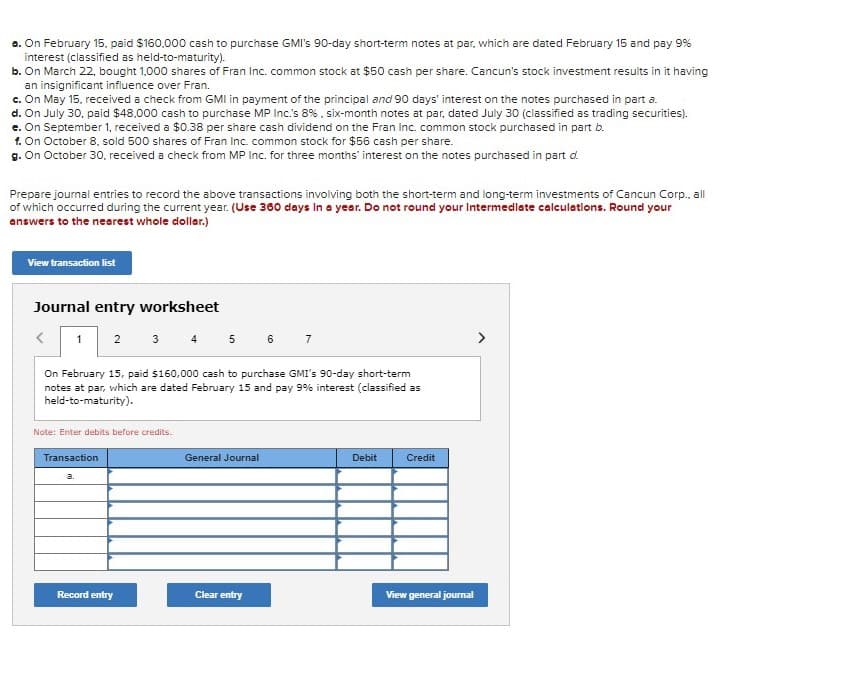

a. On February 15, paid $160,000 cash to purchase GMI's 90-day short-term notes at par, which are dated February 15 and pay 9% interest (classified as held-to-maturity). b. On March 22, bought 1,000 shares of Fran Inc. common stock at $50 cash per share. Cancun's stock investment results in it having an insignificant influence over Fran. c. On May 15, received a check from GMI in payment of the principal and 90 days' interest on the notes purchased in part a. d. On July 30, paid $48,000 cash to purchase MP Inc.'s 8%. six-month notes at par, dated July 30 (classified as trading securities). e. On September 1, received a $0.38 per share cash dividend on the Fran Inc. common stock purchased in part b. f. On October 8, sold 500 shares of Fran Inc. common stock for $56 cash per share. g. On October 30, received a check from MP Inc. for three months' interest on the notes purchased in part d. Prepare journal entries to record the above transactions involving both the short-term and long-term investments of Cancun Corp., all of which occurred during the current year. (Use 360 days In a year. Do not round your Intermediate calculations. Round your answers to the nearest whole dollar.) View transaction list Journal entry worksheet 1 2 3 4 5 6 7 On February 15, paid $160,000 cash to purchase GMI's 90-day short-term notes at par, which are dated February 15 and pay 9% interest (classified as held-to-maturity). Note: Enter debits before credits. Transaction a. General Journal Debit Credit Record entry Clear entry View general journal

a. On February 15, paid $160,000 cash to purchase GMI's 90-day short-term notes at par, which are dated February 15 and pay 9% interest (classified as held-to-maturity). b. On March 22, bought 1,000 shares of Fran Inc. common stock at $50 cash per share. Cancun's stock investment results in it having an insignificant influence over Fran. c. On May 15, received a check from GMI in payment of the principal and 90 days' interest on the notes purchased in part a. d. On July 30, paid $48,000 cash to purchase MP Inc.'s 8%. six-month notes at par, dated July 30 (classified as trading securities). e. On September 1, received a $0.38 per share cash dividend on the Fran Inc. common stock purchased in part b. f. On October 8, sold 500 shares of Fran Inc. common stock for $56 cash per share. g. On October 30, received a check from MP Inc. for three months' interest on the notes purchased in part d. Prepare journal entries to record the above transactions involving both the short-term and long-term investments of Cancun Corp., all of which occurred during the current year. (Use 360 days In a year. Do not round your Intermediate calculations. Round your answers to the nearest whole dollar.) View transaction list Journal entry worksheet 1 2 3 4 5 6 7 On February 15, paid $160,000 cash to purchase GMI's 90-day short-term notes at par, which are dated February 15 and pay 9% interest (classified as held-to-maturity). Note: Enter debits before credits. Transaction a. General Journal Debit Credit Record entry Clear entry View general journal

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter15: Investments And Fair Value Accounting

Section: Chapter Questions

Problem 3PB

Related questions

Question

dntt prrovide handwritiing solution ...

Transcribed Image Text:a. On February 15, paid $160,000 cash to purchase GMI's 90-day short-term notes at par, which are dated February 15 and pay 9%

interest (classified as held-to-maturity).

b. On March 22, bought 1,000 shares of Fran Inc. common stock at $50 cash per share. Cancun's stock investment results in it having

an insignificant influence over Fran.

c. On May 15, received a check from GMI in payment of the principal and 90 days' interest on the notes purchased in part a.

d. On July 30, paid $48,000 cash to purchase MP Inc.'s 8%. six-month notes at par, dated July 30 (classified as trading securities).

e. On September 1, received a $0.38 per share cash dividend on the Fran Inc. common stock purchased in part b.

f. On October 8, sold 500 shares of Fran Inc. common stock for $56 cash per share.

g. On October 30, received a check from MP Inc. for three months' interest on the notes purchased in part d.

Prepare journal entries to record the above transactions involving both the short-term and long-term investments of Cancun Corp., all

of which occurred during the current year. (Use 360 days In a year. Do not round your Intermediate calculations. Round your

answers to the nearest whole dollar.)

View transaction list

Journal entry worksheet

1 2 3 4 5 6 7

On February 15, paid $160,000 cash to purchase GMI's 90-day short-term

notes at par, which are dated February 15 and pay 9% interest (classified as

held-to-maturity).

Note: Enter debits before credits.

Transaction

a.

General Journal

Debit

Credit

Record entry

Clear entry

View general journal

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage