Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

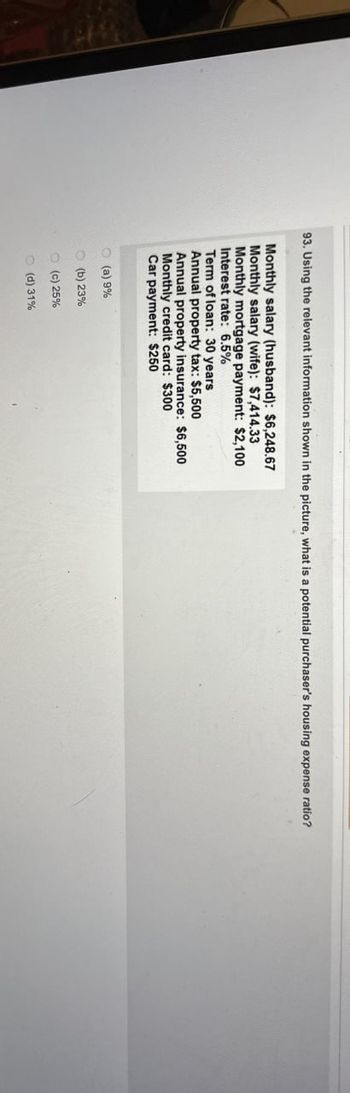

Transcribed Image Text:93. Using the relevant information shown in the picture, what is a potential purchaser's housing expense ratio?

Monthly salary (husband): $6,248.67

Monthly salary (wife): $7,414.33

Monthly mortgage payment: $2,100

Interest rate: 6.5%

Term of loan: 30 years

Annual property tax: $5,500

Annual property insurance: $6,500

Monthly credit card: $300

Car payment: $250

(a) 9%

(b) 23%

(c) 25%

(d) 31%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Conchita Martinez will have a monthly interest and principal payment of $1,820.68. Her monthly real estate taxes will be $57.06 and her monthly homeowner's insurance payments will be $89.47. If her gross monthly income is $6,778.27, find the housing ratio. Question content area bottom Part 1 The housing ratio is= (Round to two decimal places as needed.)arrow_forwardSuppose you obtain a 30 year mortgage loan of 197,000$ at an annual interest rate of 8.1%. The annual property tax bill is $967 and the annual fire insurance premium is 495$. Find the total monthly payment for the mortgage, property tax, and fire insurance.arrow_forwardCalculate the housing expense ratio and the total obligation ratio (in %) for the following mortgage applications. (Round your answers t Monthly Gross Income Monthly PITI Other Monthly Financial Obligations Housing Expense Ratio (%) Total Obligations Ratio (%) Applicant Expense Emerson $2,900 $777 $290 %arrow_forward

- fill out the worksheet using the following information: Theoretical Housing Situation: Renting: Monthly Rent: $1,800 Renter’s Insurance: $200 per year Security Deposit: $2,000 After-tax Savings Rate: 5% Buying: Home Price: $250,000 Down Payment: $50,000 Loan Amount: $200,000 Loan Term: 25 years Interest Rate: 3.5% Property Taxes: 1.25% of the home price Homeowner’s Insurance: 0.4% of the home price Maintenance Costs: 1.5% of the home price Closing Costs: $5,000 After-tax Rate of Return: 4% Tax Rate: 25% Estimated Annual Appreciation: 2%arrow_forwardCalculate the DTI ratio (in percent) for a borrower who has a gross monthly income of $4,875 and has a minimum credit car bill of $125, a car lease payment of $276.78 and a student loan payment of $216, and who is applying for a loan with a monthly payment of $2,021.79. (Round your answer to the nearest tenth of a percent.)arrow_forwardSolve B.arrow_forward

- Calculate the housing expense ratio and the total obligation ratio (in %) for the following mortgage applications. (Round your answers to two decimal places.) Applicant Emerson Monthly Monthly Gross PITI Income Expense $2,700 $633 Other Monthly Financial Obligations $270 Housing Expense Ratio (%) % Total Obligations Ratio (%) %arrow_forward1. has After moving, a homeowner's annual insurance premium increased from $480 to $710 per year. Calculate the due if there are 3 months left in the additional amount policy year. pay when 2. State two additional costs that a purchaser may have to purchasing a new home. Explain what these additional costs are. Use the chart below. Additional Costs Explanationsarrow_forwardA homeowner has five years of monthly payments of $1,100 before she has paid off her house. If the interest rate is 6% APR, what is the remaining balance on her loan? ..... A. $79,657 B. $45,518 C. $68,278 D. $56,898arrow_forward

- Question Help The Adeeva's gross monthly income is $6300. They have 18 remaining payments of $230 on a new car. They are applying for a 20-year, $172,000 mortgage at 6.5%. The taxes and insurance on the house are $360 per month. The bank will only approve a loan that has a total monthly mortgage payment of principal, interest, property taxes, and homeowners' insurance that is less than or equal to 28% of their adjusted monthly income. Click here for table of Monthly Payments a) Determine 28% of the Adeeva's adjusted monthly income. (Round to the nearest cent.) TO b) Determine the Adeeva's total monthly mortgage payment, including principal, interest, taxes, and homeowners' insurance. et e cart 1 $6 (Round to the nearest cent.) c) Do they qualify for this mortgage? No O Yesarrow_forwardCalculate the housing expense ratio and the total obligation ratio (in %) for the following mortgage applications. (Round your answers to two decimal places.) Other Monthly Housing Expense Ratio (%) Monthly Monthly Total Applicant Financial Obligations Ratio (%) Gross PITI Income Expense Obligations Martin $3,300 $805 $840 % %arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education