FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

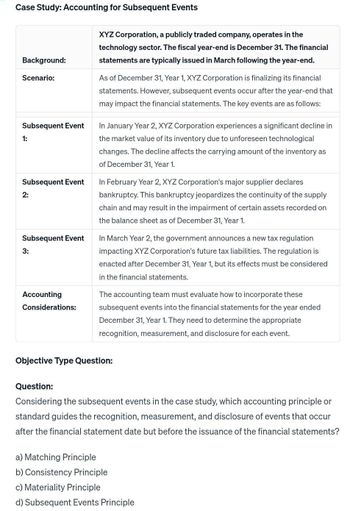

Transcribed Image Text:Case Study: Accounting for Subsequent Events

Background:

Scenario:

Subsequent Event

1:

Subsequent Event

2:

Subsequent Event

3:

Accounting

Considerations:

XYZ Corporation, a publicly traded company, operates in the

technology sector. The fiscal year-end is December 31. The financial

statements are typically issued in March following the year-end.

As of December 31, Year 1, XYZ Corporation is finalizing its financial

statements. However, subsequent events occur after the year-end that

may impact the financial statements. The key events are as follows:

In January Year 2, XYZ Corporation experiences a significant decline in

the market value of its inventory due to unforeseen technological

changes. The decline affects the carrying amount of the inventory as

of December 31, Year 1.

In February Year 2, XYZ Corporation's major supplier declares

bankruptcy. This bankruptcy jeopardizes the continuity of the supply

chain and may result in the impairment of certain assets recorded on

the balance sheet as of December 31, Year 1.

In March Year 2, the government announces a new tax regulation

impacting XYZ Corporation's future tax liabilities. The regulation is

enacted after December 31, Year 1, but its effects must be considered

in the financial statements.

The accounting team must evaluate how to incorporate these

subsequent events into the financial statements for the year ended

December 31, Year 1. They need to determine the appropriate

recognition, measurement, and disclosure for each event.

Objective Type Question:

Question:

Considering the subsequent events in the case study, which accounting principle or

standard guides the recognition, measurement, and disclosure of events that occur

after the financial statement date but before the issuance of the financial statements?

a) Matching Principle

b) Consistency Prin ple

c) Materiality Principle

d) Subsequent Events Principle

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Which of the following statements is correct? (1) In the United States, publicly traded companies can choose whether or not they wish to release periodic financial statements. (1I) Financial statements are used to show the daily activities a firm has undertaken in the previous financial year, and what activities are planned for the near future. Select one: a. I only O b. Il only O c. Both I and | d. Neither I nor l|arrow_forwardCompanies often voluntarily provide a pro forma earnings number when they announce annual or quarterly earnings. Required: 1. What is meant by the term pro forma earnings in this context? 2. How do pro forma earnings relate to the concept of earnings quality?arrow_forwardBased on the Republic Bank TT, an investment holding company, answer the following questions below using the following link below for help. Provide a detail explanation and examples to the answers. https://www.republictt.com/pdfs/annual- reports/RFHL-Annual-Report-2022.pdf 1. Assess the company's working capital position by analyzing its current assets and liabilities using common methods and measures( using the figures in the financial statements) 2. Evaluate the efficiency of the company's working capital management strategies, including inventory management, accounts receivable, and accounts payable( using figures from the financial statements) 3. Based on the assessment and evaluation above, provide ten recommendations for improving the company's working capital management practices.arrow_forward

- Read Financial Statement Analysis Case 3: Deere & Company and answer questions a) & b).arrow_forwardCurrent Attempt in Progress GAAP requires that all companies that issue an annual report should issue interim financial reports. O the three basic financial statements should be presented each time an interim period is reported upon. O the discrete view is the most appropriate approach to take in preparing interim financial reports. O the same accounting principles used for the annual report should be employed for interim reports.arrow_forwardQuestion: Prepare a statement of profit or loss and other comprehensive income for the year ended 31 December 2021 Below is the list of nominal ledger balances of Tonson Plc at 31 December 2021. Tonson’s financial year end is at 31 December. Nominal ledger closing balances at 31 December 2021 The following information is relevant. 1. Closing inventory at 31 December 2021 is £45,000 On further investigation of the suspense account in the trial balance above, it was discovered that: An expense of £8,250 for legal services had been posted to the suspense account and a cash receipt of £15,750 had been posted to the suspense account. This represented the disposal proceeds from selling equipment, which had been purchased on 1 March 2017 at a cost of £48,000. Tonson depreciates non-current assets as follows: buildings at 1 per cent on a straight-line basis plant and equipment at 10 per cent on a straight-line basis motor vehicles at 20 per cent on a reducing balance basis.…arrow_forward

- The annual reports of public corporations normally include a section on Management Discussion and Analysis (MD&A). Please examine the MD&A section of your selected company and let us know about any comments included regarding management's assessment of the company's liquidity and the availability of capital to the company. Also, please select one of the profitability ratios and calculate or find it for your company. Please let us know what this profitability ratio indicates about the financial health of your company.arrow_forwardYour firm has been engaged to examine the financial statements of Buffalo Corporation for the year 2020. The bookkeeper who maintains the financial records has prepared all the unaudited financial statements for the corporation since its organization on January 2, 2015. The client provides you with the information. Buffalo CorporationBalance SheetDecember 31, 2020 Assets Liabilities Current assets $1,899,000 Current liabilities $956,000 Other assets 5,138,660 Long-term liabilities 1,471,000 Stockholders’ equity 4,610,660 $7,037,660 $7,037,660 An analysis of current assets discloses the following. Cash (restricted in the amount of $298,000 for plant expansion) $582,000 Investments in land 187,000 Accounts receivable less allowance of $30,000 487,000 Inventories (LIFO flow assumption) 643,000 $1,899,000 Other assets include: Prepaid expenses $62,000 Plant…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education