Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

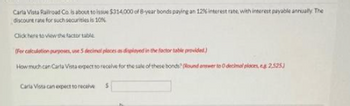

Transcribed Image Text:Carla Vista Railroad Co is about to issue $314,000 of 8-year bonds paying an 12% interest rate with interest payable annually The

discount rane for such securities is 10%

Click here to view the factor table

(For calculation purposes, use 5 decimal places as displayed in the factor table provided)

How much can Carla Vista expect to receive for the sale of these bonds? (Round answer to O decimal ploces, eg 2,525

Carla Vista can expect to receive S

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Hw.5.arrow_forwardMonty Corp. invested in a three-year, $100 face value 9% bond, paying $95.11. At this price, the bond will yield a 11% return. Interest is payable annually. Prepare a bond discount amortization table for Monty Corp., assuming Monty uses the effective interest method required by IFRS. (Round answers to 2 decimal places, e.g. 52.75.) Bond Discount Amortization Table Date Cash Received Interest Income Bond Discount Amortization Amortized Cost of Bond Day 1 $enter a dollar amount End Year 1 $enter a dollar amount $enter a dollar amount $enter a dollar amount enter a dollar amount End Year 2 enter a dollar amount enter a dollar amount enter a dollar amount enter a dollar amount End Year 3 enter a dollar amount enter a dollar amount enter a dollar amount enter a dollar amount $enter a total amount $enter a total amount $enter a total amount Prepare journal entries to record the initial…arrow_forward(Related to Checkpoint 9.2) (Yield to maturity) Abner Corporation's bonds mature in 19 years and pay 13 percent interest annually. If you purchase the bonds for $1,225, what is your yield to maturity? Question content area bottom Part 1 Your yield to maturity on the Abner bonds is enter your response here%. (Round to two decimal places.)arrow_forward

- Last year, Kevin Thomas purchased a $1000 Campbell Manufacturing corporate bond with an annual interest rate of 7.25%. The bond's current market price is $770. Calculate the following. If necessary, round all answers to two decimal places. If necessary, refer to the list of financial formulas. 1. Annual interest: 2. Current yield: $0 0% X Sarrow_forward(Related to Checkpoint 9.2) (Yield to maturity) Abner Corporation's bonds mature in 17 years and pay 8 percent interest annually. If you purchase the bonds for $825, what is your yield to maturity? Question content area bottom Part 1 Your yield to maturity on the Abner bonds is enter your response here%. (Round to two decimal places.)arrow_forwardEf 604.arrow_forward

- GoldenSeal Pharmacy borrowed $630,000 on January 2, 2025, by issuing a 15% serial bond payable that must be paid in three equal annual installments plus interest for the year. The first payment of principal and interest comes due January 2, 2026. Complete the missing information. Assume bonds are issued at face value. (Complete all input fields. For accounts with a $0 balance, make sure to enter a 0 in the appropriate cell.) Current Liabilities: Bonds Payable Interest Payable Long-Term Liabilities: Bonds Payable 2025 December 31 2026 2027arrow_forwardOn January 1, 2022, Fancy Co issued $100,000 in 10 year bonds. The bonds have a stated rate of 5% but are issued at a discount as the market rate is 7%. Because the market rate is higher, Fancy receives the present value which is $92,640. The coupon is paid annually on December 31st of each year. Provide the journal entries for Jan 1, 2022, and Dec 31st, 2022.arrow_forward(Related to Checkpoint 9.2) (Yield to maturity) Abner Corporation's bonds mature in 24 years and pay 14 percent interest annually. If you purchase the bonds for $900, what is your yield to maturity? Your yield to maturity on the Abner bonds is %. (Round to two decimal places.)arrow_forward

- shobhaarrow_forwardHeather Smith is considering a bond investment in Locklear Airlines. The $1,000 par value bonds have a quoted annual interest rate of 9 percent and the interest is paid semiannually. The yield to maturity on the bonds is 12 percent annual interest. There are 9 years to maturity. Compute the price of the bonds based on semiannual analysis. Use Appendix B and Appendix D for an approximate answer but calculate your final answer using the formula and financial calculator methods. (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Bond pricearrow_forwardPronghorn Corporation issues $590,000 of 9% bonds, due in 10 years, with interest payable semiannually. At the time of issue, the market rate for such bonds is 10%. Click here to view factor tables. Compute the issue price of the bonds. (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and the final answer to Oarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education