FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

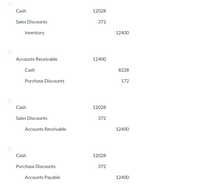

Tamarisk, Inc. receives a payment on account from Pronghorn Industries. Based on the original sale of $12400 using the periodic inventory approach, Tamarisk, Inc. honors the 3% cash discount and records the payment. Which of the following is the correct entry for Tamarisk, Inc. to record?

Transcribed Image Text:Cash

12028

Sales Discounts

372

Inventory

12400

Accounts Receivable

12400

Cash

8228

Purchase Discounts

172

Cash

12028

Sales Discounts

372

Accounts Receivable

12400

Cash

12028

Purchase Discounts

372

Accounts Payable

12400

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Shankar Company uses a perpetual system to record inventory transactions. The company purchases inventory on account on February 2 for $48,000, with terms 4/10, n/30. On February 10, the company pays on account for the inventory. Required: (a) Determine the financial statement effects for the inventory purchase on account on February 2. (b) Determine the financial statement effects for the payment on February 10. Complete this question by entering your answers in the tabs below. Required a Required b Determine the financial statement effects for the inventory purchase on account on February 2. (Amounts to be deducted should minus sign.) Revenues Income Statement Expenses Net Incomearrow_forwardplease enter the journal entriesarrow_forwardAn item was shipped from a supplier under FOB shipping point. The invoice in the amount of $2,000 included payment terms of 2/10, n/30. When the invoice was paid, a purchase discount in the amount of $40 was taken. Other details relating to the purchase of this item included the following: shipping charges of $300, storage fees of $50, and insurance premium of $100. The cost of this inventory item is $1,960 $2,410 $2,401 $2,404arrow_forward

- Want answerarrow_forwardBramble Corp. uses the perpetual inventory and the gross method. On March 1, it purchased $ 54000 of inventory, terms 2/10, n/30. On March 3, Bramble returned goods that cost $ 5400. On March 9, Bramble paid the supplier. On March 9, Bramble should credit a) purchase discounts for $ 1080. b) purchase discounts for $ 972. c) inventory for $ 972. d) inventory for $ 1080.arrow_forwardYou are accountant for New Horizon Merchandising Company. New Horizon Merchandising Company buys and sells a product called Zoom. Company uses Perpetual Inventory System with LIFO method for inventory valuation. New Horizon uses Net Method for accounting for its purchases and sales. On January 1, 2019, New Horizon’s merchandise inventory on hand consisted of the following: Zoom: Quantity Cost per Unit 1st Purchase 200 $4 2nd Purchase 110 $5 45. New Horizon Company purchased 300 units of Zoom at $5.50 each plus $99 sales taxes. Terms were 2/10, n/30, FOB Shipping Point.Shipping cost was $51.Provide the necessary journal entry to record the transaction. Debit Credit 46. Assume New Horizon paid for the above purchase within discount period. Provide the necessary journal entry to record the transaction. Debit Credit 47. Assume New Horizon paid for the above purchase after the…arrow_forward

- During 2021, your company completed the following summarized transactions. Prepare journal entries for the following events. 1. Your company sold $60,000 of merchandise to various customers for $150,000 on account, terms 2/10, n/30. Assume your company uses a PERIODIC inventory system and the GROSS method of discounts. 2. Accounts from transaction “#1." above for which the original amount was $70,000 were collected within the 10 day period. 3. Accounts from transaction "#1." above for which the original amount was $40,000 were collected 27 days after the sale. 4. One customer from transaction “#1" above returned a product which cost $410 and had been sold for $1,000. This customer had NOT paid his account so you credited his account. On December 1, 2021, you loaned $80,000 to another company and received a nine- month, 6% note. 5. 6. Your company wrote off $2,100 of past due accounts receivable. 7. At the end of the year, your company estimated bad debts would be 1% of GROSS sales for…arrow_forwardThe following are the transactions of CARI, INC during 2022: The company follows a periodic inventory system 04.01.2022 Purchases merchandise, in cash SR 100,000.00 01.03.2022 Sales merchandise, on credit SR 180,000.00 06.03.2022 Customer takes discount and pays SR 162,000.00 15.10.2022 Pays downtow's shop rent SR 4,000.00 30.12.2022 Purchases a machinery, in cash SR 35,000.00 31.12.2022 Closes beginning inventory SR 30,000.00 31.12.2022 Records the ending inventory SR 12,000.00 31.12.2022 Revenues & expenses balanced off TBD Record the transactions, prepare the trial balance and show the following financial statements: → Balance sheet (Statement of Financial Position) as of 31.12.2022 → Profit & Loss account (Income Statement) for 2022arrow_forwardHI, may i know why didn't record cost , $5000?arrow_forward

- Morton Company uses a perpetual inventory system. On December 1, 2019, the company purchased inventory on account for $9,000. The credit terms are 2/10, n/30. If Morton pays the bill on Decermber 29, 2019, what amount of discount will be taken?arrow_forwardNeed all answer'sarrow_forwardTravis Company purchased merchandise on account from a supplier for $12,300, terms 2/10, net 30. Travis Company paid for the merchandise within the discount period. Under a perpetual inventory system, record the journal entries required for the above transactions. If an amount box does not require an entry, leave it blank. a. b.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education