FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

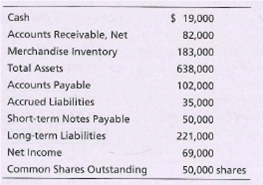

Determining the effects of business transactions on selected ratios

Financial statement data of Modern Traveler’s Magazine include the following items:

Requirements

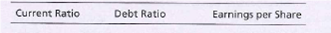

- Compute Modern Traveler’s

current ratio , debt ratio, and earnings per share. Round all ratios to two decimal places, and use the following format for your answer: - Compute the three ratios after evaluating the effect of each transaction that follows. Consider each transaction separately.

a. Purchased merchandise inventory of $42,000 on account.

b. Borrowed $121,000 on a long-term note payable.

c. Issued 5,000 shares of common stock, receiving cash of $103,000.

d. Received cash on account, $5,000.

Transcribed Image Text:Cash

$ 19,000

Accounts Receivable, Net

82,000

Merchandise Inventory

183,000

Total Assets

638,000

Accounts Payable

102,000

Accrued Liabilities

35,000

Short-term Notes Payable

Long-term Liabilities

50,000

221,000

Net Income

69,000

Common Shares Outstanding

50,000 shares

Transcribed Image Text:Current Ratio

Debt Ratio

Earnings per Share

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- How do I calculae the times interest earned ratio?arrow_forwardThe following condensed information is reported by Sporting Collectibles. Income Statement Information Sales revenue Cost of goods sold Net income Balance Sheet Information Current assets Long-term assets Total assets Current liabilities Long-term liabilities Common stock Retained earnings Total liabilities and stockholders' equity Profitability Ratios a. Gross profit ratio b. Return on assets c. Profit margin d. Asset turnover e. Return on equity % % % The amount of dividends paid Required: 1. Calculate the following profitability ratios for 2021: (Round your answers to 1 decimal place.) times % 2021 $10,440,000 6,827,760 360,000 2. Determine the amount of dividends paid to shareholders in 2021. 2020 $8,400,000 5,900,000 248,000 $ 1,600,000 2,200,000 $ 3,800,000 $ 1,200,000 1,500,000 800,000 $ 900,000 1,500,000 800,000 300,000 200,000 $ 3,800,000 $3,400,000 $1,500,000 1,900,000 $3,400,000arrow_forwardRequired: (a) You are required to calculate the following ratios:(i) Gross profit margin(ii) Operating profit margin(iii) Expenses to sales(iv) Return on Capital Employed(v) Asset turnover(vi) Non-current asset turnover(vii) Current Ratio(viii) Quick Ratio(ix) Inventory days(x) Receivables days(xi) Payable days(xii) Interest cover (b) In light of your calculations comment on the performance of the company over thelast two years.arrow_forward

- Part A. The following information is available for Entity A: Sales revenue Sales returns and allowances Sales discounts Cost of goods sold Operating expenses Interest expense Gain on sale of land Interest revenue $840,300 10,000 7,800 475,000 187,200 11,000 129,300 3,500 Instructions 1. Use the above information to prepare a multiple-step income statement for the year ended December 31, 2024. Please look at Illus. 5.12 in the text for an example. The income tax rate is 23%. Check figures: Income from operations is $160,300. Net income is $217,217. 2. Compute the profit margin and the gross profit rate. Show and label calculations. 3. Suggest at least three ways these measures might be materially improved and net income increased. Be sure to consider the relationship between net sales, cost-of- goods-sold and gross profit. 4. Last year, the profit margin was 15%. Is the increase in the profit margin this year sustainable, i.e. likely to continue? (Hint: consider what item was largely…arrow_forwardThe 2021 income statement of Adrian Express reports sales of $19,310,000, cost of goods sold of $12,250,000, and net income of $1,700,000. Balance sheet information is provided in the following table. ADRIAN EXPRESS Balance Sheets December 31, 2021 and 2020 2021 2020 Assets Current assets: Cash Accounts receivable Inventory Long-term assets $ 700,000 1,600,000 2,000,000 4,900,000 $9,200,000 $860,000 1,100,000 1,500,000 4,340,000 Total assets $7,800,000 Liabilities and Stockholders' Equity Current liabilities Long-term liabilities Common stock Retained earnings $1,920,000 $1,760,000 2,500,000 1,900,000 1,640,000 $7,800,000 2,400,000 1,900,000 2,980,000 Total liabilities and stockholders' equity $9,200,000 Industry averages for the following profitability ratios are as follows: Gross profit ratio Return on assets Profit margin 45% 25% 15% 2.5times 35% Asset turnover Return on equityarrow_forwardRefer to the following selected financial information from Texas Electronics. Compute the company's accounts receivable turnover for Year 2. Cash Short-term investments Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets Accounts payable Net sales Cost of goods sold Year 2 Year 1 $ 38,300 $ 33,050 98,000 64,000 89,500 83,500 125,000 129,000 12,900 10,500 392,000 342,000 109,400 111,800 715,000 680,000 394,000 379,000arrow_forward

- The following items are reported on a company's balance sheet: Cash $283,200 Marketable securities 83,400 Accounts receivable 251,600 Inventory 185,700 Accounts payable 315,200 Determine the (a) current ratio, and (b) quick ratio. Round your answers to one decimal place. a. Current ratio b. Quick ratioarrow_forwardWinterwear Clothiers reported the following selected items at April 30, 2025 (last year's-2024-amounts also given as needed): View the financial data. Compute Winterwear Clothiers' (a) acid-test ratio, (b) accounts receivable turnover ratio, and (c) days' sales in receivables for the year ending April 30, 2025. Evaluate each ratio value as strong or weak. Winterwear Clothiers sells on terms of net 30. (Round days' sales in receivables to a whole number.) (Ignore leap-years, using a 365-day where needed.) (a) Compute Winterwear Clothiers' acid-test ratio. (Round your final answer to two decimal places. Abbreviation used: Avg. = Average; Invest. = Investment; Liab. = Liabilities; Merch. = Merchandise; Receiv. = Receivable; Rev. = Revenue.) + + + + Financial Data = Acid-test ratio = Accounts Payable 320,000 Accounts Receivable, net: Cash 260,000 April 30, 2025 $ 270,000 Merchandise Inventory: April 30, 2024 170,000 April 30, 2025 290,000 Cost of Goods Sold 1,150,000 April 30, 2024 200,000…arrow_forwardThe following information pertains to Diane Company. Assume that all balance sheet amounts represent both average and ending balance figures and that all sales were on credit. Use this information to answer the question that follow. Assets Cash and short-term investments $39,569 Accounts receivable (net) 29,417 Merchandise inventory 30,907 Property, plant, and equipment 219,211 Total assets $319,104 Liabilities and Stockholders' Equity Current liabilities $66,051 Long-term liabilities 93,607 Stockholders' equity—common 159,446 Total liabilities and stockholders' equity $319,104 Income Statement Sales $93,952 Cost of merchandise sold (37,581) Gross profit $56,371 Operating expenses (26,268) Interest expense (4,698) Net income $25,405 Number of shares of common stock outstanding 6,014 Market price per share of common stock $31 Total dividends paid $8,800 Net cash flows from operating activities…arrow_forward

- 5. Know the calculations for all of the following ratios (see ratio sheet that can be used on the exam) and know the category (listed in Question 4) they fall in: Formula Category/Use Ratio Working Capital Current Assets - Current Liabilities Net credit sales/Average Accounts Receivable Turnover accounts receivable Asset Turnover Net sales/Average total assets Net income/Average total stockholders' equity Total liabilities/Total stockholders equity Net income/Net sales Return on Equity (ROE) Debt to equity Return on Sales (ROS) (also known as Net Margin Current Assets/Current Liabilities Cost of goods sold/Average inventory Quick assets/Current Current Ratio Inventory Turnover Quick Ratio liabilities Dividend Yield Dividends per share/Market price per share Net earnings available for common stock/Number of outstanding common shares Net income/Average total Earnings per Share (EPS) Return on Investment (ROI) assets Price Earnings Ratio (P/E) Market price per share/Earnings per share…arrow_forwardEvaluating Financials and Ratios From Chapter 17 1. From the data given in the following table, please construct as many of the financial ratios discussed in this chapter as you can and then indicate what dimension of a business firm's performance each ratio represents. Cash account Accounts receivable Inventories Fixed assets Miscellaneous assets Cost of goods sold Wages and salaries Interest expense Overhead expenses Depreciation expenses Selling, administrative, and other expenses 108 Before-tax net income 117* Taxes owed 325* After-tax net income 15 160 725 *Annual principal payments on bonds and notes payable total $55. The firm's marginal tax rate is 35 percent. Short-term debt: Accounts payable Notes payable Long-term debt (bonds) Equity capital A. Business Assets B. C. D. The financial ratios that could be computed given the data in this problem fall under the following categories: E. F. Liabilities and Equity G. Annual Revenue and Expense Items $60 Net sales 155 128 286 96 725…arrow_forwardComparative Income Statement Use the following comparative income statement form to enter amounts you identify from the computations on the Liquidity and Solvency Measures part and on the Profitability Measures part. Compute any missing amounts and complete the horizontal analysis columns. Enter percentages as decimal amounts, rounded to one decimal place. When rounding, look only at the figure to the right of one decimal place. If 5, round up. For example, for 32.048% enter 32.0%. For 32.058% enter 32.1%. Sales Cost of goods sold Gross profit Selling expenses Administrative expenses Total operating expenses Operating income Other expense (interest) Income before income tax expense Income tax expense Net income Comparative Income Statement For the Years Ended December 31, 20Y6 and 20Y5 $ 20Y6 8,250,000 X (1,242,000) 20Y5 $7,287,000 (3,444,000) $3,843,000 $(1,457,600) (1,106,000) $(2,563,600) $1,279,400 (120,600) $1,158,800 (181,980) $976,820 $ $ $ Increase/(Decrease) Amount 823,000 X…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education