ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

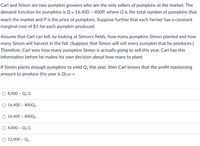

Transcribed Image Text:Carl and Simon are two pumpkin growers who are the only sellers of pumpkins at the market. The

demand function for pumpkins is Q = 16,400 – 400P, where Q is the total number of pumpkins that

reach the market and P is the price of pumpkins. Suppose further that each farmer has a constant

marginal cost of $1 for each pumpkin produced.

Assume that Carl can tell, by looking at Simon's fields, how many pumpkins Simon planted and how

many Simon will harvest in the fall. (Suppose that Simon will sell every pumpkin that he produces.)

Therefore, Carl sees how many pumpkins Simon is actually going to sell this year. Carl has this

information before he makes his own decision about how many to plant.

If Simon plants enough pumpkins to yield Qs this year, then Carl knows that the profit maximising

amount to produce this year is Qcarl =

O 8,000 – Qs/2.

O 16,400 – 400Qs.

O 16,400 – 800Qs.

O 4,000 – Qs/2.

O 12,000 – Qs.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- A manufacturer of fine pens produces in two plants. The total cost of producing in the first plant is given by TC1 = yi + 100. The total cost of producing in the second plant is given by TC2 + 200. 3 In these cost functions, y1 corresponds to the number of pens produced in the first plant, and y2 corresponds to the number of pens produced in the second plant. Suppose the firm's marginal cost is $256. If the firm is minimizing costs, the firm must be producing pens.arrow_forwardFor the pizza seller whose marginal, average variable, and average total cost curves are shown in the graph below, what is the profit-maximizing level of output and how much profit will this producer earn if the price of pizza is $1.50 per slice?Instructions: In the graph below, label all three curves by clicking on the dropdown to select the appropriate label. Instructions: Enter your response as a whole number. If you are entering a negative number, be sure to include a negative sign (−). When the price is $1.50 per slice, the profit-maximizing level of output is slices per day. Instructions: Enter your response rounded to the nearest penny (two decimal places). At the profit-maximizing level of output, the producer's profit is: $ per day.arrow_forwardA firm faces the inverse demand function: P = 900-2Q+0.24⁰.5 The firms TC of production is given as: TC = 5Q² +12Q + A What level of Q. A, and P maximize the firm's profits?arrow_forward

- #2arrow_forwardWalmart can be viewed as a first mover. Now suppose both Walmart and HEB are considering whether and how to enter a potential market. Market demand is given by the inverse demand function p= 900−q1−q2, where p is the market price margin, q1 is the quantity sold by Walmart and q2is the quantity sold by HEB. To enter the market, a retailer must build a store. Two types of stores can be built: Small and Large. A Small pantry store requires an investment of $50,000, and it allows the retailer to sell as many as 100 units of the goods at zero marginal cost. Alternatively, the retailer can pay $175,000 to construct a Large full-service supermarket that will allow it to sell any number of units at zero marginal cost. Assume Walmart stays out of the potential market (i.e.Walmart chooses not to enterN1at the first stage,q1= 0). Calculate HEB’s profit for the following cases: a.) HEB chooses not to enter N at the second stage after viewing Walmart’schoice. b.) HEB chooses to build a small…arrow_forwardSuppose that pig farming in a region is a perfectly compet- itive industry. However, one negative consequence of this activity is that it creates water pollution that adversely affects the health of the residents in the nearby communities that rely on the water sources that are contaminated by the pig farms. The market supply curve for pigs (or hogs) is given by H^S = 6p where H^S is the quantity of hogs supplied to the market by farmers in this region. The market demand for hogs is given by H^P = 300 – 4p. The government estimates that the additional medical costs (M) imposed on the nearby communities is given by M = 5H, where H is the quantity of hogs produced and sold in the market. Q: In the absence of clearly defined property rights over water use or con- ventions or some form of government intervention, derive the market equilibrium for hogs and the DWL resulting from the additional medical costs associated with hog production. Please show the formula, thank you.arrow_forward

- A village has 4 farmers. Each summer, all the farmers graze their sheep on the village green. The cost of buying and caring for sheep is very small and can be regarded as 0. The value to a farmer of grazing a sheep on the green when a total of F sheep are grazing is v(F) per sheep: v(F) (price of a sheep) 1 $13 $12 3 $9 4 $7 $4 6+ $0 Suppose you are one of the 4 farmers in the game. Your optimal choice is to own (choose on) farmers chooses to own one (1) sheep. sheep if each of the other three Your optimal choice is to own (choose on). farmers chooses to own one (1) sheep. sheep if each of the other three 1 4.arrow_forwardam. 116.arrow_forwardAn industry has the following cost function: C(X, Y ) = 1500+20X +20Y . Market demands for the 2 goods are given by PX =80−X, and PY =140−2Y Suppose the government wished to use two part tariffs in these markets, and suppose further that two part tariffs are feasible. Imagine that there are 10 consumer in each market. Solve for a set of two part tariffs (one for each martket) that pay the firm zero profits in total, yet achieves efficiency.arrow_forward

- See image for question with sub-parts.arrow_forwardWalmart can be viewed as a first mover. Now suppose both Walmart and HEB are considering whether and how to enter a potential market. Market demand is given by the inverse demand function p= 900−q1−q2, where p is the market price margin, q1 is the quantity sold by Walmart and q2is the quantity sold by HEB. To enter the market, a retailer must build a store. Two types of stores can be built: Small and Large. A Small pantry store requires an investment of $50,000, and it allows the retailer to sell as many as 100 units of the goods at zero marginal cost. Alternatively, the retailer can pay $175,000 to construct a Large full-service supermarket that will allow it to sell any number of units at zero marginal cost. *Assume Walmart has built a Large full-service supermarket (i.e.Walmart chooses to build a large full-service supermarket L1 at the first stage). Calculate Walmart's profit for the following cases: a.) HEB chooses not to enter N at the second stage after viewing Walmart’s…arrow_forwardPete sells two different soups (chicken soup and beef soup) in two competitive markets. Suppose the firm's cost function is given by C = ½ q1^2 + ¼ q2^2 - 1/6 (q1)(q2) where q1 is the output of chicken soup and q2 is the output of beef soup. The price of beef soup is $3. a. Find the firm's supply curve for chicken soup. b. Find how the firm's supply of beef soup varies with the price of chicken soup Show work and explainarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education