FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

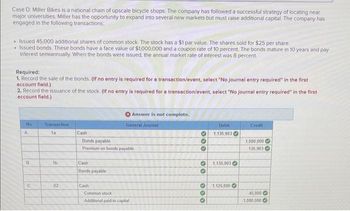

Transcribed Image Text:Case D: Miller Bikes is a national chain of upscale bicycle shops. The company has followed a successful strategy of locating near

major universities. Miller has the opportunity to expand into several new markets but must raise additional capital. The company has

engaged in the following transactions:

• Issued 45,000 additional shares of common stock. The stock has a $1 par value. The shares sold for $25 per share.

• Issued bonds. These bonds have a face value of $1,000,000 and a coupon rate of 10 percent. The bonds mature in 10 years and pay

interest semiannually. When the bonds were issued, the annual market rate of interest was 8 percent.

Required:

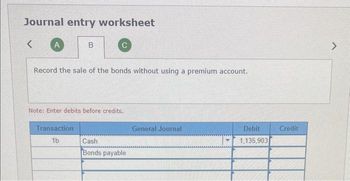

1. Record the sale of the bonds. (If no entry is required for a transaction/event, select "No journal entry required" in the first

account field.)

2. Record the issuance of the stock. (If no entry is required for a transaction/event, select "No journal entry required" in the first

account field.)

No

A

8

C

Transaction

1a

1b.

02

Cash

Bonds payable

Premium on bonds payable

Cash

Bonds payable

Answer is not complete.

General Journal

Cash

Common stock

Additional paid-in capital

000 00

000

Debit

1,135,903

1,135,903

1,125,000

Credit

1,000,000

135,903

45,000

1,000,000

Transcribed Image Text:Case D: Miller Bikes is a national chain of upscale bicycle shops. The company has followed a successful strategy of locating near

major universities. Miller has the opportunity to expand into several new markets but must raise additional capital. The company has

engaged in the following transactions:

• Issued 45,000 additional shares of common stock. The stock has a $1 par value. The shares sold for $25 per share.

• Issued bonds. These bonds have a face value of $1,000,000 and a coupon rate of 10 percent. The bonds mature in 10 years and pay

interest semiannually. When the bonds were issued, the annual market rate of interest was 8 percent.

Required:

1. Record the sale of the bonds. (If no entry is required for a transaction/event, select "No journal entry required" in the first

account field.)

2. Record the issuance of the stock. (If no entry is required for a transaction/event, select "No journal entry required" in the first

account field.)

No

A

8

C

Transaction

1a

1b.

02

Cash

Bonds payable

Premium on bonds payable

Cash

Bonds payable

Answer is not complete.

General Journal

Cash

Common stock

Additional paid-in capital

000 00

000

Debit

1,135,903

1,135,903

1,125,000

Credit

1,000,000

135,903

45,000

1,000,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- The Board of Directors of Challenger, Inc. has authorized 10,000 shares of stock at a price of $200/share. Currently, there are 7,000 shares issued with 6,000 outstanding. If Challenger, Inc wanted to raise more capital, how much capital could it raise by selling shares? $600,000 $800,000 $1,400,000 $2,000,000arrow_forwardHow do I do this?arrow_forwardMyers Drugs Inc. has 2 million shares of stock outstanding. Earnings after taxes are $9 million. Myers also has warrants outstanding that allow the holder to buy 100,000 shares of stock at $15 per share. The stock is currently selling for $50 per share. a. Compute basic earnings per share. (Do not round intermediate calculations and round your answer to 2 decimal places.) Basic earnings per share b. Compute diluted earnings per share considering the possible impact of the warrants. Assume the cash proceeds are used to repuchase shares. (Do not round intermediate calculations and round your answer to 2 decimal places.) Use the following formula: Earnings after taxes Shares outstanding + Assumed net increase in shares from the warrants Diluted earnings per sharearrow_forward

- Temptation Food Products Ltd is an established processed foods company specialising in latest packaged and branded foods. The following particulars about its capital structure and other parameters are given to you. 1138 6896 -131 Jasoor Paid up equity share capital(shares of Rs. 10 each) Free Reserves of the company 6% Convertible Preference Shares (Rs. 100 each convertible into two equity shares in the next 2 years) Total Long Term Debt in the company Retained Earnings (excluding current year) Current Year PAT Proposed dividend Trading P/E Amount Rs. 350,000,000 6,800,000,000 850,000,000 6,000,000,000 Rs. 780,000,000 Rs. 225,000,000 From the above given facts of the case, answer the following questions. 2096 431 52 boll What is the networth of the company considering preference capital and current year retained earnings as Ppart of it? Prasarrow_forwardCase D: Miller Bikes is a national chain of upscale bicycle shops. The company has followed a successful strategy of locating near major universities. Miller has the opportunity to expand into several new markets but must raise additional capital. The company has engaged in the following transactions: Issued 45, 600 additional shares of common stock. The stock has a $1 par value. The shares sold for $25 per share. Issued bonds. These bonds have a face value of $ 1,060,000 and a coupon rate of 10 percent. The bonds mature in 10 years and pay interest semiannually. When the bonds were issued, the annual market rate of interest was 8 percent. Required: Record the sale of the bonds. Record the issuance of the stockarrow_forwardAn online medical advice company just completed an IPO with an investment bank on a firm- commitment basis. The firm issued five million shares of common stock, and the underwriting fees were $2.20 per share. The offering price was $27.60 per share. (a) Your answer is correct. What were the total proceeds from the common-stock sale? Total proceeds $ 138.000,000 eTextbook and Media Attempts: 2 of 3 used (b) How much money did the company receive? Net proceeds to firm $ eTextbook and Media Save for Later Attempts: 0 of 3 used Submit Answer (c) The parts of this question must be completed in order. This part will be available when you complete the part above.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education