FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

Whispering industries purchased $8,100 of merchandise on february 1, 2025, subject to a trade discount of 10% and with credit terms of 3/15, n/60. it returned $2,100 ( gross price before trade or cash discount) on february 4. the invoice was paid on february 13

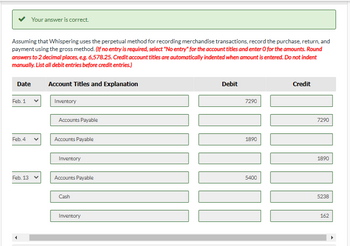

Transcribed Image Text:Assuming that Whispering uses the perpetual method for recording merchandise transactions, record the purchase, return, and

payment using the gross method. (If no entry is required, select "No entry" for the account titles and enter O for the amounts. Round

answers to 2 decimal places, e.g. 6,578.25. Credit account titles are automatically indented when amount is entered. Do not indent

manually. List all debit entries before credit entries.)

Your answer is correct.

Date

Feb. 1

Feb. 4

Feb. 13 ✓

Account Titles and Explanation

Inventory

Accounts Payable

Accounts Payable

Inventory

Accounts Payable

Cash

Inventory

Debit

7290

1890

5400

Credit

7290

11

1890

5238

162

Transcribed Image Text:(b)

Assuming that Whispering uses the periodic method for recording merchandise transactions, record the purchase, return, and

payment using the gross method. (If no entry is required, select "No entry" for the account titles and enter O for the amounts. Round

answers to 2 decimal places, e.g. 6,578.25. Credit account titles are automatically indented when amount is entered. Do not indent

manually. List all debit entries before credit entries.)

Date

Account Titles and Explanation

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Restin Co. uses the gross method to record sales made on credit. On June 1, 2020, it made sales of $50,000 with terms 3/15, n/45. On June 12, 2020, Restin received full payment for the June 1 sale. Prepare the required journal entries for Restin Co.arrow_forwardTauros Company’s usual sales terms are net 60 days, FOB Shipping point. Sales, net of returns and allowances, totaled P2,300,000 for the year ended December 31, 2022, before year-end adjustments. Additional data are as follows: · On December 27, 2022, Taurus authorized a customer to return, for full credit, goods shipped and billed at P50,000 on December 15, 2022. The returned goods were received by Taurus on January 4, 2023, and a P50,000 credit memo was issued and recorded on the same date. · Goods with an invoice amount of P80,000 were billed and recorded on January 3, 2023. The goods were shipped on December 30, 2022. · Goods with an invoice amount of P100,000 were billed and recorded on December 30, 2022. The goods were shipped on January 3, 2023. The adjusted net sales for 2022 should be? a. 2,300,000b. 2,250,000c. 2,230,000d. 2,070,000arrow_forwardA company makes a credit sale of $1,000 on June 13 according to the payment terms 5/10, n/30. On June 16, there is a return of $100. The buyer makes the payment for the remaining amount by utilizing the discount. What should be the amount to be paid? O A) $855 B) $900 C) $950 D) $810 E) $600arrow_forward

- Merchandise costing $714 is sold for $1,234 on terms 2/10, n/30. If the buyer pays within the discount period, When collection of cash within the 10 days, the debit to Cash will be $arrow_forwardOn June 30, 2024, the Esquire Company sold some merchandise to a customer for $68,000. In payment, Esquire agreed to accept a 9% note requiring the payment of interest and principal on March 31, 2025. The 9% rate is appropriate in this situation. Required: Prepare journal entries to record the sale of merchandise (omit any entry that might be required for the cost of the goods sold), the December 31, 2024 interest accrual, and the March 31, 2025 collection. If the December 31 adjusting entry for the interest accrual is not prepared, by how much will income before income taxes be over- or understated in 2024 and 2025?arrow_forwardHahaarrow_forward

- The invoice price of goods purchased is $10,000 with purchase terms of 4/7, n/30 and FOB shipping point. The invoice is paid within the week of receipt and shipping costs are $200. By what amount should the purchaser's Inventory be increased?arrow_forward48. An Entity sold 10 units of goods with a unit list price of P2,000 on Jan. 1, 2021. The Entity offered a trade discount of 5% and a cash discount of 10%, and that the cash discount period is 10 days, and the credit period is 30 days. If the customer settles the debt on Jan. 28,2021, what is the actual amount he needs to pay? O A. P17,100 О в. B. P1,710 C. P19,000 O D. P1,900arrow_forwardRiverbed Company sells goods to Danone Inc. by accepting a note receivable on January 2, 2020. The goods have a sales price of $630,700 (cost of $500,000). The terms are net 30. If Danone pays within 5 days, however, it receives a cash discount of $10,700. Past history indicates that the cash discount will be taken. On January 28, 2020, Danone makes payment to Riverbed for the full sales price. (a)Prepare the journal entry(ies) to record the sale and related cost of goods sold for Riverbed Company on January 2, 2020, and the payment on January 28, 2020. Assume that Riverbed Company records the January 2, 2020, transaction using the net method. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter 0 for the amounts.) Date Account Titles and Explanation Debit Credit Choose date Jan 2 or Jan 28…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education