Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

solution want from general account tutor

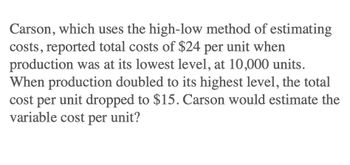

Transcribed Image Text:Carson, which uses the high-low method of estimating

costs, reported total costs of $24 per unit when

production was at its lowest level, at 10,000 units.

When production doubled to its highest level, the total

cost per unit dropped to $15. Carson would estimate the

variable cost per unit?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Variable cost per unit?arrow_forwardAbdulwahab Corporation is estimating the cost function for total cost of production of product A using the high-low method. The data collected for the past year is as following: Number of units Total Quarter produced Costs 1 4,000 $ 1,000 2 5,400 1,280 3 7,000 1,600 4 9,000 2,000 Calculate the following amounts: The variable cost per unit The fixed cost Explain the method used by the company to estimate the cost function. Suggest other methods than may be used to estimate cost function.arrow_forwardVariable cost per unit? General accountingarrow_forward

- Crawford Industriesarrow_forwardF Company, which uses the high-low method, reported total costs of $24 per unit at its lowest activity level, when production equaled 10,000 units. When production doubled, at its highest activity level, the total cost per unit dropped to $15. Foster would estimate variable cost per unit asarrow_forwardCardinal uses the high-low method of estimating costs. Cardinal had total costs of $26,450 at its lowest level of activity, when 7,100 units were sold. When, at its highest level of activity, sales equaled 12,700 units, total costs were $39,890. What would be the estimated variable cost per unit be?arrow_forward

- During its first year, Pine Corp. reported a $22 per-unit profit under absorption costing but would have reported $20,000 less profit under variable costing. Suppose production exceeded sales by 600 units, and an average contribution margin of 65% was maintained. a) What is the fixed cost per unit? b) What is the sales price per unit? c) What is the variable cost per unit? d) What is the unit sales volume if total profit under absorption costing was $220,000?arrow_forwardDuring its first year, Maple Corp. showed a $20 per-unit profit under absorption costing but would have reported a total profit of $18,000 less under variable costing. Suppose production exceeded sales by 600 units and an average contribution margin of 60% was maintained. a. What is the fixed cost per unit? b. What is the sales price per unit? c. What is the variable cost per unit? d. What is the unit sales volume if total profit under absorption costing was $220,000?arrow_forwardSong, Inc., uses the high-low method to analyze cost behavior. The company observed that at 20,000 machine hours of activity, total maintenance costs averaged $34.30 per hour. When activity jumped to 27,000 machine hours, which was still within the relevant range, the average total cost per machine hour was $27.30. On the basis of this information, the variable cost per machine hour was (Round your final answer to 2 decimal places): On the basis of this information, the fixed cost was (Round your Intermedlate calculatlons to 2 declmal places final answer to nearest dollar amount): On the basis of this information, what were total maintenance costs when the company experienced 25,000 machine hours? (Round your Intermedlate calculatlons to 2 declmal places final answer to nearest dollar amount.)arrow_forward

- Sierra Company produces its product at a total cost of $120 per unit. Of this amount, $40 per unit is selling and administrative costs. The total variable cost is $96 per unit, and the desired profit is $24.00 per unit. Determine the markup percentage using the (a) total cost, (b) product cost, and (c) variable cost methods. Round your answers to one decimal place. a. Total cost b. Product cost c. Variable cost % % %arrow_forwardDuring its first year, Maple Ltd. reported a $25 per-unit profit under absorption costing but would have reported $12,000 less profit under variable costing. Suppose production exceeded sales by 400 units, and an average contribution margin of 60% was maintained. a) What is the fixed cost per unit? b) What is the sales price per unit? c) What is the variable cost per unit? d) What is the unit sales volume if total profit under absorption costing was $250,000?arrow_forwardA review of Parson Corporation's accounting records found that at a volume of 138,000 units, the variable and fixed cost per unit amounted to $5 and $2, respectively. On the basis of this information, what amount of total cost would Parson anticipate at a volume of 128,800 units?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning