Cornerstones of Financial Accounting

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Carducci corporation reported accounting questions solution

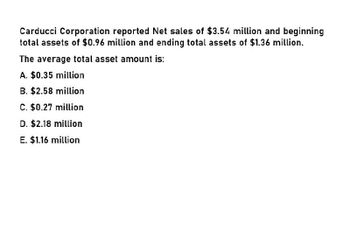

Transcribed Image Text:Carducci Corporation reported Net sales of $3.54 million and beginning

total assets of $0.96 million and ending total assets of $1.36 million.

The average total asset amount is:

A. $0.35 million

B. $2.58 million

C. $0.27 million

D. $2.18 million

E. $1.16 million

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- General accountingarrow_forwardTatye Corporation reported Net sales of $4.6 million and average Total assets of $1.1 million. The Total asset turnover is:arrow_forwardFlask Company reports net sales of $4,343 million; cost of goods sold of $2,808 million; net income of $283 million; and average total assets of $2,150. Compute its total asset turnover. Multiple Choice 0.13. 0.77. 1.31. 2.02. 1.55.arrow_forward

- Rush Company had net income of $152 million and average total assets of $1,810 million. Its return on assets (ROA) is: Multiple Choice 8.4%. 84.0%. 120.0%. 119.0%. 16.8%.arrow_forwardMartinez Corporation reported net sales of $765,000, net income of $141,525, and total assets of $7,634,409. The profit margin is: A. 539.0% B. 5.4% C. 81.4% D. 1.9% E. 18.5%arrow_forwardThe following information was drawn from the accounting records of Jones Company. (Round your ans Net sales $361,290 Net income 56,000 Average total assets 530,000 Average total liabilities Average total stockholders' equity 330,000 215,000 Based on this information the company's asset turnover is Multiple Choice $0.68 of sales dollars per $1 of assets. $1.55 of sales dollars per $1 of assets. $1.06 of sales dollars per $1 of assets. MacBook Ain 80 DII F2 F3 F4 F5 F6 F7 F8 2$ 5 CO CO 13arrow_forward

- JPJ Corp has sales of $1.27 million, accounts receivable of $52,000, total assets of $4.96 million (of which $2.77 million are fixed assets), inventory of $152,000, and cost of goods sold of $604,000. What is JPJ's accounts receivable days? Fixed asset turnover? Total asset turnover? Inventory turnover? JPJ's inventory turnover isarrow_forwardCrafty Inc. reported the following financial data. Sales, $180,000; operating expenses $160,000; average operating assets, $150,000; total liabilities, $98,000. The company requires a minimum 12% return on investments. What is the asset turnover ratio? O.133 O.18 O 1.2 O .111arrow_forwardJPJ Corp has sales of $1.33 million, accounts receivable of $52,000, total assets of $5.05 million (of which $2.88 million are fixed assets), inventory of $153000, and cost of goods sold of $601000. What is JPJ's accounts receivable days? Fixed asset turnover? Total asset turnover? Inventory turnover? **round to two decimal places**arrow_forward

- A company has sales of $87,400, net income of $20,400, costs sales of $30,000, selling and administrative expenses of $4,100, and depreciation of $6,800. The common-size statement value of EBITDA is percent.arrow_forwardThe most recent financial statements for Assouad, Inc., are shown here: Income Statement Balance Sheet Sales $3,500 Current assets $4,000 Current liabilities $970 Costs 2,500 Fixed assets 6,200 Long-term debt 3,500 Taxable income $1,000 Equity 5,730 Taxes (25%) 250 Total $10,200 Total $10,200 Net income $750 Assets, costs, and current liabilities are proportional to sales. Long-term debt and equity are not. The company maintains a constant 50 percent dividend payout ratio. As with every other firm in its industry, next year's sales are projected to increase by exactly 20 percent. What is the external financing needed?arrow_forwardJPJ Corp has sales of $1.11 million, accounts receivable of $52,000, total assets of $5.12 million (of which $3.14 million are fixed assets), inventory of $151,000, and cost of goods sold of $608,000. What is JPJ's accounts receivable days? Fixed asset turnover? Total asset turnover? Inventory turnover? What is JPJ's accounts receivable days? JPJ's accounts receivable days are _____ days. (Round to two decimal places.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT