Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:R

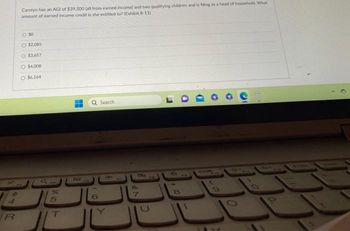

Carolyn has an AGI of $39,500 (all from earned income) and two qualifying children and is filing as a head of household. What

amount of earned income credit is she entitled to? (Exhibit 8-11)

0 50

O $2,085

O $3,657

O $4,008

O $6.164

%

T

Q Search

(0

&

V

8

CO

(O

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Fully furnished accommodation with monthly rent of $5,000. Ms Tan contributed a total rent of $6,000 in the year 2019, with the rest paid for by the company. Calculate the accommodation benefit.arrow_forwardKaleb Makes a salary of $5,000 per month and has no other loans. What maximum amount of monthly home paymment ( mortgage, insurance, and property tax) can he realistically afford? 1. $750 2. $1,500 3. $2,500 4. $2,750 5. $4,250arrow_forwardSally purchased a home in Georgia for $167,500. She took out a mortgage for 80% of the purchase price at a 7.75% interest rate and put up a 20% down payment. The sale closed on March 16. What is the total dollar amount of the prepaid interest? Select one: a. $452.08 b. $461.55 C. $455.23 d. $576.94arrow_forward

- Required Informatlon [The following information applies to the questions displayed below.] Javier and Anita Sanchez purchased a home on January 1 of year 1 for $1,000,000 by paying $200,000 down and borrowing the remaining $800,000 with a 6 percent loan secured by the home. The Sanchezes made interest-only payments on the loan in years 1 and 2. (Leave no answer blank. Enter zero if applicable.) c. Assume year 1 is 2020 and by the beginning of year 4, the Sanchezes have pald down the principal amount of the loan to $500,000. In year 4, they borrow an additional $100,000 through a loan secured by the home in order to finish their basement. The new loan carries a 7 percent interest rate and is termed a "home equity loan" by the lender. What amount of interest can the Sanchezes deduct on the $100,000 loan? Maximum deductible interest expensearrow_forwardng gifts to sales contracts. Can Armelio deduct the cost of the lapel buttons as business gifts? 49. Melissa recently paid $400 for round-trip airfare to San Francisco to attend a business conference for three days. Melissa also paid the following expenses: $250 fee to register for the conference, $300 per night for three nights' lodging, $200 for meals in restaurants, and $150 for cab fare. LO 1-2arrow_forwardwhich is right?arrow_forward

- A5 please help......arrow_forwardPls help ASAParrow_forwardExercise 10-12 (Algorithmic) (LO. 3) In 2023, Ivanna, who has three children under age 13, worked full-time while her spouse, Sergio, was attending college for nine months during the year. Ivanna earned $79,500 and incurred $8,625 of child care expenses. Click here to access the percentage chart to us for this problem. Determine Ivanna and Sergio's child and dependent care credit. 1,200 $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education