FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

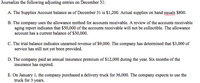

Transcribed Image Text:Journalize the following adjusting entries on December 31:

A. The Supplies Account balance as of December 31 is $1,200. Actual supplies on hand equals $800.

B. The company uses the allowance method for accounts receivable. A review of the accounts receivable

aging report indicates that $50,000 of the accounts receivable will not be collectible. The allowance

account has a current balance of $30,000.

C. The trial balance indicates unearned revenue of $9,000. The company has determined that $3,000 of

service has still not yet been provided.

D. The company paid an annual insurance premium of $12,000 during the year. Six months of the

insurance has expired.

E. On January 1, the company purchased a delivery truck for 36,000. The company expects to use the

truck for 3 years.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- answer in text form please (without image), Note: .Every entry should have narration pleasearrow_forwardAt December 31, Gill Co. reported accounts receivable of $294,000 and an allowance for uncollectible accounts of $1,050 (credit) before any adjustments. An analysis of accounts receivable suggests that the allowance for uncollectible accounts should be 4% of accounts receivable. The amount of the adjustment for uncollectible accounts would be: Multiple Choice $11,760. $10,710. $9,220. $1,050.arrow_forwardAt the beginning of the year, the balance in Allowance for Doubtful Accounts is a credit of $766. During the year, previously written off accounts of $138 are reinstated and accounts totaling $741 are written off as uncollectible. The end-of-year balance (before adjustment) in Allowance for Doubtful Accounts should be a.$741 b.$766 c.$138 d.$163arrow_forward

- company’s accounting records provide the following information concerning certain account balances and changes in the account balances during the current year. Transaction information is missing from each of the below. Prepare the journal entry to record the information for each account. b. Allowance for Doubtful Accounts: Jan. 1 balance, $1,500; Dec. 31 balance, $2,200; adjusting entry increasing allowance on Dec. 31, $4,800. Record write-off uncollectible accounts receivable. c. Inventory of office supplies: Jan. 1 balance, $1,500; Dec. 31 balance, $1,350; office supplies expense for the year, $9,500. Record purchase of office supplies. d. Equipment: Jan. 1 balance, $20,500; Dec. 31 balance, $18,000; equipment costing $8,000 was sold during the year. Record purchase of equipment. e. Accounts Payable: Jan. 1 balance $9,000; Dec. 31 balance, $11,500; purchases on - account for the year, $48,000. Record cash payments. Please dont provide solution in image thnxarrow_forwardnalysis of Receivables Method At the end of the current year, Accounts Receivable has a balance of $565,000, Allowance for Doubtful Accounts has a credit balance of $5,000, and sales for the year total $2,540,000. Using the aging method, the balance of Allowance for Doubtful Accounts is estimated as $26,000. a. Determine the amount of the adjusting entry for uncollectible accounts.$fill in the blank 1 b. Determine the adjusted balances of Accounts Receivable, Allowance for Doubtful Accounts, and Bad Debt Expense. Accounts Receivable $fill in the blank 2 Allowance for Doubtful Accounts $fill in the blank 3 Bad Debt Expense $fill in the blank 4 c. Determine the net realizable value of accounts receivable.$fill in the blank 5arrow_forwardAnalysis of Receivables Method At the end of the current year, Accounts Receivable has a balance of $440,000, Allowance for Doubtful Accounts has a debit balance of $4,000, and sales for the year total $1,980,000. Using the aging method, the balance of Allowance for Doubtful Accounts is estimated as $18,400. a. Determine the amount of the adjusting entry for uncollectible accounts.$fill in the blank 1 b. Determine the adjusted balances of Accounts Receivable, Allowance for Doubtful Accounts, and Bad Debt Expense. Accounts Receivable $fill in the blank 2 Allowance for Doubtful Accounts $fill in the blank 3 Bad Debt Expense $fill in the blank 4 c. Determine the net realizable value of accounts receivable.$fill in the blank 5 Answer with all workarrow_forward

- Winfrey Designs had an unadjusted credit balance in its Allowance for Doubtful Accounts at December 31, 2023, of $2,200 Required: a. Prepare the adjusting entry assuming that Winfrey estimates uncollectible accounts based on an aging analysis as follows. December 31, 2023 Accounts Receivable $148,000 43,000 10,000 2,400 View transaction list Journal entry worksheet < 1 Age of Accounts Receivable Not due (under 30 days) 1 to 30 days past due 31 to 60 days past due Over 60 days past due Record the estimate for uncollectible accounts. Note: Enter debits before credits. Date December 31, 3332 General Journal Expected Percentage Debit Uncollectible 1% 4% 10% 60% Credit ☆arrow_forwardAt December 31, Gill Co. reported accounts receivable of $236,000 and an allowance for uncollectible accounts of $1,450 (credit) before any adjustments. An analysis of accounts receivable suggests that the allowance for uncollectible accounts should be 2% of accounts receivable. The amount of the adjustment for uncollectible accounts would be: Multiple Choice $1,450 $4.980 $3,270. $4,720arrow_forwardAt the end of the first year of operations mayberry advertising had account receivable of $21100. Management of the company estimates that 8% of the accounts will not be collected What adjustment would mayberry advertising record to establish allowance for accounts? Record the adjusting for allowance for uncollectibl accountsarrow_forward

- At December 31, Gill Co. reported accounts receivable of $281,000 and an allowance for uncollectible accounts of $1,600 (credit) before any adjustments. An analysis of accounts receivable suggests that the allowance for uncollectible accounts should be 3% of accounts receivable. The amount of the adjustment for uncollectible accounts would be: Multiple Choice $8,340. $1,600. $8,430. $6,830.arrow_forwardQuestion 5 of 9 Current Attempt in Progress Journalize the following independent situations. (a) > The ledger of Blossom Company at the end of the current year shows Accounts Receivable $138,000, Credit Sales $841,000, and Sales Returns and Allowances $26,000. Your answer is correct. Date Dec. 15 If Blossom uses the direct write-off method to account for uncollectible accounts, journalize the entry at December 15, if Blossom determines that L. Dole's $2,100 balance is uncollectible. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation Bad Debt Expense Accounts Receivable 1 Debit 2100 !!! Credit 2100 :arrow_forwardHi,I am having a terrible time trying to understand when the balance in the allowance for doubtful account is involved in the final answer, and when it is not. Will you please explain why the answers are what they are in the attachment?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education