Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

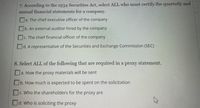

Transcribed Image Text:7. According to the 1934 Securities Act, select ALL who must certify the quarterly and

annual financial statements for a company.

a. The chief executive officer of the company

b. An external auditor hired by the company

c. The chief financial officer of the company

С.

d. A representative of the Securities and Exchange Commission (SEC)

8. Select ALL of the following that are required in a proxy statement.

a. How the proxy materials will be sent

b. How much is expected to be spent on the solicitation

c. Who the shareholders for the proxy are

Od. Who is soliciting the proxy

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- I need the answer as soon as possiblearrow_forwardThe accuracy and the presentation of the Public listed companies financial reports is the primary responsibility of: Select one:a. The auditorb. The management. c. Auditing and Assurance Standards Board. d. Australian Accounting standard boardarrow_forwardPick a publicly traded company and find the most current annual report SeC. How easy or hard was it to find? What are the main components of the annual report and/or form 10-K? Where are the audited financial statements? Were they easy to locate? Find the balance sheet: What items on the asset section of the balance sheet seem most relevant to the company? (For instance, inventory is far more relevant to Home Depot than it is to McDonalds or Facebook.) Why do you think those items are relevant? What additional information do you find in the footnotes? What information is not disclosed that you might want to know? What kinds of things is the company invested in? Are the statements consolidated? Is there goodwill recorded? What other intangible assets and investments do you find? Which of these seem relevant to the business operations? (For instance, Facebook has billions of dollars invested in marketable securities, but it’s business is social media.) What other items do you find on…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education