Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

General Accounting

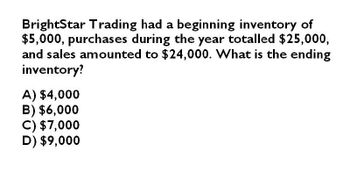

Transcribed Image Text:BrightStar Trading had a beginning inventory of

$5,000, purchases during the year totalled $25,000,

and sales amounted to $24,000. What is the ending

inventory?

A) $4,000

B) $6,000

C) $7,000

D) $9,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The following selected information is taken from the financial statements of Arnn Company for its most recent year of operations: During the year, Arnn had net sales of 2.45 million. The cost of goods sold was 1.3 million. Required: Note: Round all answers to two decimal places. 1. Compute the current ratio. 2. Compute the quick or acid-test ratio. 3. Compute the accounts receivable turnover ratio. 4. Compute the accounts receivable turnover in days. 5. Compute the inventory turnover ratio. 6. Compute the inventory turnover in days.arrow_forwardOn January 1, Pope Enterprises inventory was 625,000. Pope made 950,000 of net purchases during the year. On its year-end income statement, Pope reported cost of goods sold of 1,025,000. Calculate Popes December 31 ending inventory.arrow_forwardGREEN Enterprises reported the following information for the current year: Inventory, January 1 - P2,300,000; Purchases - 27,105,000; Purchase returns and allowances - 520,000; Sales returns and allowances - P692,000; Inventory, December 31 - 2,470,000. Gross profit rate on net sales is 20%. What is the amount of gross sales for the current year?arrow_forward

- During the current year, Peach Industries' reports sales of $184,000 and an average sale period of 50 days. The inventory balance is $11,000 at the beginning of the year and $13,000 at the end of the year. What is Peach's gross margin percentage? Round to one decimal point. O 42.8% O 44.5% O 47.6% O 52.4% 56.2%arrow_forwardQuestion: For the year, your company's sales are $305,000, the gross profit is $250,000, and the ending inventory is purchases are $100,000, inventory must have been $75,000. If net the beginningarrow_forwardFor the year, your company's sales are $305,000, the gross profit is $250,000, and ending inventory is $75,000. If net purchases are $100,000, beginning inventory must have been: $55,000 $175,000 $25,000 $arrow_forward

- Concord Corporation had January 1 inventory of $305000 when it adopted dollar-value LIFO. During the year, purchases were $1820000 and sales were $2990000. December 31 inventory at year-end prices was $429000, and the price index was 110. What is Concord Corporation’s gross profit?arrow_forward1. What is the Cost of Goods Sold (COGS) for the year? Beginning Inventory: $10,000Purchase for the year: $113,000Freight-in for the shipping under F.O.B Shipping Point term: $5,000Purchase Discount for the year: $12,000Purchase Return for the year: $6,000End of the year physical inventory balance: $35,000arrow_forwardA company's beginning inventory was valued at $25,000. During the year, it made purchases worth $60,000 and ended with inventory valued at $30,000. What is the Cost of Goods Sold (COGS)? a) $55,000 b) $60,000 c) $65,000arrow_forward

- Cost of goods sold for Abe Distributors was $550,330 for the year. If the beginning inventory at cost was $118,700 and the ending inventory at cost was $303,400, find the inventory turnover at cost. (Round your answer to the nearest tenth.) a. 2.6 b. 2.7 c. 4.8 d. 5.1arrow_forwardWildhorse Company had a January 1 inventory of $295000 when it adopted dollar - value LIFO. During the year, purchases were $1820000 and sales were $3080000. December 31 inventory at year-end prices was $371520, and the price index was 108. What is Wildhorse Company's gross profit? $1312920 $1336520 $1308020 $2732080arrow_forwardWaterway Industries had January 1 inventory of $310000 when it adopted dollar-value LIFO. During the year, purchases were $1720000 and sales were $3040000. December 31 inventory at year-end prices was $377400, and the price index was 111.What is Waterway Industries’s gross profitarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning