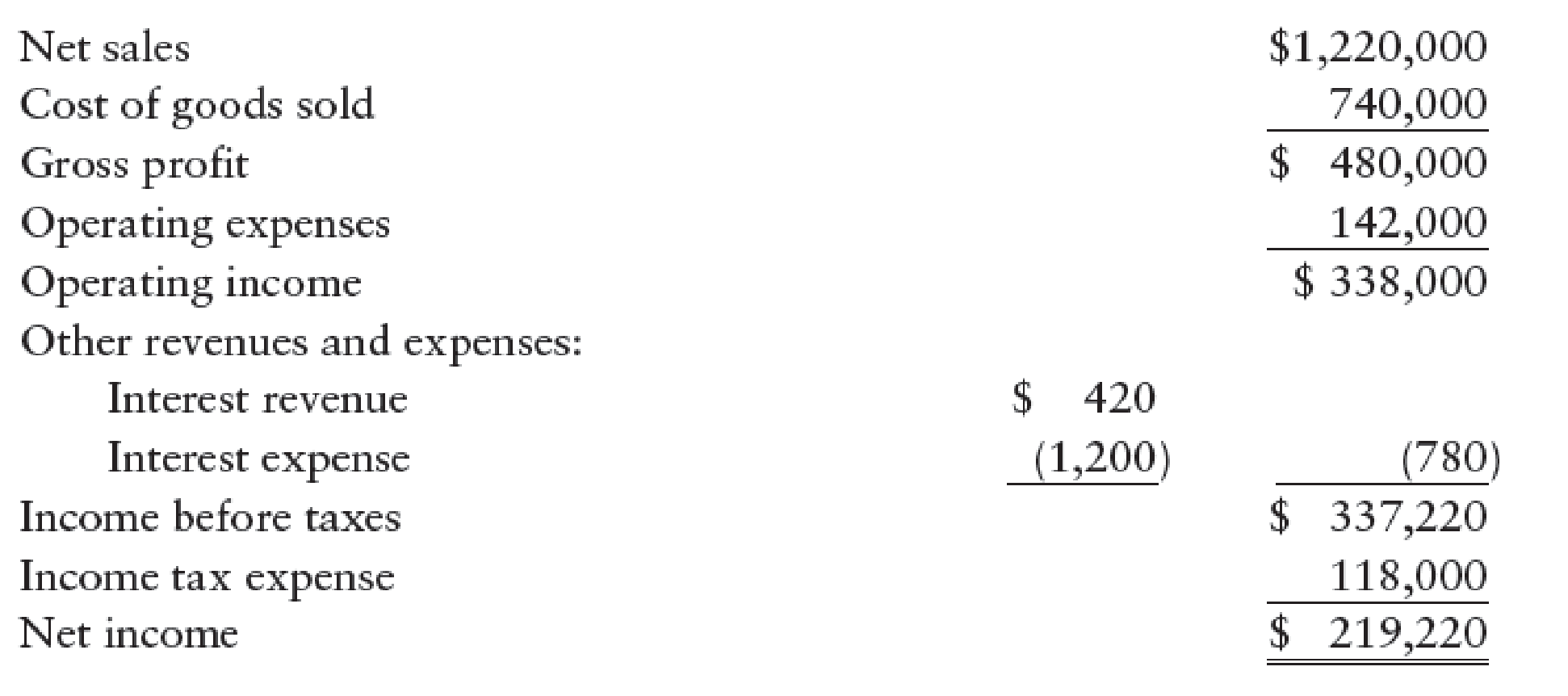

COMPUTE CASH PROVIDED BY OPERATING ACTIVITIES Horn Company’s condensed income statement for the year ended December 31, 20-2, was as follows:

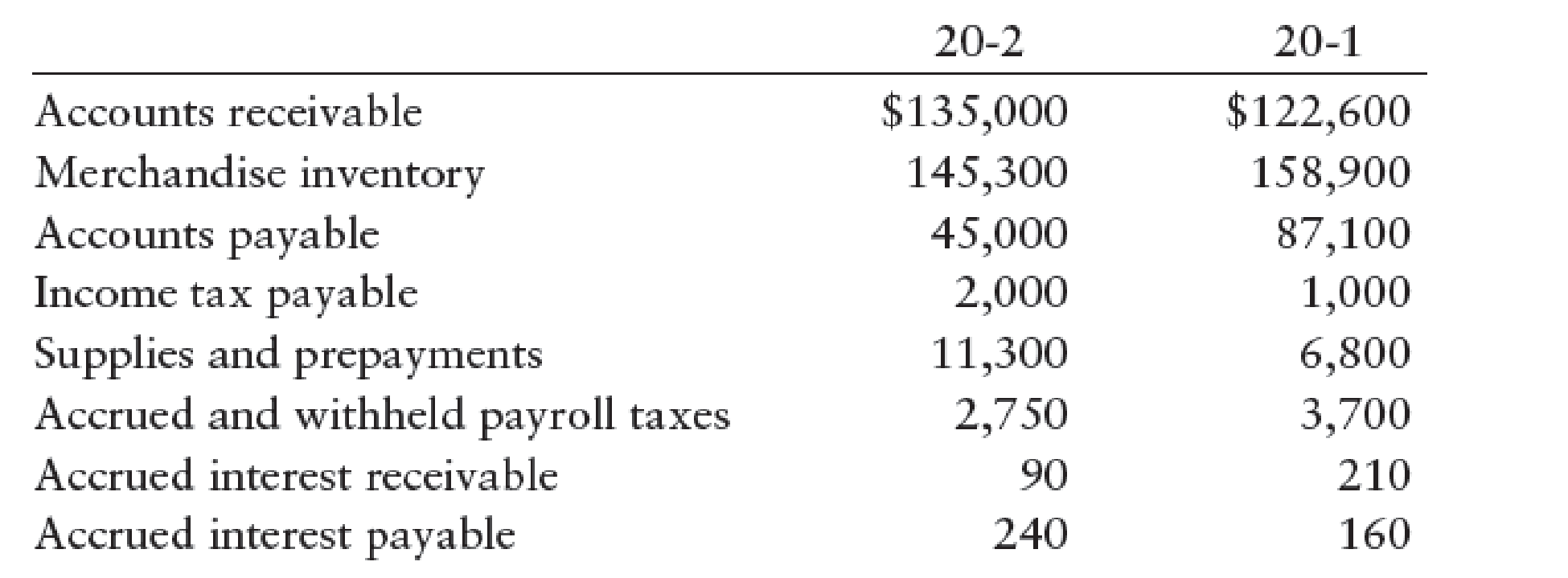

Additional information obtained from Horn’s comparative

REQUIRED

Prepare a partial statement of

SCHEDULE FOR CALCULATION OF CASH GENERATED FROM OPERATING ACTIVITIES Using the information provided in Problem 23-9A for Horn Company, prepare the following:

1. A schedule for the calculation of cash generated from operating activities for Horn Company for the year ended December 31, 20-2.

2. A partial statement of cash flows for Horn Company reporting cash from operating activities under the direct method for the year ended December 31, 20-2.

Want to see the full answer?

Check out a sample textbook solution

Chapter 23A Solutions

College Accounting, Chapters 1-27

- Can you please answer this financial accounting question?arrow_forwardWhy does stakeholder diversity influence disclosure choices? [Financial Accounting MCQ] (a) Diversity creates problems (b) Standard reports satisfy everyone (c) Users want identical information (d) Different information needs require varied reporting approachesarrow_forwardhello Sir Please Need Answer of this General Accounting Questionarrow_forward

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning