FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Please help me

Thankyou

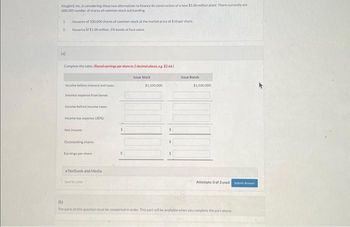

Transcribed Image Text:Kingbirl, Inc. is considering these two alternatives to finance its construction of a new $1.00 million plant: There currently are

600,000 number of shares of common stock outstanding

1

2

(a)

suance of 100.000 shares of common stock at the market price of $10 per share

Issuance of $1.00 million, 5% bonds at face value

Complete the table (Round earnings per share to 2 decimal places, eg. $2.66)

Issue Stock

Income before interest and taxes

Interest expense from bonds

Income before income taxes

Income tax expere (30%)

Net income

Outstanding shares

Earnings per share

eTextbook and Media

Le for Late

$1,500,000

$

Issue Bonds

$1,500,000

Attempts: 0 of 3 used Ar

(b)

The parts of this question must be completed in order. This part will be available when you complete the part above.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- help please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardMa1 . Who benefits most from Peace of Mind®? Complex return filers. EITC filers. Clients with refunds. All clients.arrow_forwardAssistarrow_forward

- Title 1. Complete a search of online resources for grieving individuals. Which ones might you find helpful Description 1. Complete a search of online resources for grieving individuals. Which ones might you find helpful in your work with clients? Which ones might be helpful for your clients? 2. What do you think should be the minimum level of education, training, and experience for individuals who assist bereaved individuals?arrow_forwardHow would I calculate this problem? I just guessed on which answer made sense to me. Please help. thank you in advance.arrow_forwardStudents Home M Federal Financial Aid Program X Students Home Ch. 7 Hmwk: Invoices, Trade &X A Ch. 7 Hmwk Invoices, Trade & X A webassign.net/web/Student/Assignment-Responses/last?dep3D27277752 Apps M Gmail DYouTube Maps ... ... EReading list 7. [-/1 Points] DETAILS BRECMBC9 7.I1.010. MY NOTES ASK YOUR TEACHER PRACTICE ANOTHER Calculate the net price factor (as a %) and net price (in $) by using the complement method. Round your answer to the nearest cent. List Price Trade Discount Rate Net Price Factor Net Price $3,499.00 35% $4 Need Help? Read It 8. [-/1 Points] DETAILS BRECMBC9 7.J1.014. MY NOTES ASK YOUR TEACHER PRACTICE ANOTHER Calculate the trade discount (in $) and trade discount rate (as a %). Round your answer to the nearest tenth of a percent. List Price Trade Discount Rate Trade Discount Net Price $4,500.00 $3,515.00 Need Help? 11:28 PM 71°F (岁 10/9/2021 P Type here to searcharrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education