FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

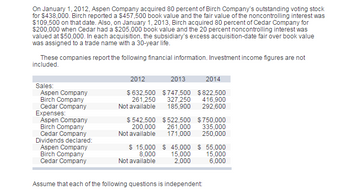

Transcribed Image Text:On January 1, 2012, Aspen Company acquired 80 percent of Birch Company's outstanding voting stock

for $438,000. Birch reported a $457,500 book value and the fair value of the noncontrolling interest was

$109,500 on that date. Also, on January 1, 2013, Birch acquired 80 percent of Cedar Company for

$200,000 when Cedar had a $205,000 book value and the 20 percent noncontrolling interest was

valued at $50,000. In each acquisition, the subsidiary's excess acquisition-date fair over book value

was assigned to a trade name with a 30-year life.

These companies report the following financial information. Investment income figures are not

included.

Sales:

Aspen Company

Birch Company

Cedar Company

Expenses:

Aspen Company

Birch Company

Cedar Company

Dividends declared:

Aspen Company

Birch Company

Cedar Company

2012

$ 632,500

261,250

Not available

$ 542,500

200,000

Not available

$15,000

8,000

Not available

2013

2014

$747,500

327,250

$822,500

416,900

185,900 292,600

$522,500 $750,000

261,000 335,000

171,000 250,000

$45,000 $ 55,000

15,000

15,000

2,000

6,000

Assume that each of the following questions is independent:

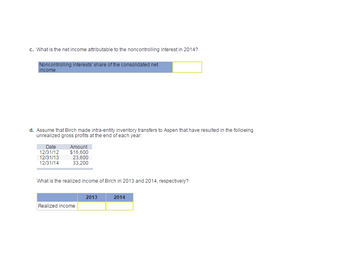

Transcribed Image Text:c. What is the net income attributable to the noncontrolling interest in 2014?

Noncontrolling interests' share of the consolidated net

income

d. Assume that Birch made intra-entity inventory transfers to Aspen that have resulted in the following

unrealized gross profits at the end of each year:

Date

Amount

12/31/12 $16,600

12/31/13

12/31/14

23,600

33,200

What is the realized income of Birch in 2013 and 2014, respectively?

Realized income

2013

2014

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On January 1, 2016, Uncle Company purchased 80 percent of Nephew Company's capital stock for $512,000 in cash and other assets. Nephew had a book value of $626,000 and the 20 percent noncontrolling interest fair value was $128,000 on that date. On January 1, 2015, Nephew had acquired 30 percent of Uncle for $283,000. Uncle's appropriately adjusted book value as of that date was $910,000. Separate operating income figures (not including investment income) for these two companies follow. In addition, Uncle declares and pays $30,000 in dividends to shareholders each year and Nephew distributes $4,000 annually. Any excess fair-value allocations are amortized over a 10-year period. Year UncleCompany NephewCompany 2016 $ 138,000 $ 34,000 2017 203,000 51,800 2018 236,000 52,600 Assume that Uncle applies the equity method to account for this investment in Nephew. What is the subsidiary's income recognized by Uncle in 2018? What is the net income…arrow_forwardBelden, Inc. acquires 30 percent of the outstanding voting shares of Sheffield, Inc. on January 1, 2017, for $316,000, which gives Belden the ability to significantly influence Sheffield. Sheffield has a net book value of $796,000 at January 1, 2017. Sheffield's asset and liability accounts showed carrying amounts considered equal to fair values except for a copyright whose value accounted for Belden's excess cost over book value in its 30 percent purchase. The copyright had a remaining life of 16 years at January 1, 2017. No goodwill resulted from Belden's share purchase. Sheffield reported net income of $192,000 in 2017 and $232,000 of net income during 2018. Dividends of $64,000 and $96,000 are declared and paid in 2017 and 2018, respectively. Belden uses the equity method. On its 2018 comparative income statements, how much income would Belden report for 2017 and 2018 in connection with the company's investment in Sheffield? If Belden sells its entire investment in…arrow_forwardOn January 1, 2018, Marshall Company acquired 100 percent of the outstanding common stock of Tucker Company. To acquire these shares, Marshall issued $200,000 in long-term liabilities and 20,000 shares of common stock having a par value of $1 per share but a fair value of $20 per share. Marshall paid $30,000 to accountants, lawyers, and brokers for assistance in the acquisition and another $12,000 in connection with stock issuance costs. Prior to these transactions, the balance sheets for the two companies were as follows: Marshall Company Book Value Tucker Company Book Value Cash $ 60,000 $ 20,000 Receivables 270,000 90,000 Inventory 360,000 140,000 Land…arrow_forward

- On January 1, 2018, Cameron Inc. bought 20% of the outstanding common stock of Lake Construction Companyfor $300 million cash. At the date of acquisition of the stock, Lake’s net assets had a fair value of $900 million.Their book value was $800 million. The difference was attributable to the fair value of Lake’s buildings and itsland exceeding book value, each accounting for one-half of the difference. Lake’s net income for the year endedDecember 31, 2018, was $150 million. During 2018, Lake declared and paid cash dividends of $30 million. Thebuildings have a remaining life of 10 years.Required:1. Prepare all appropriate journal entries related to the investment during 2018, assuming Cameron accounts forthis investment by the equity method.2. Determine the amounts to be reported by Cameron:a. As an investment in Cameron’s 2018 balance sheetarrow_forwardOn January 1, 2010, A Corporation acquired 80% of ordinary shares of G Company at fair value of net assets acquired. All assets of G company are fairly valued except for a blue office equipment with book value of P2,100,000 and fair value of P1,400,000. On June 30, 2010, G Company sold the said blue office equipment to A Corporation at a selling price of P3,000,000. On June 30, 2010, the remaining useful life of the blue equipment is 3 years. On October 1, 2010, A Corporation sold a 2-year-old red office equipment to G Company for P2,800,000 at a gain of P400,000. On October 1, 2010, the remaining useful life of the red equipment is 4 years. What is the consolidated book value of equipment on December 31, 2010, respectively? Ans. 3,250,000 (Show solution)arrow_forwardOn January 1, 2017, Corgan Company acquired 70 percent of the outstanding voting stock of Smashing, Inc., for a total of $1,120,000 in cash and other consideration. At the acquisition date, Smashing had common stock of $830,000, retained earnings of $380,000, and a noncontrolling interest fair value of $480,000. Corgan attributed the excess of fair value over Smashing's book value to various covenants with a 20-year remaining life. Corgan uses the equity method to account for its investment in Smashing. During the next two years, Smashing reported the following: Net Income 2017 S 2018 Inventory Purchases Dividends Declared from 280,000 260,000 Corgan $ 48,000 58,000 $ 230,000 250,000 Corgan sells inventory to Smashing using a 60 percent markup on cost. At the end of 2017 and 2018, 30 percent of the current year purchases remain in Smashing's inventory. 1. Compute the equity method balance in Corgan's Investment in Smashing, Inc., account as of December 31, 2018. 2. Prepare the…arrow_forward

- The Holtz Corporation acquired 80 percent of the 100,000 outstanding voting shares of Devine, Inc., for $6.45 per share on January 1, 2020. The remaining 20 percent of Devine’s shares also traded actively at $6.45 per share before and after Holtz’s acquisition. An appraisal made on that date determined that all book values appropriately reflected the fair values of Devine’s underlying accounts except that a building with a 5-year future life was undervalued by $65,500 and a fully amortized trademark with an estimated 10-year remaining life had a $85,000 fair value. At the acquisition date, Devine reported common stock of $100,000 and a retained earnings balance of $224,500. Following are the separate financial statements for the year ending December 31, 2021: HoltzCorporation Devine,Inc. Sales $ (747,000 ) $ (432,750 ) Cost of goods sold 207,000 135,000 Operating expenses 338,000 126,750 Dividend income (16,000 ) 0 Net income $…arrow_forwardPerke Corporation purchased 80% of the stock of Superstition Company for $1,970,000 on January 1, 2012. On this date, the fair value of the assets and liabilities of Superstition Company was equal to their book value except for the inventory and equipment accounts. The inventory had a fair value of $725,000 and a book value of $600,000. Sixty percent of Superstition Company's inventory was sold in 2012; the remainder was sold in 2013. The equipment had a book value of $900,000 and a fair value of $1,075,000. The remaining useful life of the equipment is seven years. The balances in Superstition Company's capital stock and retained earnings accounts on the date of acquisition were $1,200,000 and $600,000, respectively. Perke uses the complete equity method to account for its investment in Superstition. The following financial data are from Superstition Company's records. Net income: (2012) $750,000; (2013) $900,000 Dividends declared: (2012) $150,000; (2013) $225,000 Required: c.…arrow_forwardOn January 1, 2020, QuickPort Company acquired 90 percent of the outstanding voting stock of NetSpeed, Inc., for $1,125,000 in cash and stock options. At the acquisition date, NetSpeed had common stock of $1,170,000 and Retained Earnings of $58,500. The acquisition-date fair value of the 10 percent noncontrolling interest was $125,000. QuickPort attributed the $21,500 excess of NetSpeed's fair value over book value to a database with a five-year remaining life. During the next two years, NetSpeed reported the following: Net Income Dividends Declared 2020 $ 30,100 $ 4,300 2021 43,000 4,300 On July 1, 2020, QuickPort sold communication equipment to NetSpeed for $27,500. The equipment originally cost $30,500 and had accumulated depreciation of $5,400 and an estimated remaining life of three years at the date of the intra-entity transfer. Compute the equity method balance in QuickPort's Investment in NetSpeed, Inc., account as of December 31, 2021.…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education