FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

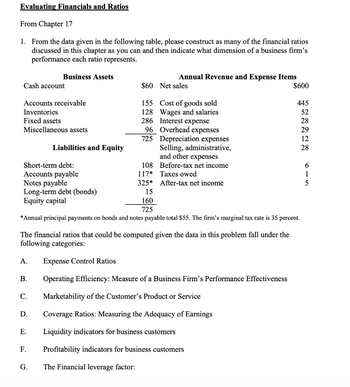

Transcribed Image Text:Evaluating Financials and Ratios

From Chapter 17

1. From the data given in the following table, please construct as many of the financial ratios

discussed in this chapter as you can and then indicate what dimension of a business firm's

performance each ratio represents.

Cash account

Accounts receivable

Inventories

Fixed assets

Miscellaneous assets

Cost of goods sold

Wages and salaries

Interest expense

Overhead expenses

Depreciation expenses

Selling, administrative,

and other expenses

108 Before-tax net income

117* Taxes owed

325*

After-tax net income

15

160

725

*Annual principal payments on bonds and notes payable total $55. The firm's marginal tax rate is 35 percent.

Short-term debt:

Accounts payable

Notes payable

Long-term debt (bonds)

Equity capital

A.

Business Assets

B.

C.

D.

The financial ratios that could be computed given the data in this problem fall under the

following categories:

E.

F.

Liabilities and Equity

G.

Annual Revenue and Expense Items

$60 Net sales

155

128

286

96

725

Expense Control Ratios

Operating Efficiency: Measure of a Business Firm's Performance Effectiveness

Marketability of the Customer's Product or Service

$600

Coverage Ratios: Measuring the Adequacy of Earnings

Liquidity indicators for business customers

Profitability indicators for business customers

The Financial leverage factor:

445

52

28

29

12

28

6

1

5

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- According to the following ratio of Toyota critically assess the business financial condition of Toyotaarrow_forwardThe following condensed information is reported by Sporting Collectibles. Income Statement Information Sales revenue Cost of goods sold Net income Balance Sheet Information Current assets Long-term assets Total assets Current liabilities Long-term liabilities Common stock Retained earnings Total liabilities and stockholders' equity Profitability Ratios a. Gross profit ratio b. Return on assets c. Profit margin d. Asset turnover e. Return on equity % % % The amount of dividends paid Required: 1. Calculate the following profitability ratios for 2021: (Round your answers to 1 decimal place.) times % 2021 $10,440,000 6,827,760 360,000 2. Determine the amount of dividends paid to shareholders in 2021. 2020 $8,400,000 5,900,000 248,000 $ 1,600,000 2,200,000 $ 3,800,000 $ 1,200,000 1,500,000 800,000 $ 900,000 1,500,000 800,000 300,000 200,000 $ 3,800,000 $3,400,000 $1,500,000 1,900,000 $3,400,000arrow_forwardSome recent financial statements for Smolira Golf, Incorporated, follow. Assets Current assets Cash Accounts receivable Inventory Total Fixed assets Net plant and equipment Total assets Sales Cost of goods sold Depreciation EBIT Interest paid Taxable income Taxes SMOLIRA GOLF, INCORPORATED 2022 Income Statement Net income Dividends Retained earnings 2021 Short-term solvency ratios a. Current ratio b. Quick ratio c. Cash ratio Asset utilization ratios d. Total asset turnover e. Inventory turnover f. Receivables turnover Long-term solvency ratios g. Total debt ratio h. Debt-equity ratio i. Equity multiplier j. Times interest earned ratio k. Cash coverage ratio Profitability ratios I. Profit margin m. Return on assets n. Return on equity $3,061 4,742 12,578 $ 20,381 SMOLIRA GOLF, INCORPORATED Balance Sheets as of December 31, 2021 and 2022 2022 Liabilities and Owners' Equity Current liabilities Accounts payable Notes payable Other $ 52,746 $ 73,127 2021 $ 188,370 126, 703 5,283 $ 56,384…arrow_forward

- What's the total asset turnover ratio of this company? Assets: Cash and marketable securities Accounts receivable Inventories Prepaid expenses Total current assets Fixed assets Less: accum. depr. Net fixed assets Total assets Liabilities: Accounts payable Notes payable Accrued taxes Total current liabilities Long-term debt Owner's equity (1 million shares of common stock outstanding) Total liabilities and owner's equity Net sales (all credit) Less: Cost of goods sold Selling and administrative expense Depreciation expense Interest expense Earnings before taxes Income taxes Net income 1.41 2.33 O 4.45 1.11 8,000,000 (2,075,000) $600,000 900,000 1,500,000 75,000 $3,075,000 $5,925.000 $9,000,000 $800,000 700,000 50,000 $1,550,000 2,500,000 4,950,000 $9,000,000 $10,000,000 (3,000,000) (2,000,000) (250,000) (200,000) 4,550,000 (1,820,000) $2,730,000arrow_forwardSome recent financial statements for Smolira Golf Corporation follow. Assets Current assets Cash Accounts receivable Inventory Total Total assets Fixed assets Net plant and equipment $336,695 Sales Cost of goods sold Depreciation Taxable income Taxes (22%) Net income SMOLIRA GOLF CORPORATION 2021 Income Statement Earnings before interest and taxes Interest paid Dividends Retained earnings a. Current ratio b. Quick ratio c. Cash ratio Short-term solvency ratios: Asset utilization ratios: d. Total asset turnover e. Inventory tumover 1. Receivables turnover 2020 $23,066 $25,300 13,648 16,400 27,152 28,300 $63,866 $70,000 g. Total debt ratio h. Debt-equity ratio I. Equity multiplier Long-term solvency ratios: Times Interest emned K Cash coverage ratio Profitability ratios: SMOLIRA GOLF CORPORATION 2020 and 2021 Balance Sheets 2021 $ 400,561 $ 434,000 1. Profit margin m. Return on assels n. Return on equity $ 364,000 $ 22,000 19,891 Find the following financial ratios for Smolira Golf…arrow_forward36 Ratio Analysis - Explain how the following ratios are calculated and what the ratio indicates. Include how these ratios provide useful information related to accounting decision making topics such as efficiency (collecting amounts owed to the firm, using the assets well, getting items to market, etc.), liquidity (ability to pay current debts), solvency (ability to pay long term or all debts) Asset Turnover Return on Assets Current Ratio Accounts Receivable Turnover Average Collection Period Debt Ratio Days’ sales in Inventory Gross Profit Percentage Return on Sales Ratioarrow_forward

- We are given the following information for Pettit Corporation. Sales (credit) Cash Inventory Current liabilities Asset turnover Current ratio Debt-to-assets ratio Receivables turnover $2,068,000 150,000 923,000 763,000 a. Accounts receivable b. Marketable securities c. Capital assets. d. Long-term debt $ Current assets are composed of cash, marketable securities, accounts receivable, and inventory. Calculate the following balance sheet items: LA LA LA $ $ 1.00 times 2.60 times $ 40 % 4 times 517000arrow_forwardAnswer Using the Pictures 4) Evaluate the information from (i) two liquidity ratios (ii) four debt management ratios (iii) four profitability ratiosarrow_forwardplease help me understand this :) please thank you :)arrow_forward

- Please type the answer with good explanationarrow_forwardThe following information comes from the accounting records of Wildhorse Ltd.: Statement of Financial Position Assets Cash Accounts receivable Inventory Capital assets (net) Other assets Liabilities and shareholders' equity Accounts payable Long-term debt Common shares Retained earnings Statement of Income Sales Cost of goods sold Other expenses Income tax Net income (a1) Sales Cost of goods sold Gross margin Other expenses Income taxes Net income Current ratio Quick ratio A/R turnover Average collection period Inventory turnover 2022 Days to sell inventory $34,900 101,700 164,000 639,000 345,000 $149,000 300,000 779,000 757,000 402,000 $1,284,600 $1,341,000 $1,556,000 56,600 254,160 2022 21,180 17,000 $4,180 100 % 74 % $1,284,600 $1,341,000 26 % $1,059,000 $1.199,000 783,660 24 % 1.6 % 0.39 % 2022 2023 $32,000 3.2 119,000 9.5 195,000 Based on the above information, analyze the changes in the company's profitability and liquidity, in addition to the management of accounts receivable…arrow_forwardPaddy's Pub reported the following year-end data: Income before interest expense and income tax expense Cost of goods sold Interest expense Total assets Total liabilities Total equity Compute the (a) debt-to-equity ratio and (b) times Interest earned. Complete this question by entering your answers in the tabs below. Debt To Equity Times Interest Ratio Earned Compute the debt-to-equity ratio. Numerator: 1 1 Debt-To-Equity Ratio Denominator: IIarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education